Last month, lower-than-expected CPI and PPI inflation readings for May, along with rising unemployment claims for June, raised market expectations that the Fed will ease monetary policy sooner rather than later. The week ahead will be dominated by inflation data and jobless claims that are likely to confirm that the economy is in a disinflationary soft patch. That could boost both stock and bond prices. Consider the following:

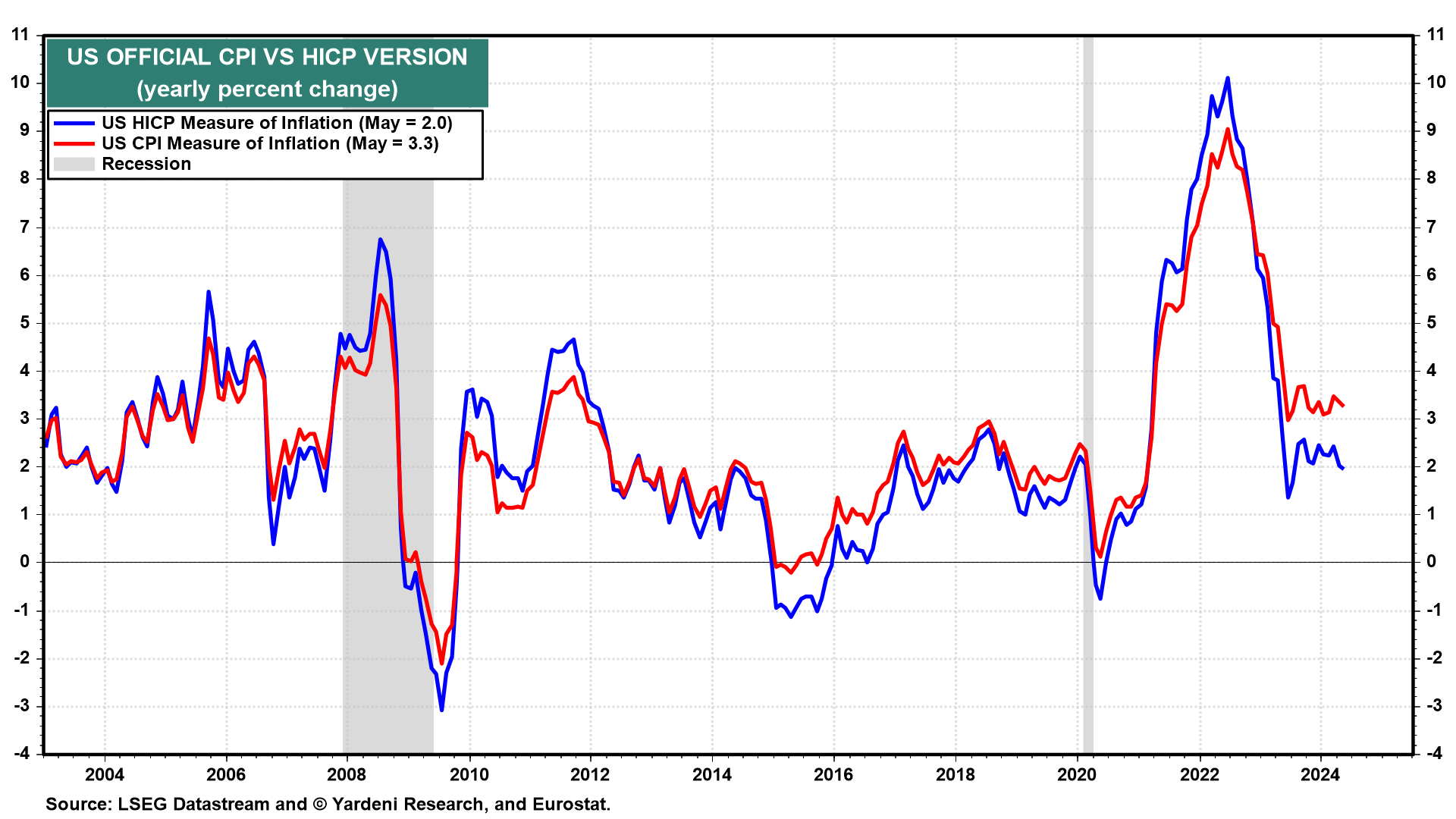

(1) CPI. June's CPI (Thu) should show further disinflation. The Cleveland Fed’s Inflation Nowcasting model forecasts the headline and core CPI rose 3.12% and 3.52% y/y (0.07% and 0.28% m/m) last month. By some measures, inflation is already much lower. The Harmonized Index of Consumer Prices (HICP) used by the Eurozone includes the rural population and excludes owner-occupied housing. The US HICP rose just 2.0% y/y in May(chart). It's been fluctuating around that pace since H2-2023!

Gasoline prices were probably down in June's CPI. They seem to be headed higher in July along with oil prices. However, reported progress on a ceasefire between Israel and Hamas might push oil prices lower (chart). Markets would greet that favorably as well as the recent election of a "pro-reform" president in Iran.

(2) PPI. The PPI has been at or below 2.3% y/y since April 2023, weighed down by falling goods and import prices (chart). We expect more of the same from June's PPI (Fri). The PPI does not include rent.