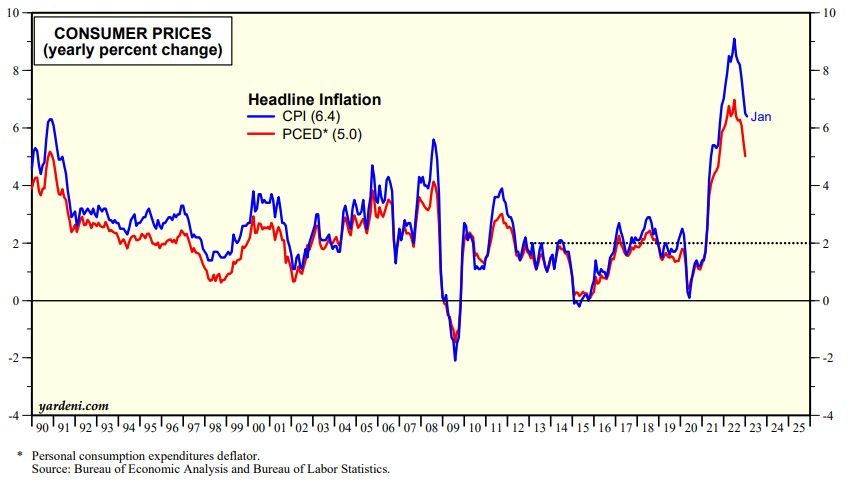

The holiday-shortened week is a light one for economic indicators. The BIG number will be January's PCED inflation rate, which will be released along with personal income on Friday. The month's CPI was higher than expected , though the y/y inflation rate continued to disinflate. The PCED inflation rate tends to be lower than the CPI inflation rate (chart). That's because rent of shelter has a smaller weight in the former than the latter. Also the consumer durable goods and medical care inflation rates tend to be lower in the PCED than in the CPI. We are still predicting that the headline PCED inflation rate will fall from 5.0% at the end of 2022 to 3.0%-4.0% this year.

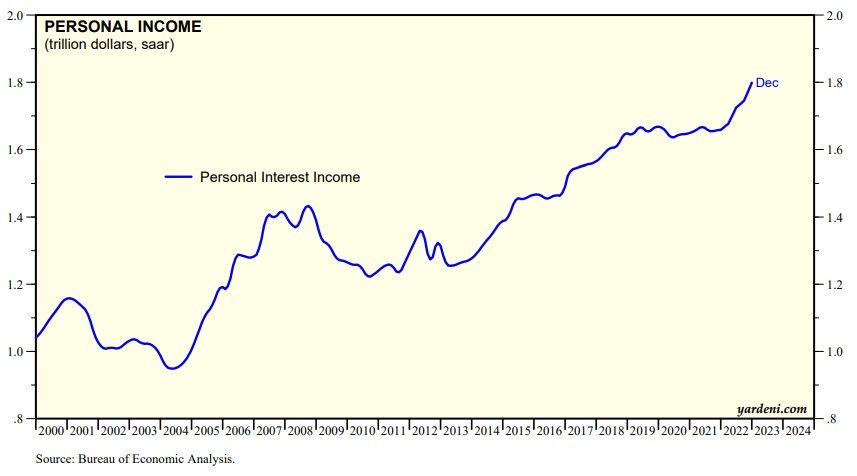

Undoubtedly, we will hear from a few Fed officials this week that they might have to raise interest rates further given the strength of January's economic indicators. We are expecting to see a solid increase in January's personal income led by wages and salaries. In addition, personal interest income has been rising rapidly over the past year along with interest rates (chart).

Also boosting personal income is the 8.7% COLA increase received by 70 million Americans in their Social Security benefits. They average $140/month starting in January. That adds up to $117.6 billion in additional pre-tax personal income this year.