We know there will be fireworks on July 4th. The question is whether we should expect any blasts or just fizzling sounds during the week ahead related to the economy and the labor market. The holiday-shortened week will be jampacked with employment indicators. We aren't expecting any big surprises:

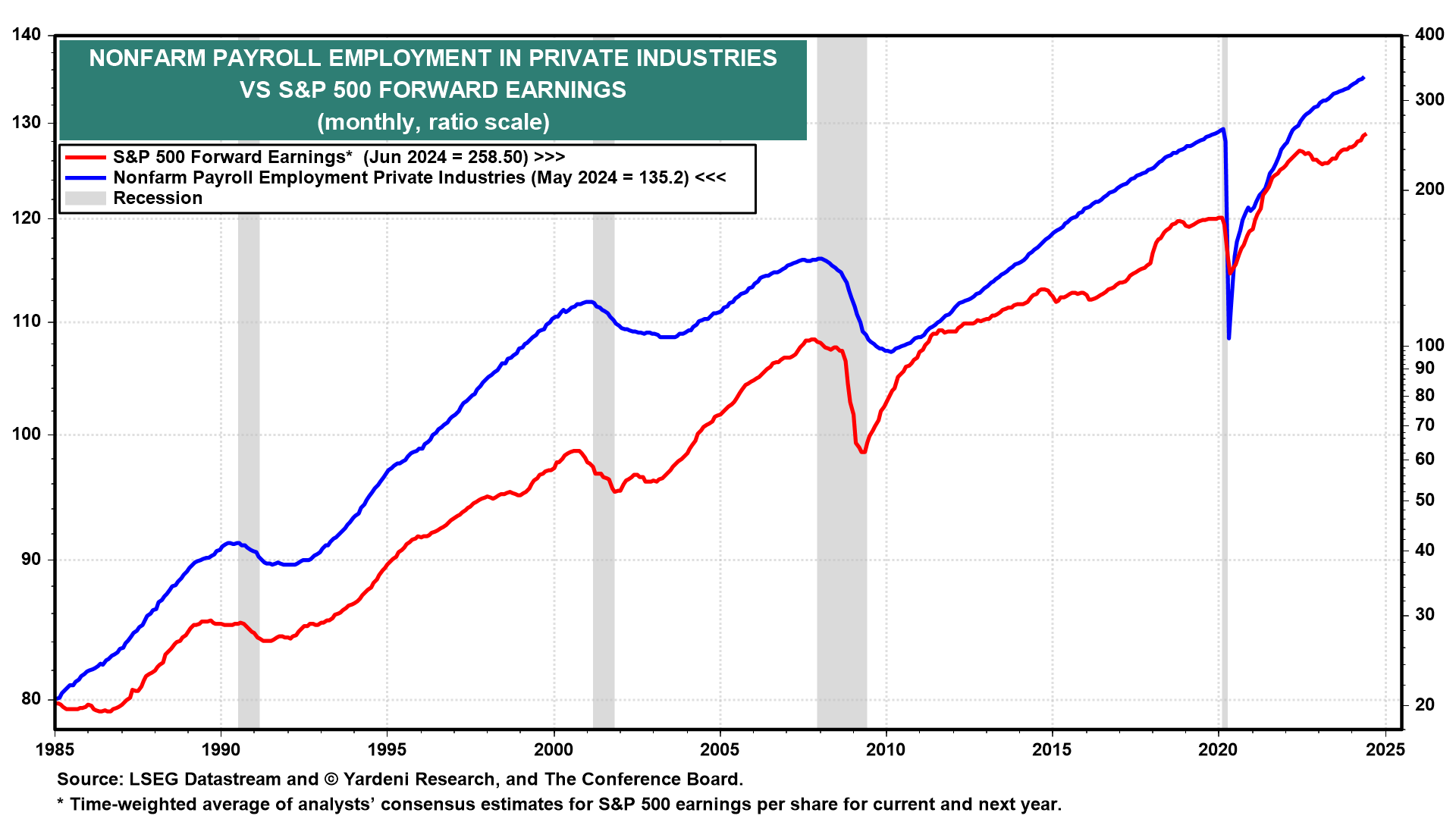

(1) Payroll employment. We expect that June's employment report (Fri) will show payrolls rose by 150,000 to 200,000, and that wage inflation continued to moderate. We've previously observed that payroll employment is highly correlated with S&P 500 forward earnings, which climbed to a record high in June (chart). That makes sense, since profitable companies tend to expand their payrolls. while unprofitable ones are forced to pare their payrolls.

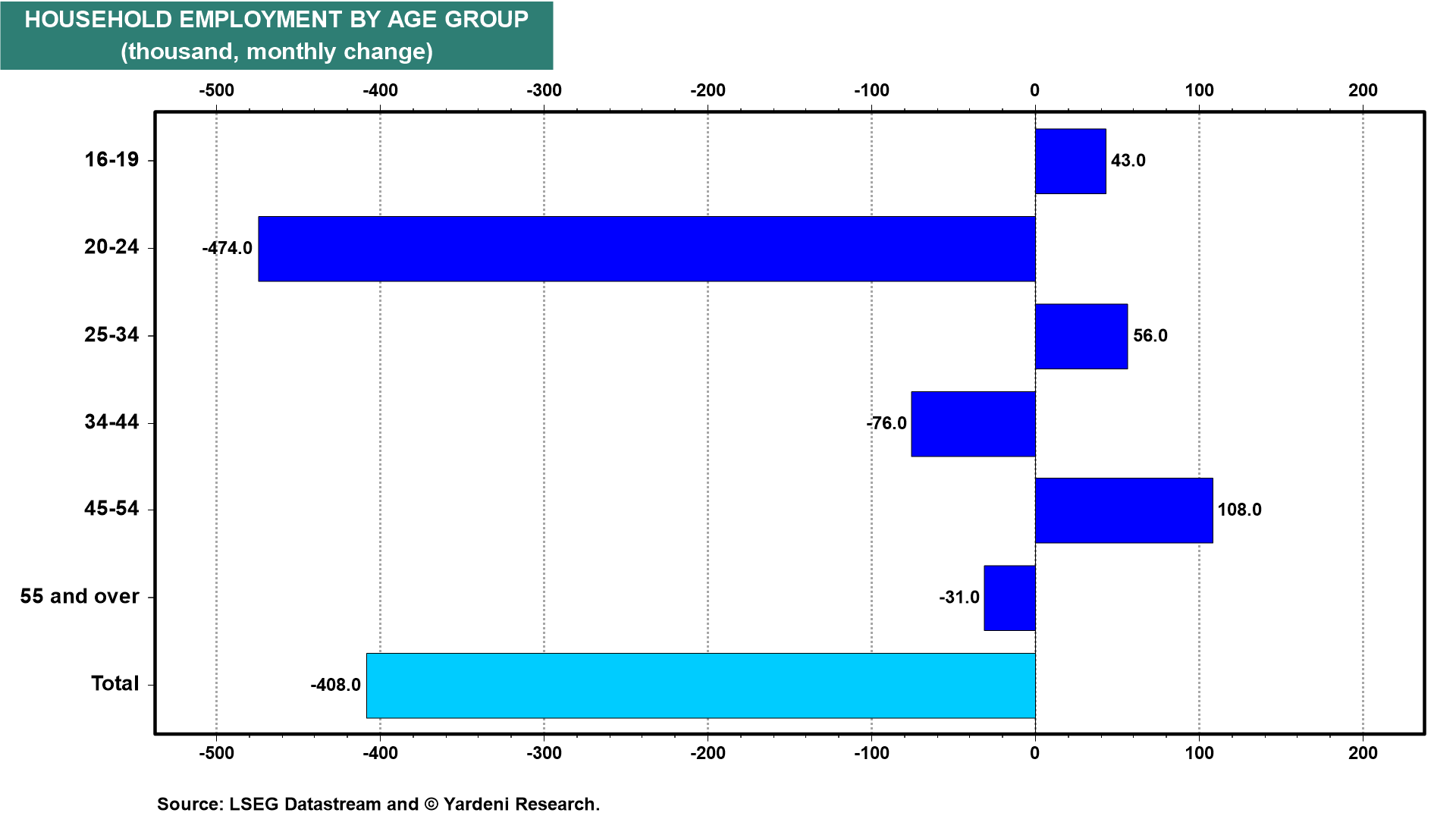

(2) Household employment. We will be having a close look at the household measure of employment, which fell 408,000 during May, led by a 474,000 drop in 20-24 year-old workers (chart). We suspect that was a seasonal issue related to college students. If so, then both these series should have rebounded during June.

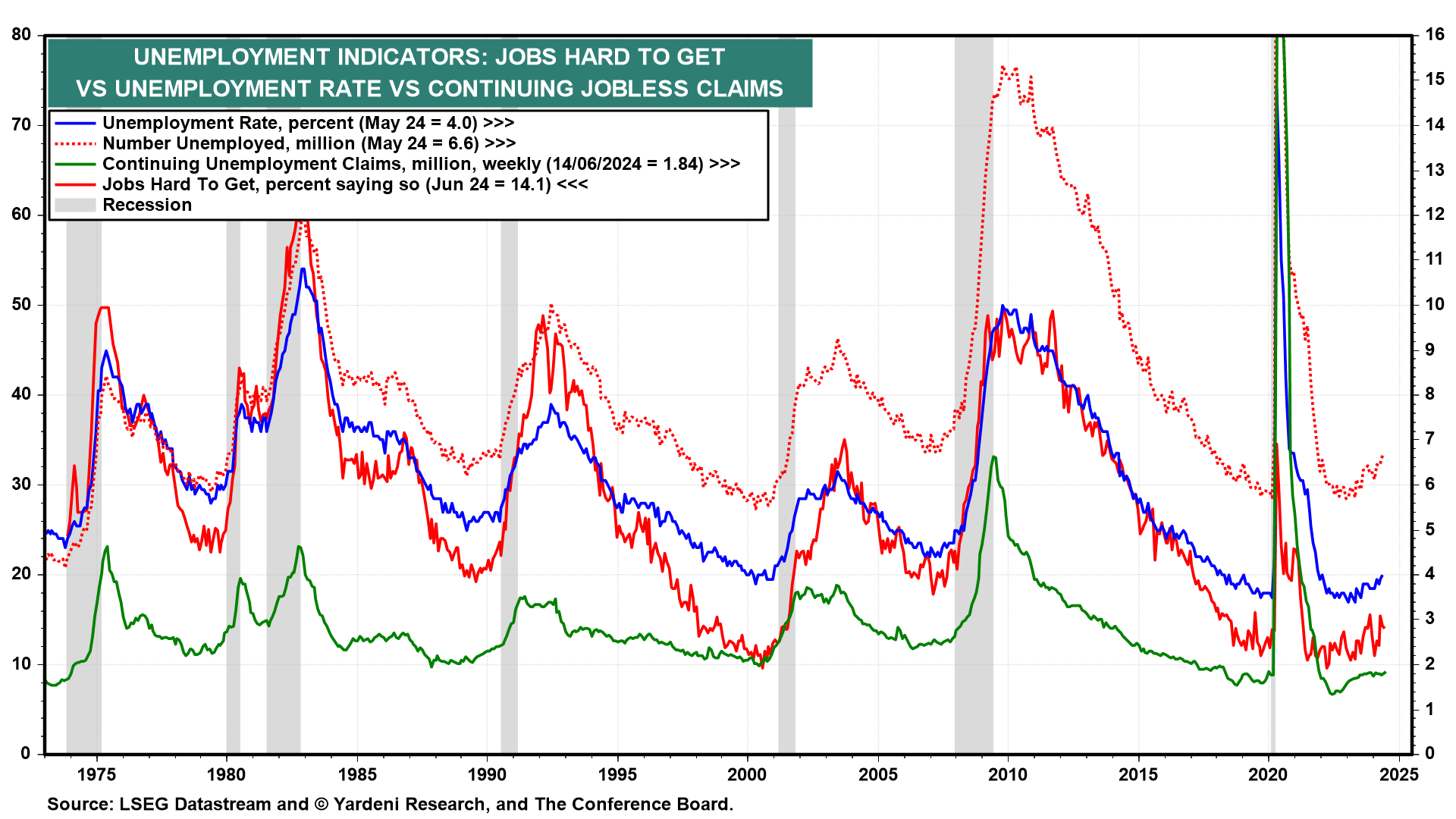

(3) Unemployment rate. Everyone seems to be expecting that the next surprise in the labor market will be a jump in the unemployment rate (Fri). It rose to 4.0% in May, the highest reading since January 2022. We think that uptick was related to the seasonal issue among college students. If so, then the unemployment rate should have remained at, or fell back below, 4.0% during June. The jobs-hard-to-get series confirms our expectation (chart).