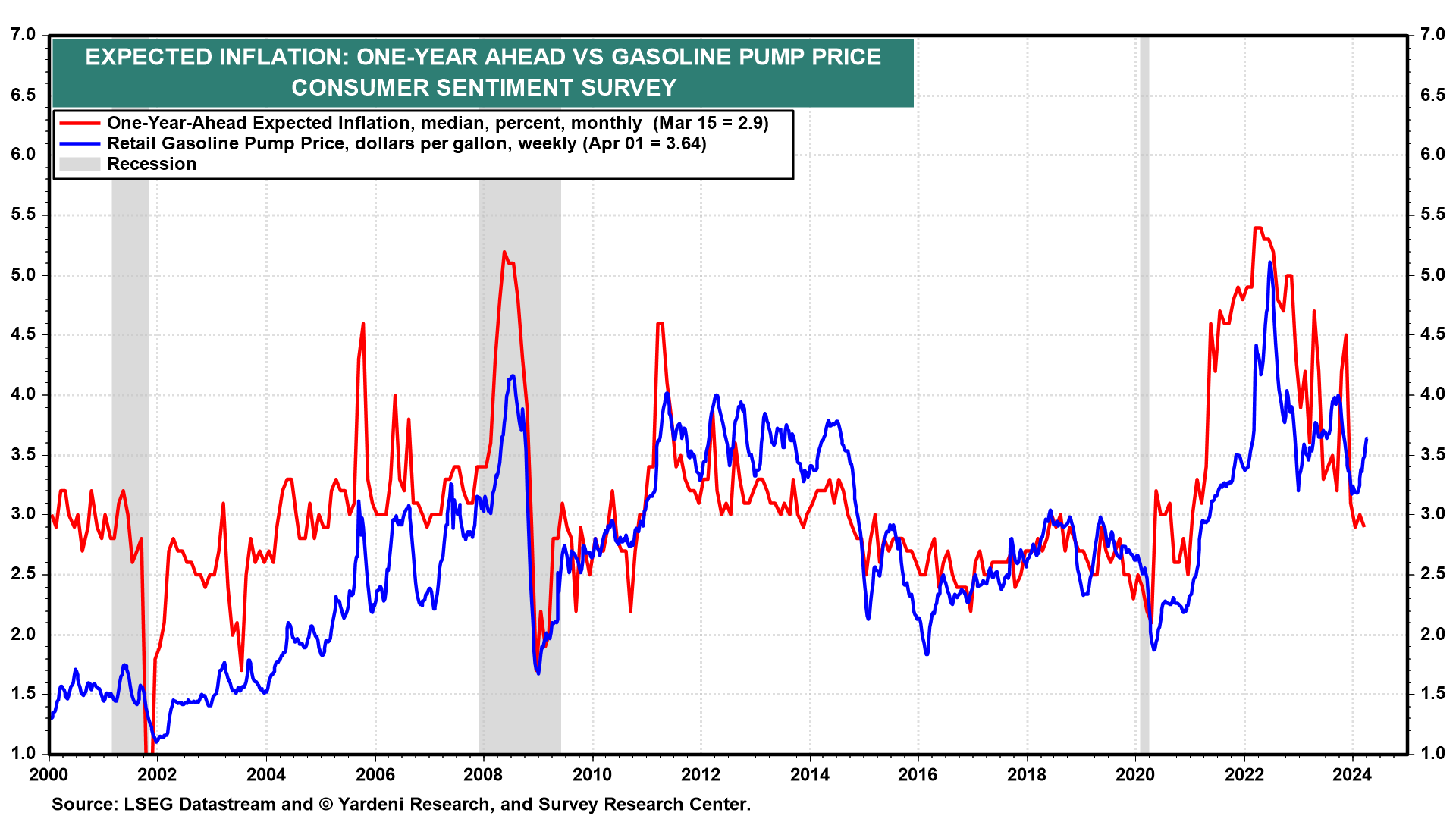

This week will feature some key inflation numbers. The March headline CPI (Wed) and PPI (Mar) will get a boost from higher gasoline prices. Their core inflation rates should continue to moderate. The week starts with the FRBNY survey of inflation expectations (Mon). The pump price of gasoline jumped last month and probably boosted inflation expectations (chart):

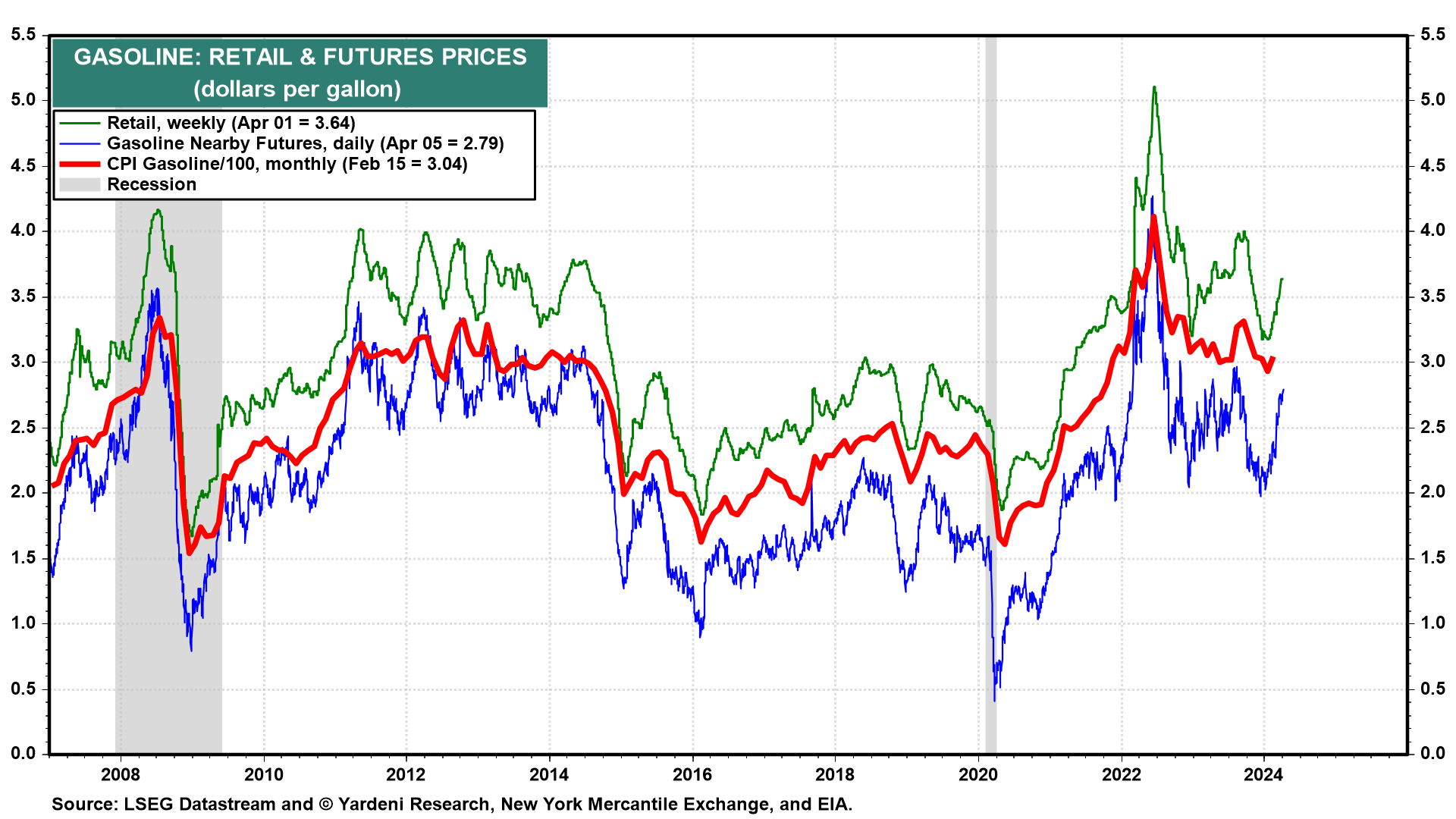

The gasoline component of the March CPI will also reflect the jump in the gasoline pump price (chart).

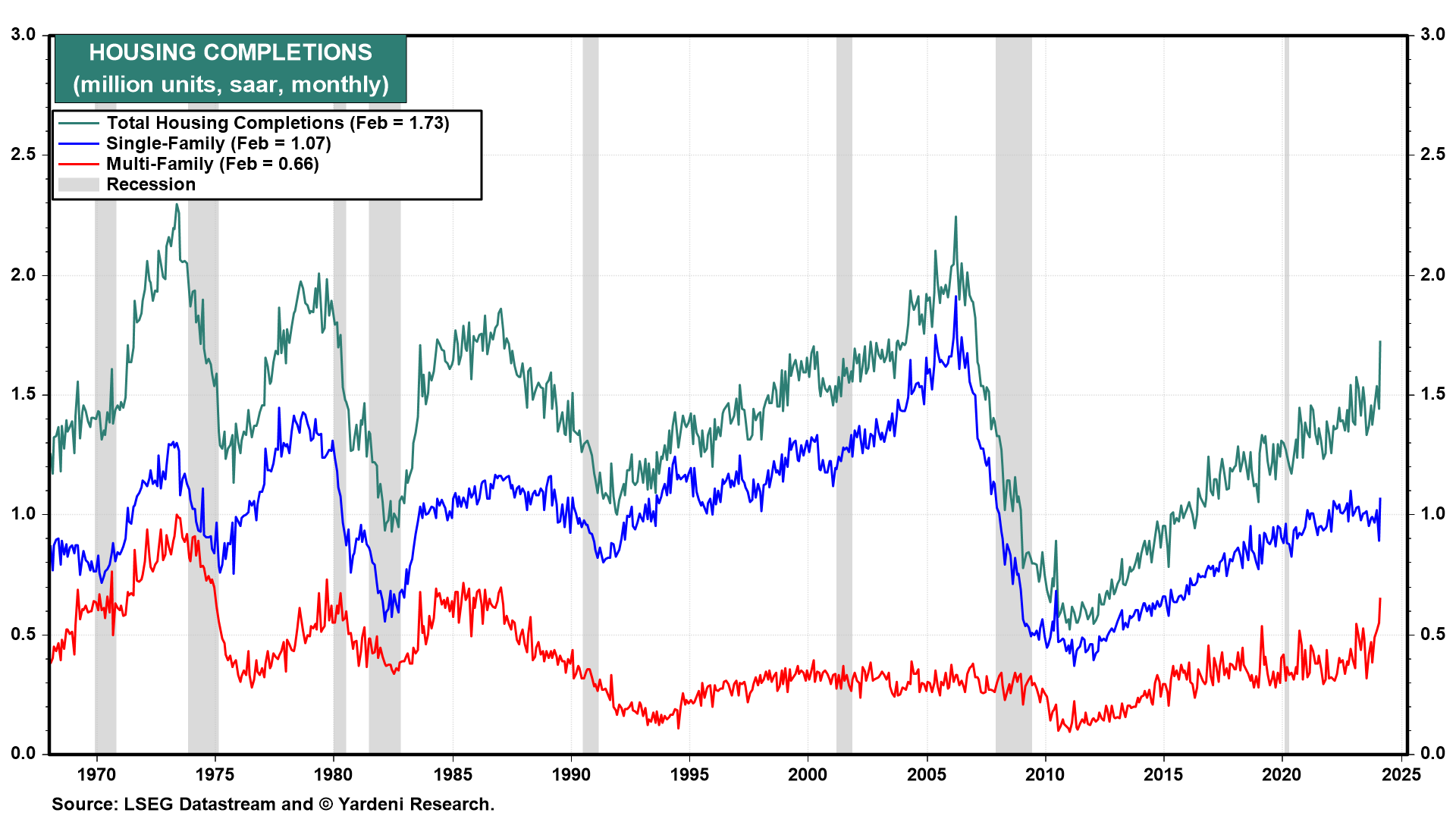

Nevertheless, the Cleveland Fed's Inflation Nowcasting shows that the headline and core CPI inflation rates rose by 0.34% m/m and 0.31% m/m--i.e., not much of a difference. By the way, the jump in multi-family housing completions during February suggests that rent inflation should continue to moderate as the supply of rental apartments increases (chart).

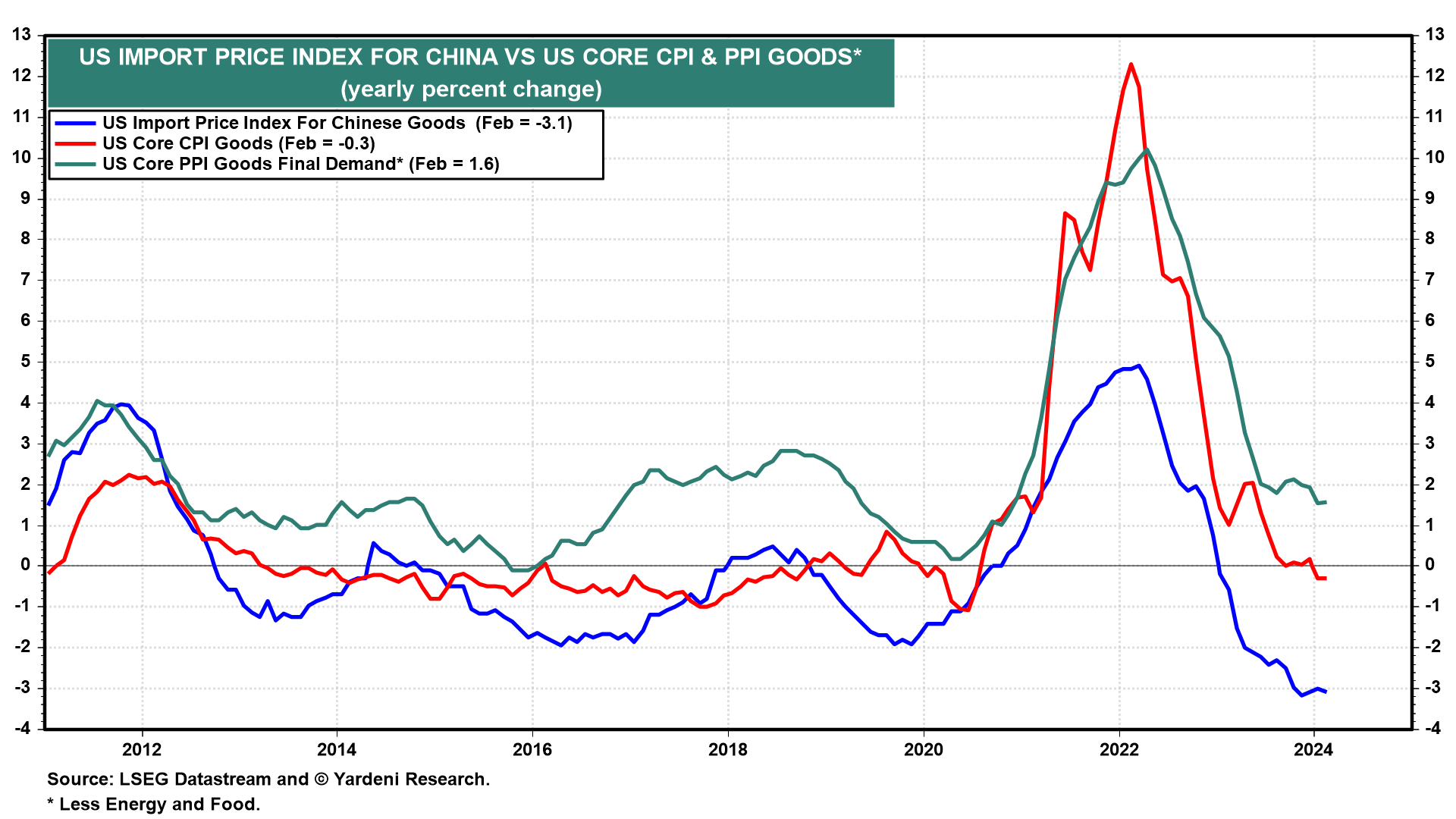

At the end of the week, March US import prices (Fri) should show higher petroleum import prices, but ongoing deflation in goods imported from China, which should weigh on the goods components of the CPI and PPI (chart). Treasury Secretary Janet Yellen is in China trying to convince the country's government to stop dumping goods in world markets. Good luck with that!

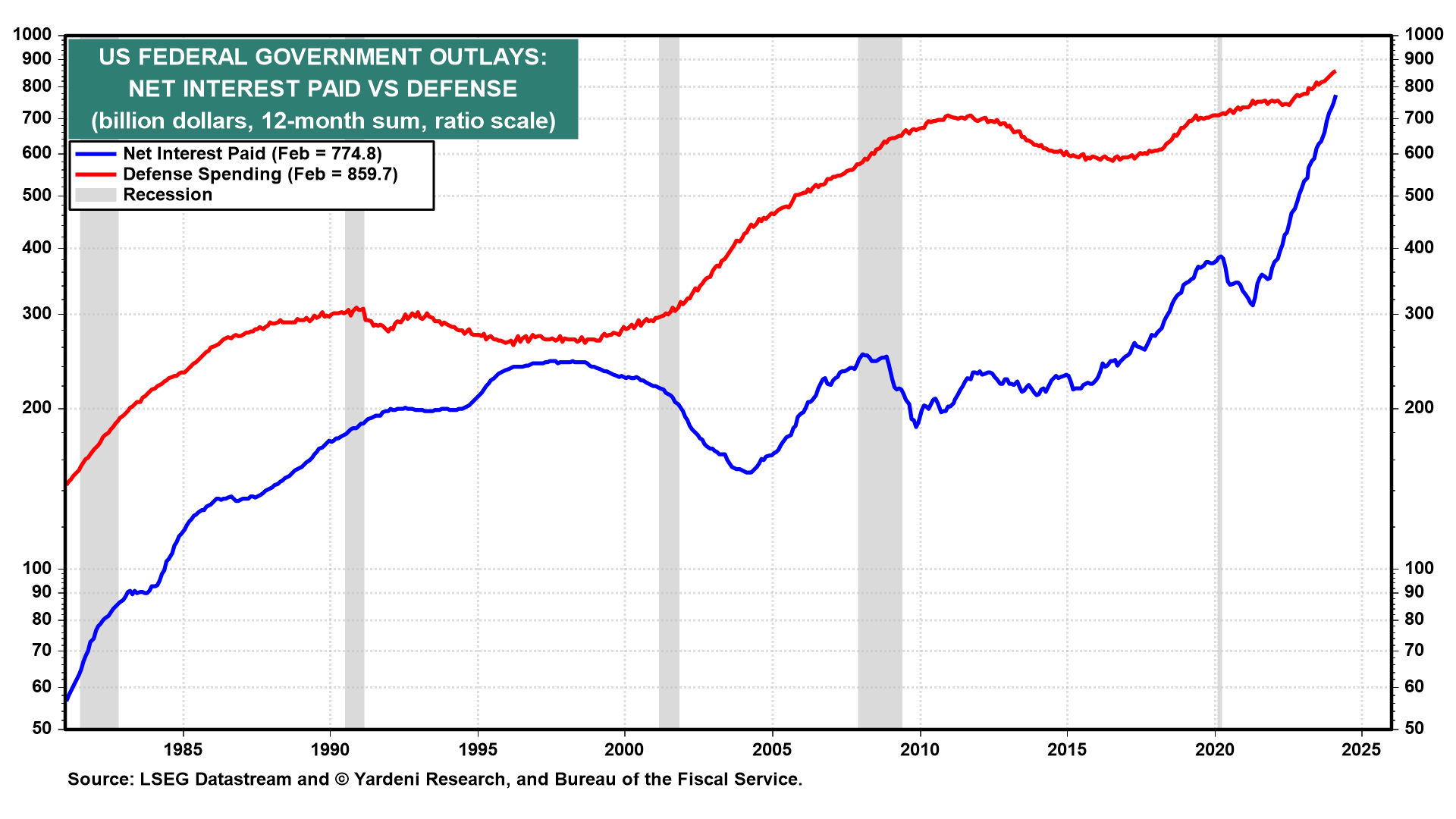

The March federal budget deficit (Wed) is likely to show that the FY2024 shortfall is heading toward $2.0 trillion. Shocking, but not surprising, will be to see net interest outlays exceeding defense outlays for the first time ever (chart).