This could be another action packed week as the Fed's meeting and the latest S&P 500 earnings reporting season take center stage. Fed Chair Jerome Powell will hold his press conference on Wednesday after the latest FOMC meeting adjourns. He is likely to reiterate that the FOMC is in no rush to lower interest rates, and isn't considering raising them either. That won't be surprising to the markets. Q1 earnings, however, could continue to mostly surprise to the upside this week, as they have so far.

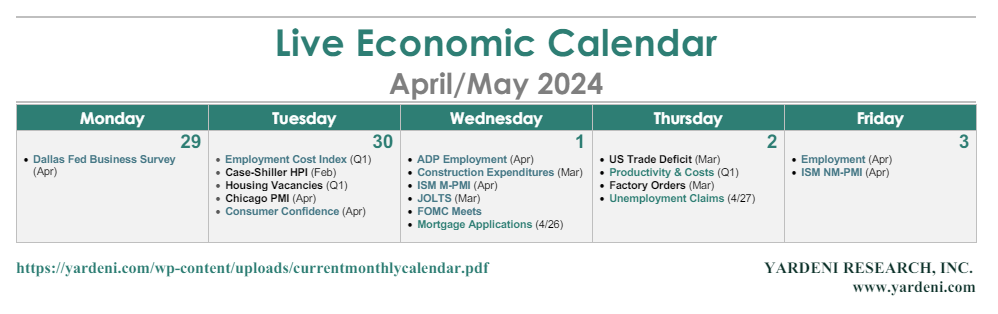

There could be surprises in this week's batch of economic indicators for both inflation and employment:

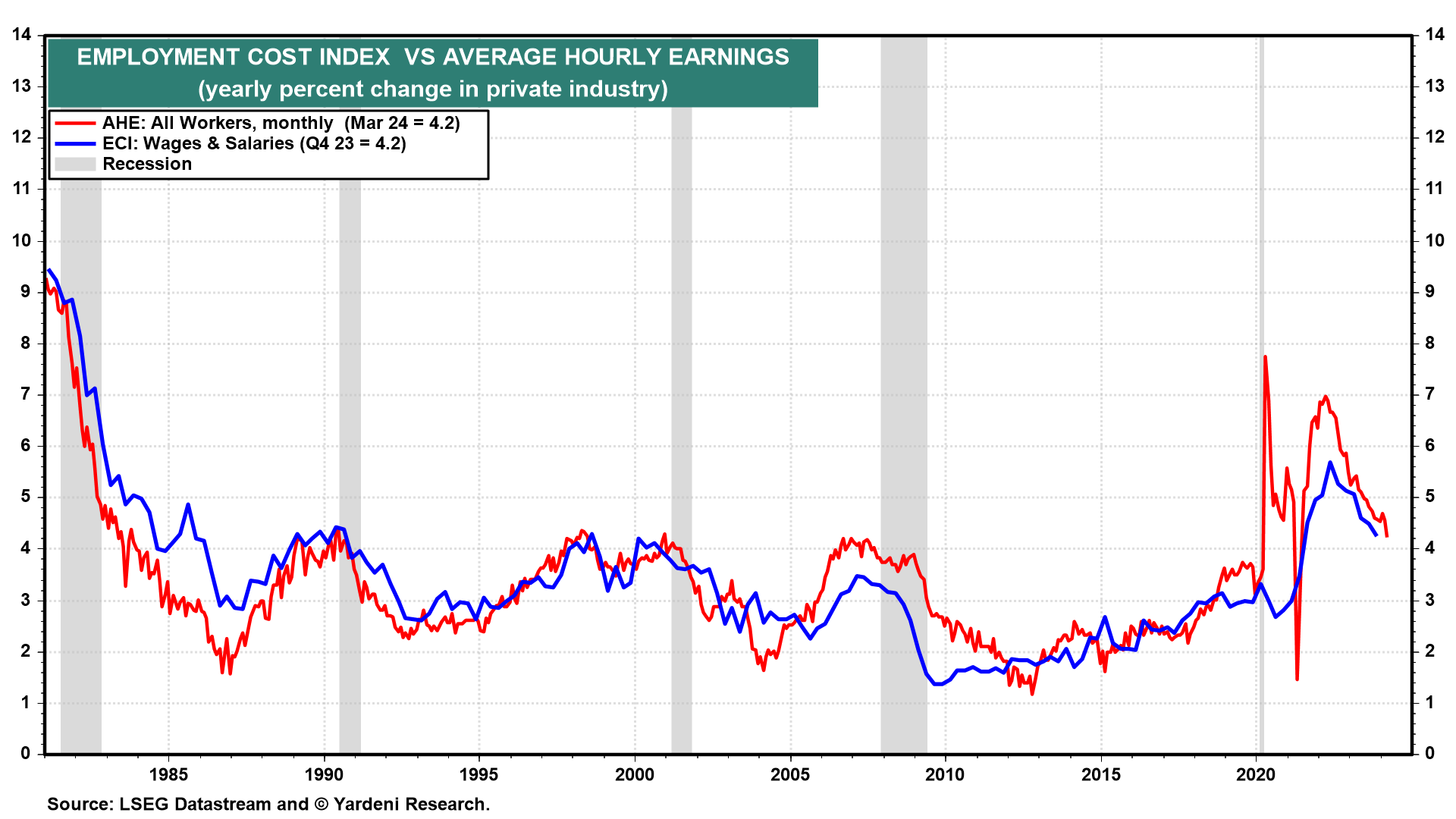

(1) Inflation. Q1's Employment Cost Index inflation rate (Tue) likely continued to moderate as it did last year notwithstanding significant gains for many union members with new contracts. We are expecting a 4.0% y/y increase down from Q4's 4.2% (chart). April's average hourly earnings inflation rate (Fri) should confirm that wage inflation is still moderating.

On the other hand, Q1's productivity growth (Thu) was probably weak following last year's big gains, reflecting solid employment increases and a weak increase in output as indicated by real GDP. Unit labor costs (ULC) probably rose faster during Q1. The bond and stock markets might not like the numbers, though we believe that productivity growth will rebound over the rest of this year, helping to moderate ULC inflation.