Last week had plenty of indicators that allowed us to assess the latest readings on US inflation: It is continuing to moderate. This week has plenty of reports that will allow us to assess the strength of the economy: They are likely to show some mixed readings for the goods sector.

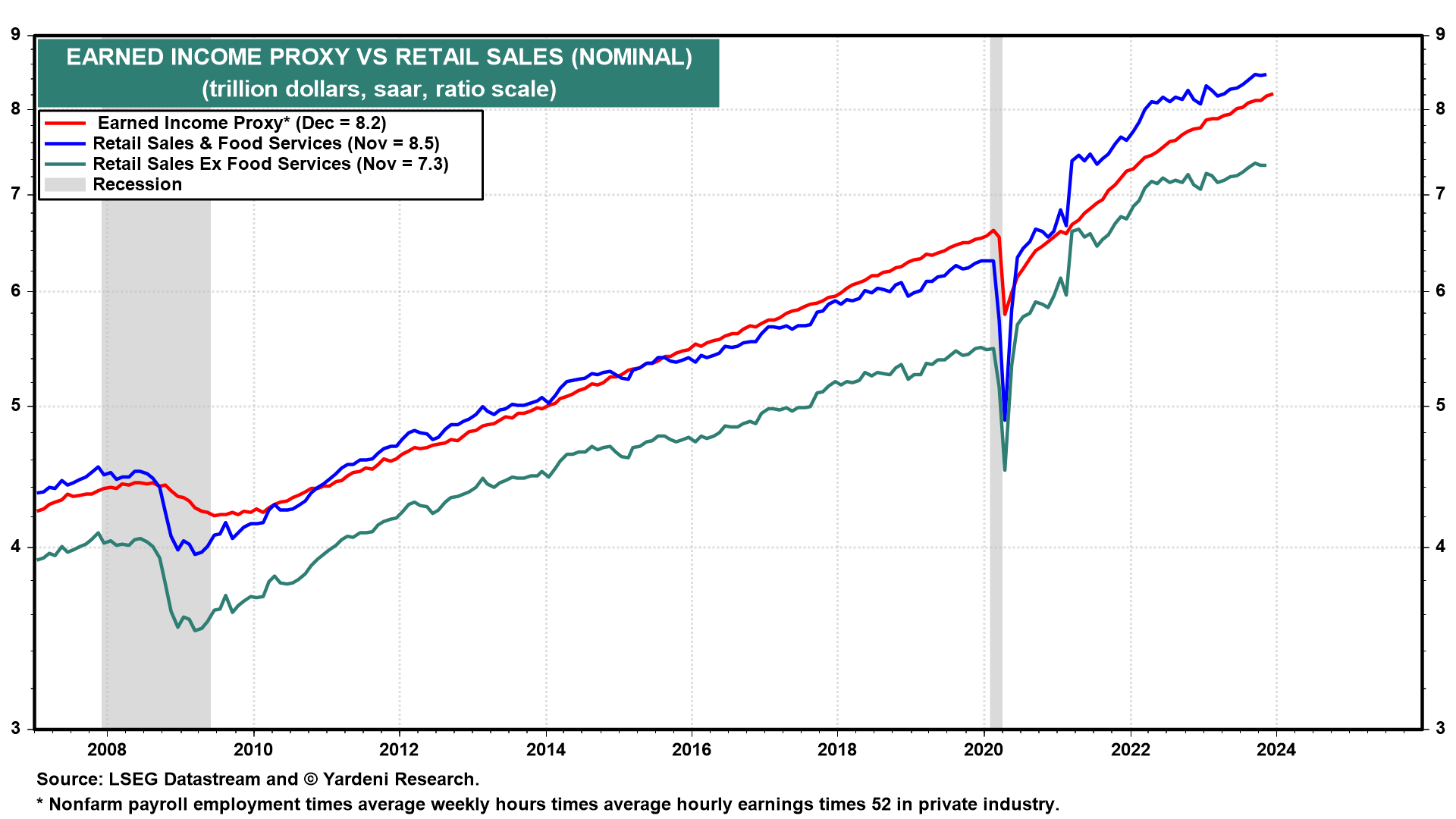

Most important will be December's retail sales (Wed). We know that aggregate hours worked fell 0.2% m/m, while average hourly earnings rose 0.4% during the month. So our Earned Income Proxy for private wages and salaries edged up by just o.2% in nominal terms and fell 0.1% in real terms (since the headline CPI for all goods and services was up 0.3%). That augurs for a weak increase in nominal retail sales (chart). However, keep in mind that the CPI for goods fell 0.8% m/m and 1.2% m/m excluding food. So real retail sales could actually boost Q4's real GDP growth rate.

The index of aggregate weekly hours in manufacturing decreased 0.2% m/m during December suggesting that industrial production (Wed) also ticked down last month (chart). We think that the rolling recession for goods producers and distributors will turn into a rolling recovery in coming months. January's business surveys conducted by the New York Fed (Tue) and Philly Fed (Thu) should confirm their recent signs of bottoming.