The week ahead is light on economic data. However, there will be lots of news coming out of Jackson Hole, Wyoming from Thursday through Saturday as many of the world's central bankers gather for their annual meeting near the Grand Teton mountain range. Most important will be Fed Chair Jerome Powell's speech on Friday at 10:00 a.m. (EST). Many other central bankers from the Fed and around the world will speak to the press there as well. Here's a quick rundown of what we'll be watching for, the potential market implications, and economic data we're monitoring this week:

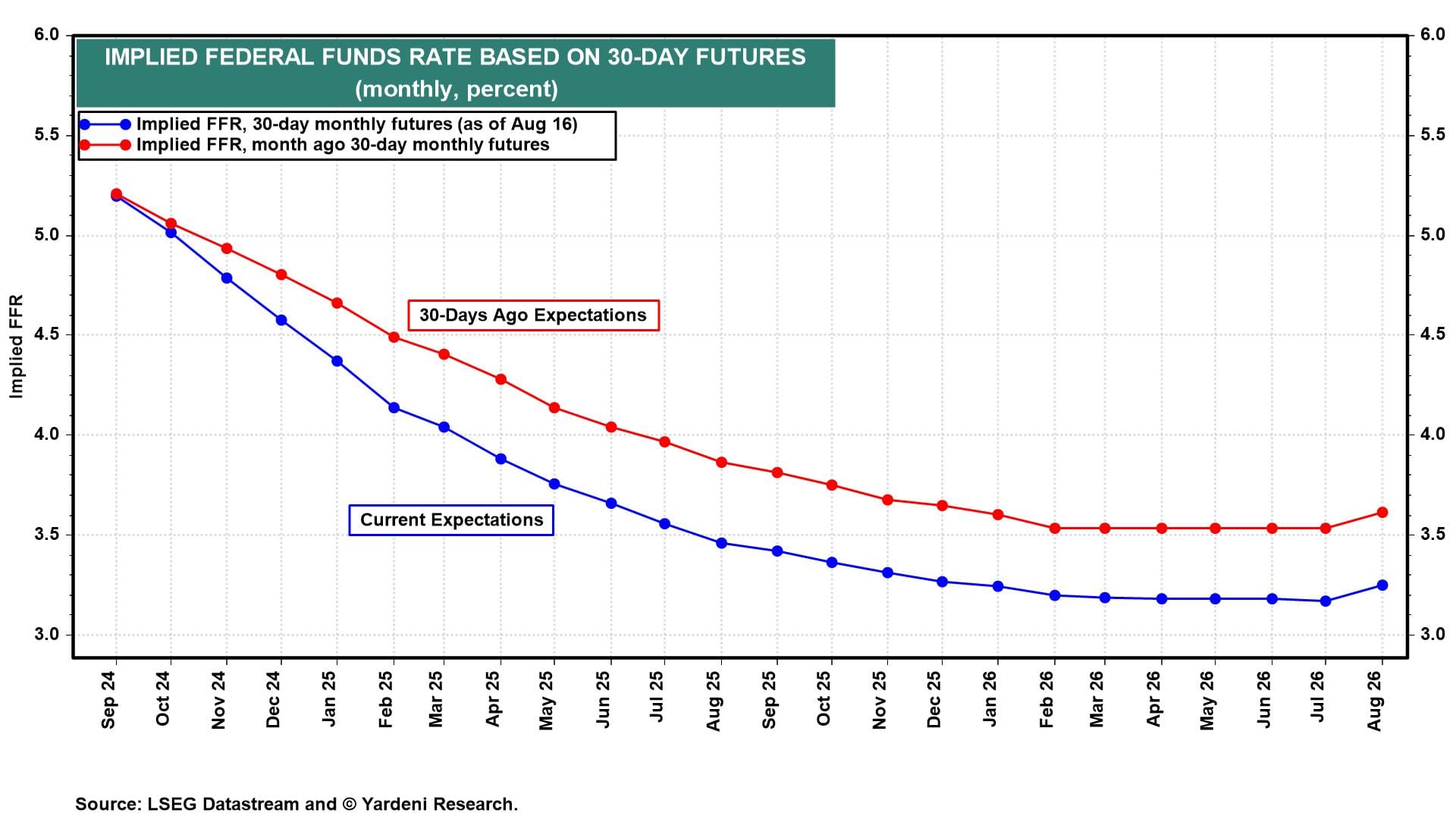

(1) Fed. As the Fed's dual mandate comes into better balance, we'll be listening for Fed officials' take on the latest unemployment and inflation data. Will they agree with us that July's weak employment report was mostly caused by bad weather? If they do, will they push back against market expectations of several rate cuts ahead (chart)?

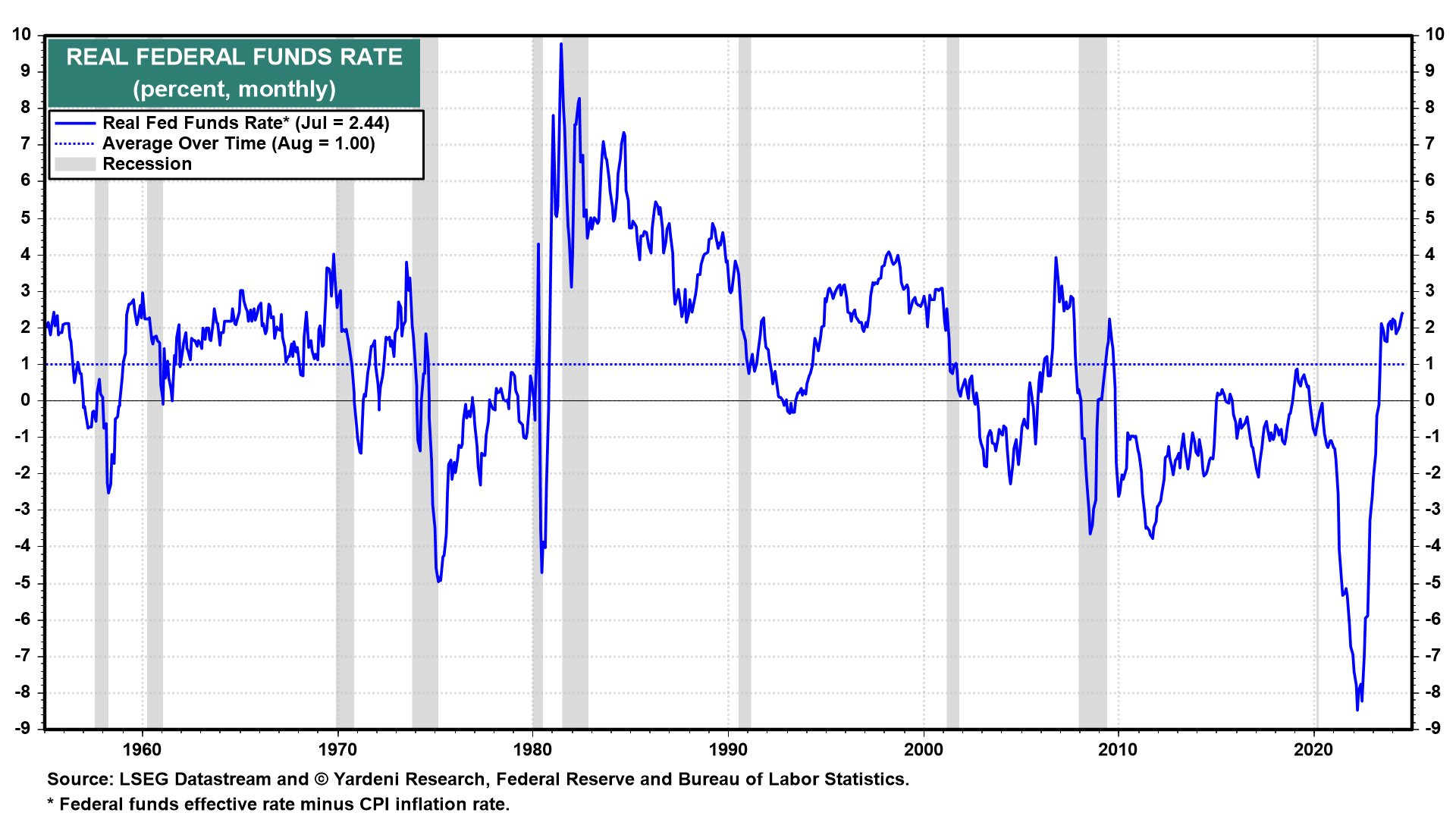

Or will the Fed's talking heads favor swiftly cutting the federal funds rate (FFR) as inflation falls in order to loosen the restrictiveness of policy as measured by the real FFR (chart)? Might they hint at some concerns about the potential inflationary consequences of the next administration's policies as well as of unsettling geopolitical developments? Might they indicate that unwinding carry trades may limit their ability to cut interest rates quickly? If Fed officials confirm that they are likely to start cutting the FFR in September, might they signal a willingness to end quantitative tightening (QT) in the coming months?

(2) BoJ. Japan's real GDP rose 3.1% q/q (saar) in Q2 and the CPI increased 2.8% y/y in June. The BoJ would likely be tightening policy further if it weren't for the havoc the yen carry trade unwind wreaked on the Nikkei 225 last week (chart).

Will the BoJ care more about global market volatility or inflationary pressures in Japan? If it continues to backdown to markets, the yen should weaken, the yield differential between JGBs and Treasuries widen, and carry trades rip. The opposite is true if BoJ Governor Ueda or his colleagues express hawkish views, which we deem to be unlikely.