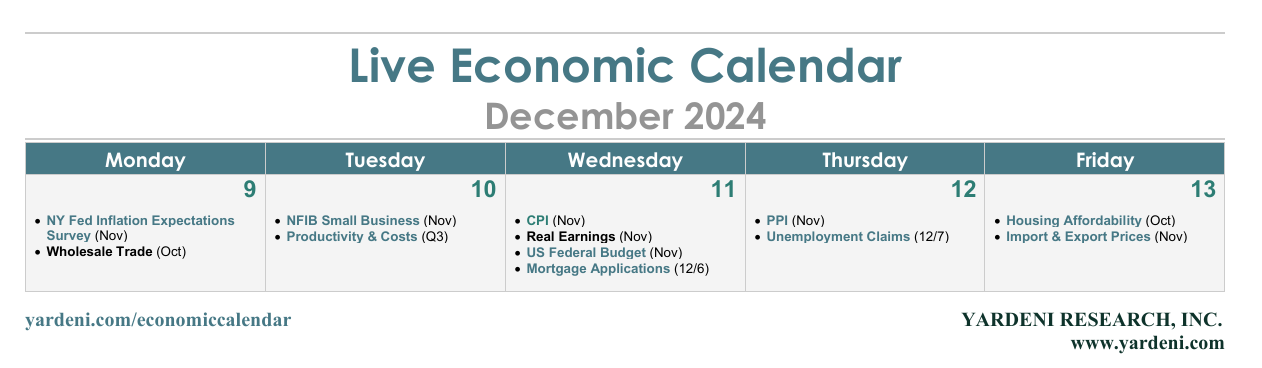

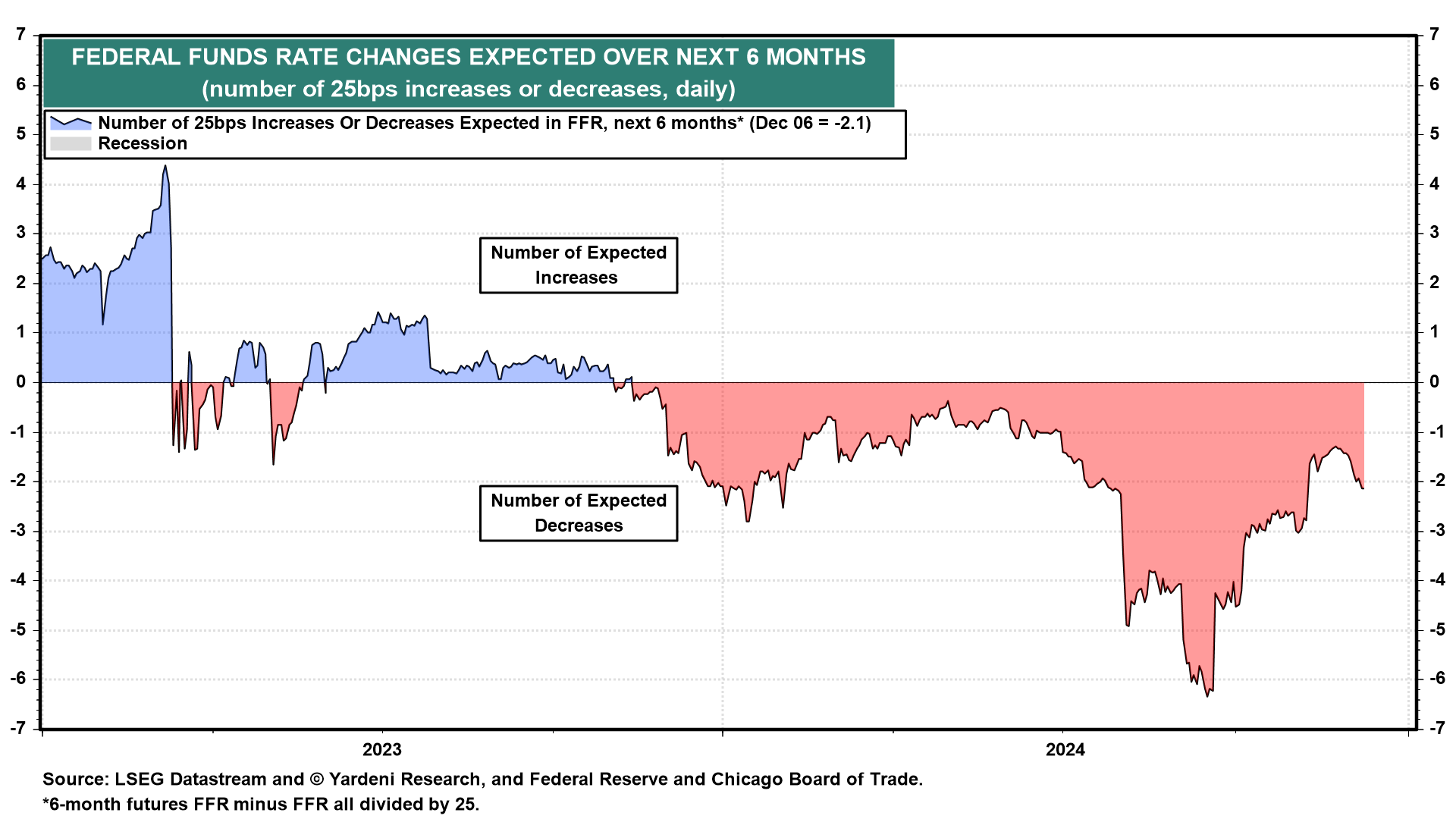

The economic week ahead is chockful of inflation updates. We're expecting stickier inflation readings that should ruffle the feathers of the Fed's doves. The FOMC is in a blackout period ahead of its December 17-18 meeting, meaning FOMC members won't be able to comment publicly. If the CPI news changes their minds about cutting the federal funds rate (FFR), they'll have to plant a front cover story in The Wall Street Journal. Current CME FedWatch odds show an 85% chance of a 25bps cut, and FFR futures show at least one more cut early next year (chart).

Further FFR reductions are likely to overheat the economy and the stock market, in our opinion. The 75bps of cuts since September 18 may have done that already. Optimism over Trump 2.0 should do enough to keep the Roaring 2020s roaring without additional rate cuts, and we expect that to be reflected in November's NFIB small business survey (Tue).

Here's what we're expecting form this week's indicators: