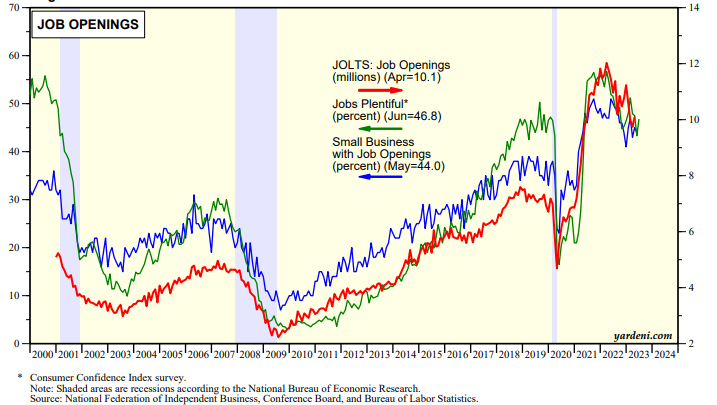

The first week of every month tends to be jampacked with employment and PMI releases. All eyes will be on June's employment report at the end of the week. The recent upturn in initial unemployment claims suggests that the labor market may be cooling off a bit. Thursday's jobless claims should confirm that. However, that same day, May's JOLTS report should show that job openings remain very high (chart).

Monday's M-PMI and Thursday's NM-PMI should confirm that the manufacturing sector is bottoming, while the non-manufacturing sector (which includes services and construction) is doing well (chart). Investors will be examining the prices-paid indexes of both surveys along with wage inflation in Friday's employment report. On balance, we expect to see more evidence that inflation is moderating.