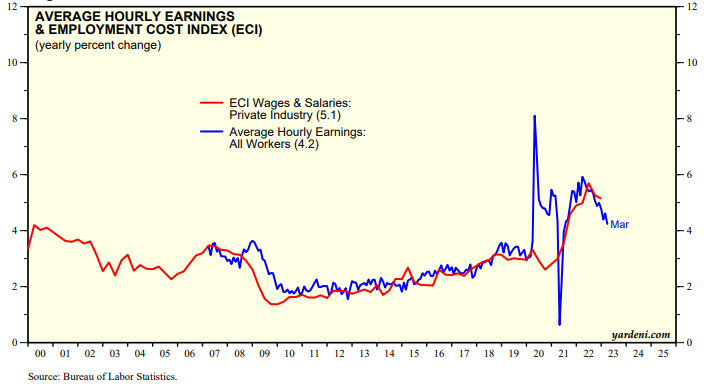

This week is jampacked with economic indicators and earnings reports. The BIGGEST numbers will come out on Friday for the PCED and ECI inflation rates. Both should show that inflation remains high but is continuing to moderate. The ECI wage inflation rate was 5.1% during Q4. We know that AHE fell to 4.2% y/y during March (chart).

Q1's preliminary real GDP (Thu) is tracking at a 2.5% saar according to the Atlanta Fed's GDPNow model, led by a 4.2% increase in consumer spending. March personal income (Fri) should confirm that reading. The April regional business surveys conducted by the FRBs of Dallas (Mon), Richmond (Tue), and KC (Thu) should confirm that the manufacturing recession is bottoming as did the NY and Philly surveys combined (chart).