Financial markets are likely to be action packed this week because the economic calendar is jampacked with key economic indicators that will impact the debate about both the economic and inflation outlooks, and their impact on Fed policy.

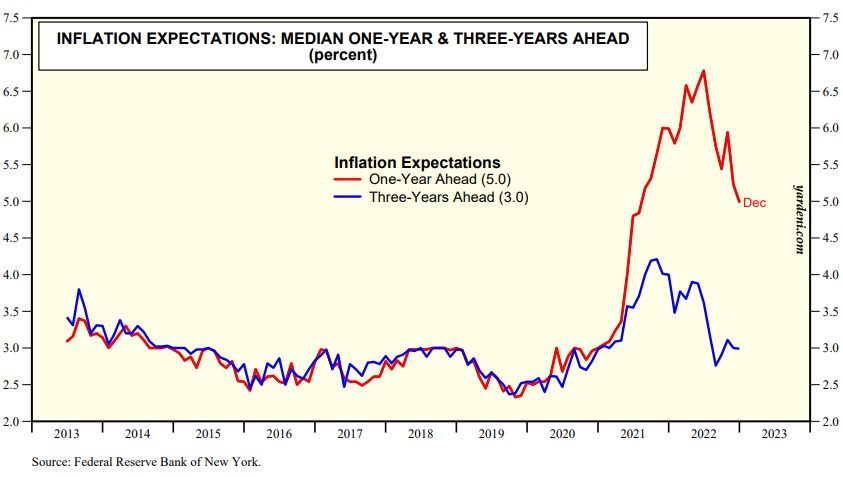

The inflation action starts on Monday with January's FRBNY consumer inflationary expectations survey likely to show some more moderation in the one-year ahead series (chart). January's CPI (Tue) is the week's BIG inflation number, as we discussed in the previous QT. The financial press seems to be raising fears that it will be a bad number because gasoline and used car prices rose last month. The latest consensus is that headline and core CPIs will both be up 0.4% m/m, or 6.2% y/y and 5.5% y/y--down from 6.4% and 5.7%. January's PPI (Thu) should also continue to move lower.