This will be a big week for S&P 500 earnings. Fed officials are in their blackout period until Fed Chair Jerome Powell speaks at his May 1 press conference following the next meeting of the "Federal Open Mouth Committee." On the economic front, the big fireworks will occur at the end of the week:

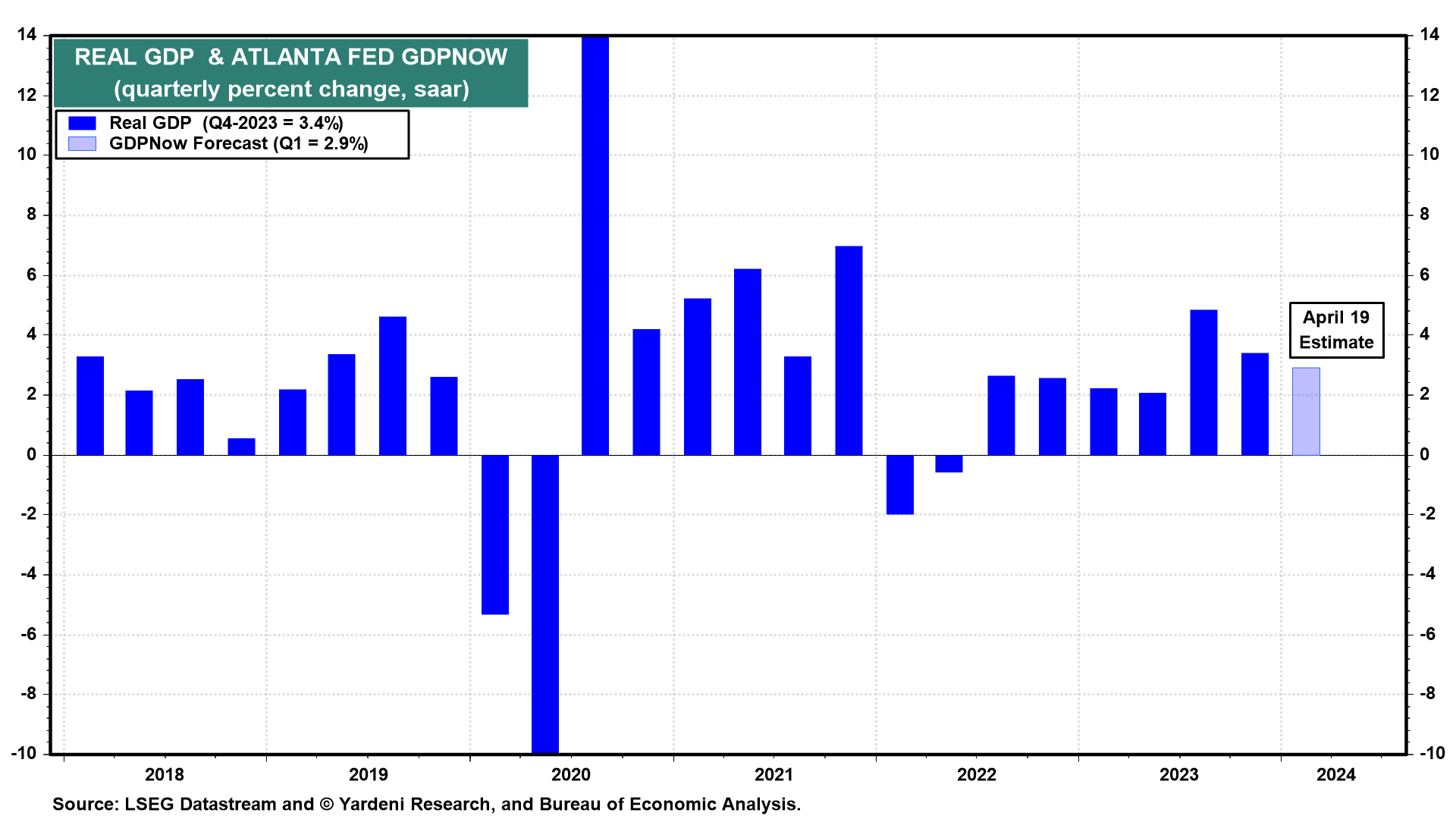

(1) Q1's real GDP (Thu) should show an increase of about 2.9% according to Friday's GDPNow tracking model with real consumer spending and real private investment up 3.5% and 3.7%. That would be the seventh consecutive solid reading for real GDP (chart). That certainly isn't a hard landing and hardly a soft one.

(2) Our Earned Income Proxy and retail sales suggest that March personal income and consumer spending (Fri) were strong (chart). Consumers have the means and the will to shop, without any signs that they are about to drop.