The key indicator everyone's watching this week is May's PCED (Fri). We expect the Fed's preferred inflation gauge will continue to show progress toward its 2.0% target. The labor market may also take center stage this week.

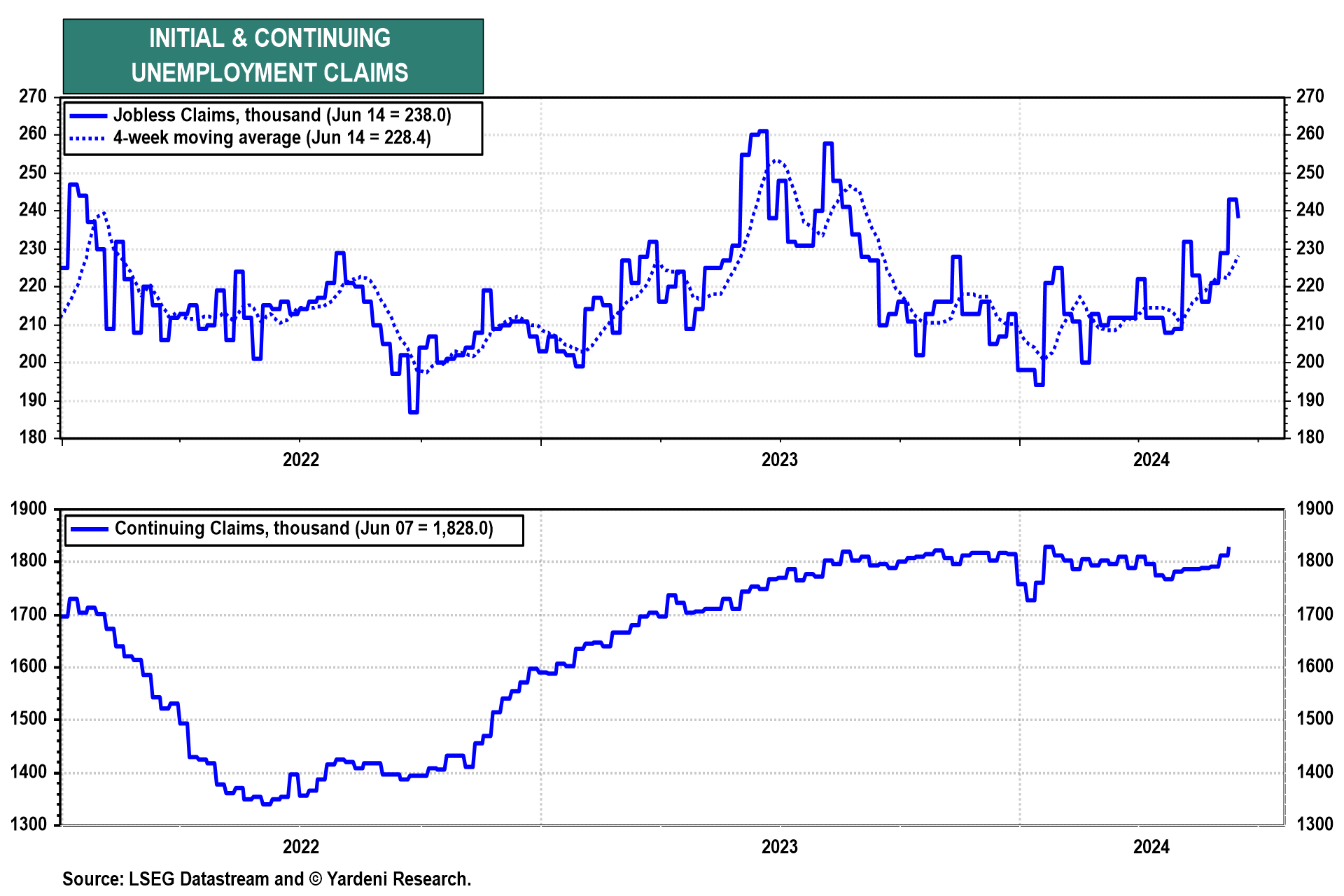

If weekly jobless claims (Thu) increase sharply after falling 5,000 to 238,000 in the June 15 week, the 10-year Treasury yield would likely dip below 4.20% while stocks might jump on hopes the Fed will cut interest rates sooner rather than later (chart). We think initial claims will stay relatively low below 250,000, and we still expect no rate cut this year. Here's our take:

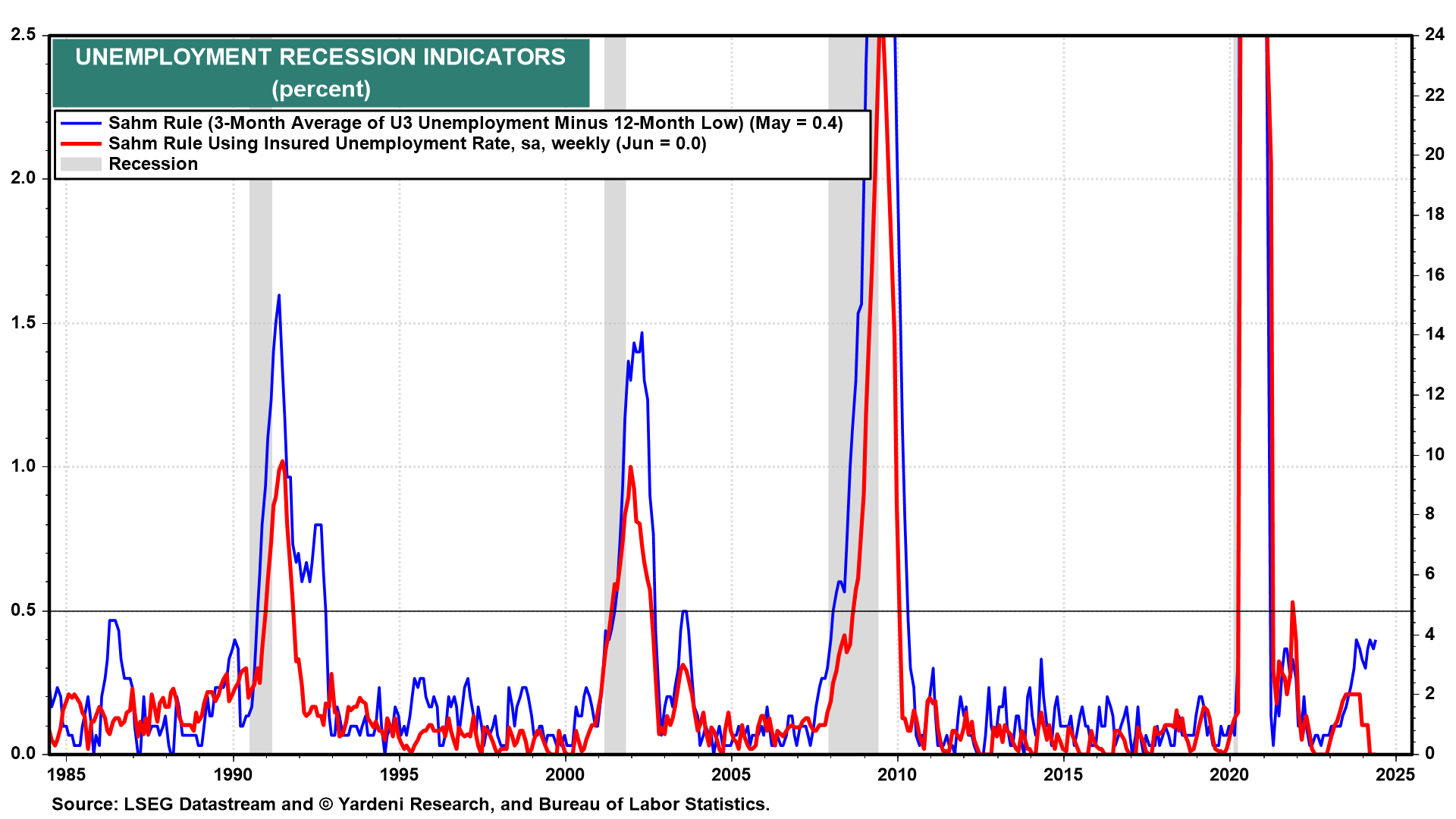

(1) Unemployment. There's much ado about the Sahm Rule. In May, the three-month average unemployment rate (3.9%) was 0.4 percentage point above its low point of the past year (3.5%). The Sahm Rule says a recession is either impending or here if that spread reaches 0.5 points. Should unemployment tick higher from 4.0% to 4.1% in June, the rule will be triggered.

Looking at unemployment claims data, we aren't concerned. We replace the monthly unemployment rate with the weekly insured unemployment rate (sa), finding this modified Sahm Rule flat at 0.0% currently (chart). The monthly national unemployment data tracks the weekly state-level numbers (which measures the number of workers claiming unemployment relative to all workers covered by it) quite closely. We're chalking up some of the difference to immigrants not claiming state insurance due to ineligibility or inaccessibility. We expect the weekly rule will remain calm as the labor market normalizes but stays relatively strong.

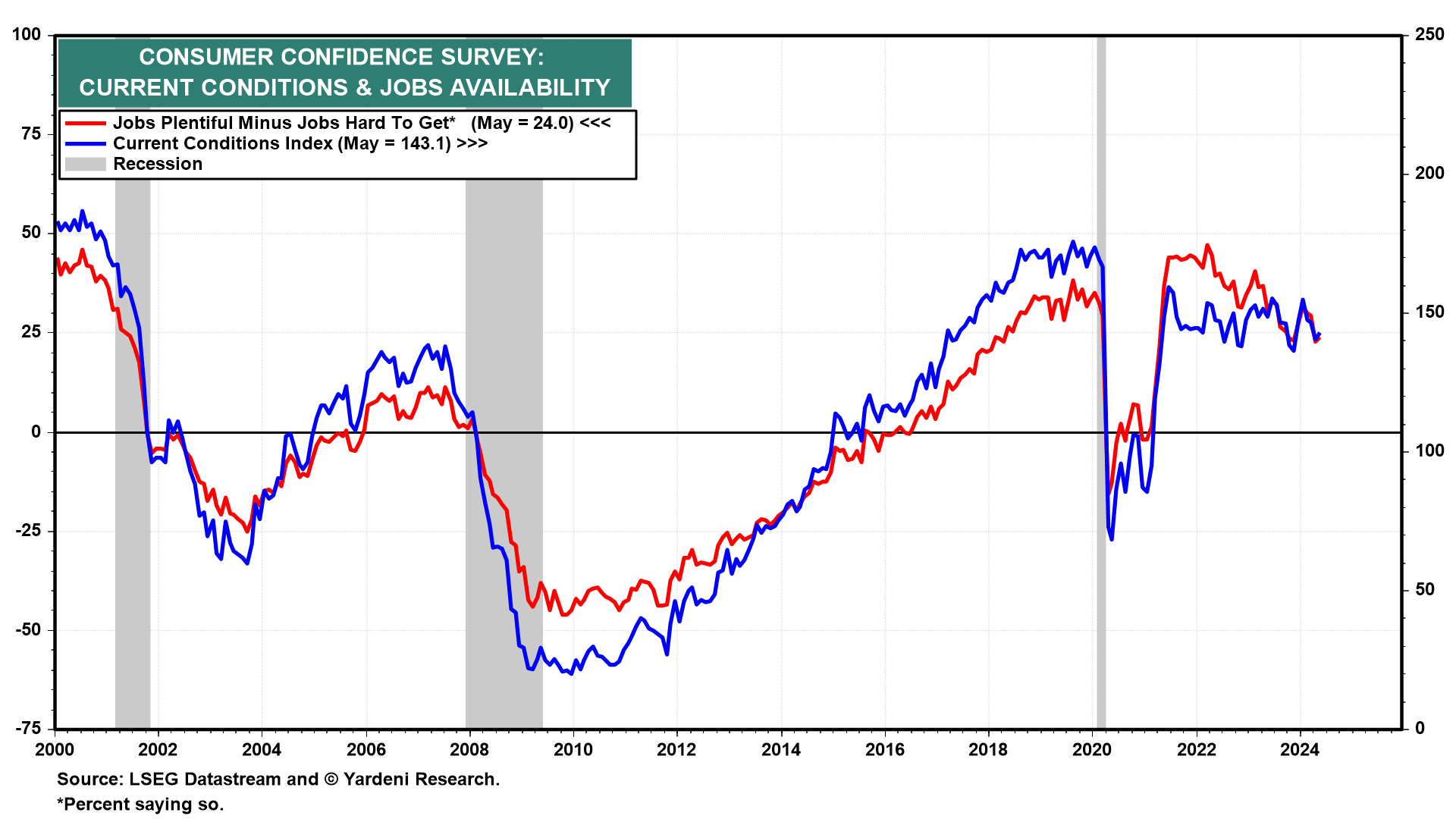

(2) Consumer confidence. We'll get another early read on the labor market's health this month from June's Consumer Confidence Index (CCI) (Tue). We expect jobs plentiful to continue moderating from its pandemic peak as jobs hard to get edges up. We see fewer workers quitting their jobs as a positive sign that they're comfortable with their jobs and wages. That's why current conditions in the CCI has remained near pre-pandemic highs (chart).