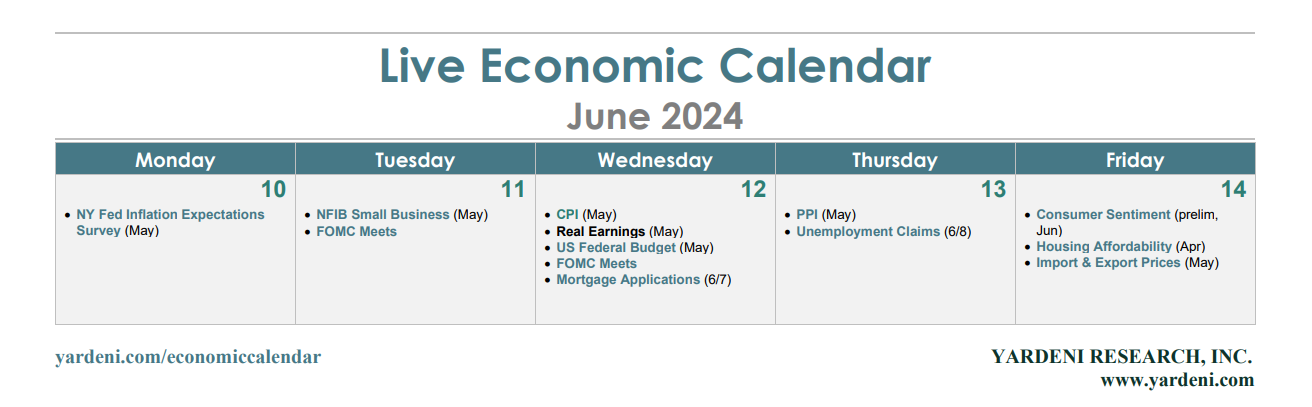

The economic week ahead will be dominated by the FOMC’s latest meeting (Wed) and May’s CPI report. The FOMC is widely expected to keep the federal funds rate (FFR) target range between 5.25% to 5.50% on Wednesday. The committee will also release its latest Summary of Economic Projections (SEP) showing the participants’ median forecasts for real GDP, the unemployment rate, the inflation rate, and the FFR.

We expect that Fed Chair Jerome Powell will push back on market expectations for the Fed to cut interest rates this year. The SEP might be changed to signal one rate cut at most this year rather than 2 to 3 cuts. We think the economy can handle rates at these levels and cutting preemptively would be a mistake because it would fuel a stock market meltup.

Now let’s review the outlook for this week’s important inflation news:

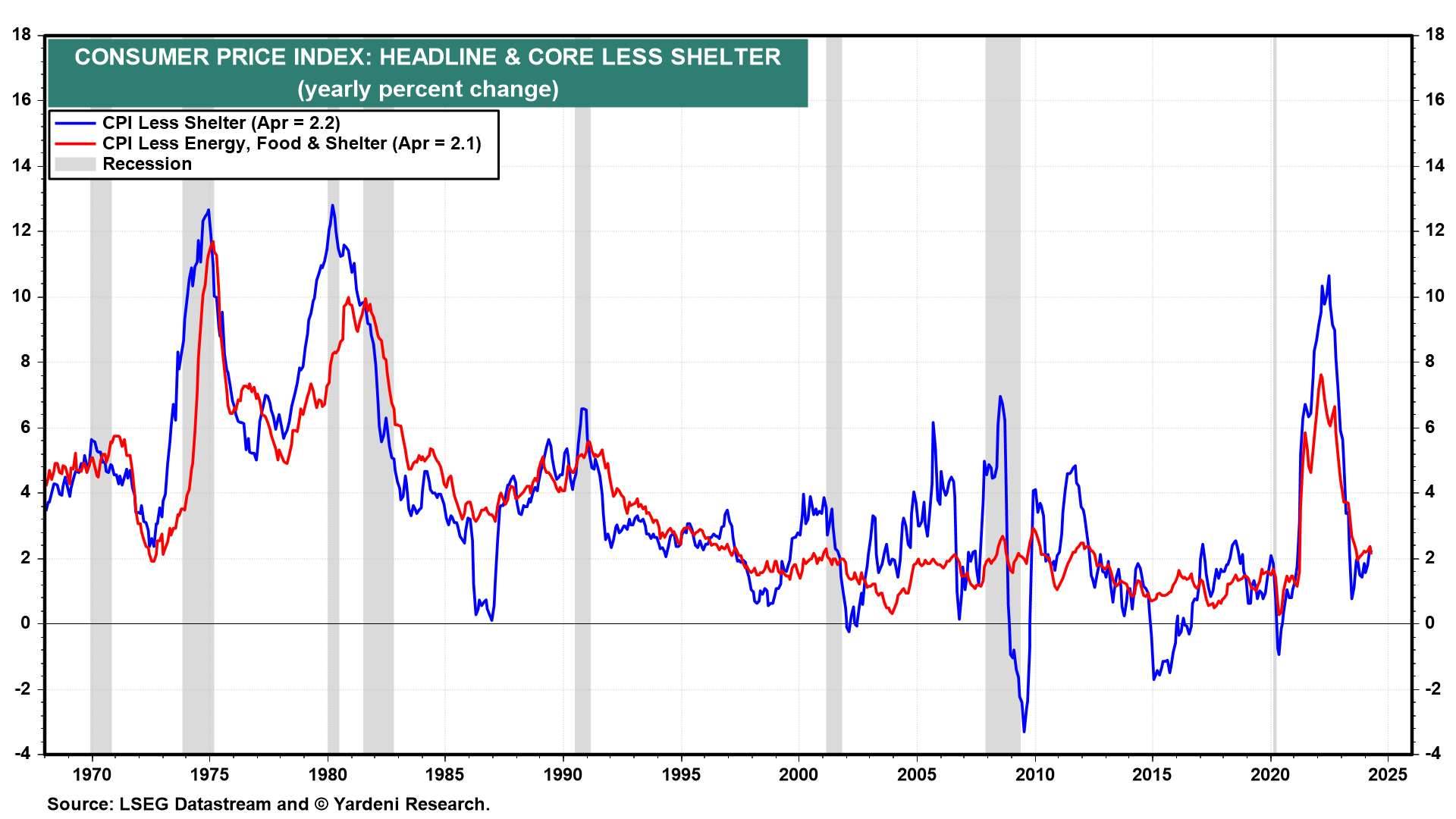

(1) CPI. May’s CPI (Wed) should confirm that inflation continues to moderate. The Cleveland Fed’s Inflation Nowcasting model shows headline and core CPI rose 3.36% and 3.55% y/y (0.08% and 0.30% m/m) last month. That would be the lowest reading on annual core inflation since April 2021. Excluding lagging rent inflation, the CPI is already right around 2.0% (chart).

Shelter inflation in the CPI should continue to fall toward measures of current market rental rates. The national retail pump price of gasoline edged down in May. Used car prices fell during the month (chart). We are expecting (hoping) that other auto-related consumer prices (especially insurance, maintenance, and repairs) have stopped soaring.