It's a slow, holiday-shortened week for economic data up ahead. It will start on Tuesday with January's Index of Leading Economic indicators (LEI) and Index of Coincident Economic Indicators (CEI). Regarding the LEI, we are reminded of Bradley Cooper's song, "Maybe it's time to let the old ways die." The LEI peaked at a record high during December 2021, and has been predicting a recession since then. Diehard hard-landers have been counting on it. Maybe they should bury it.

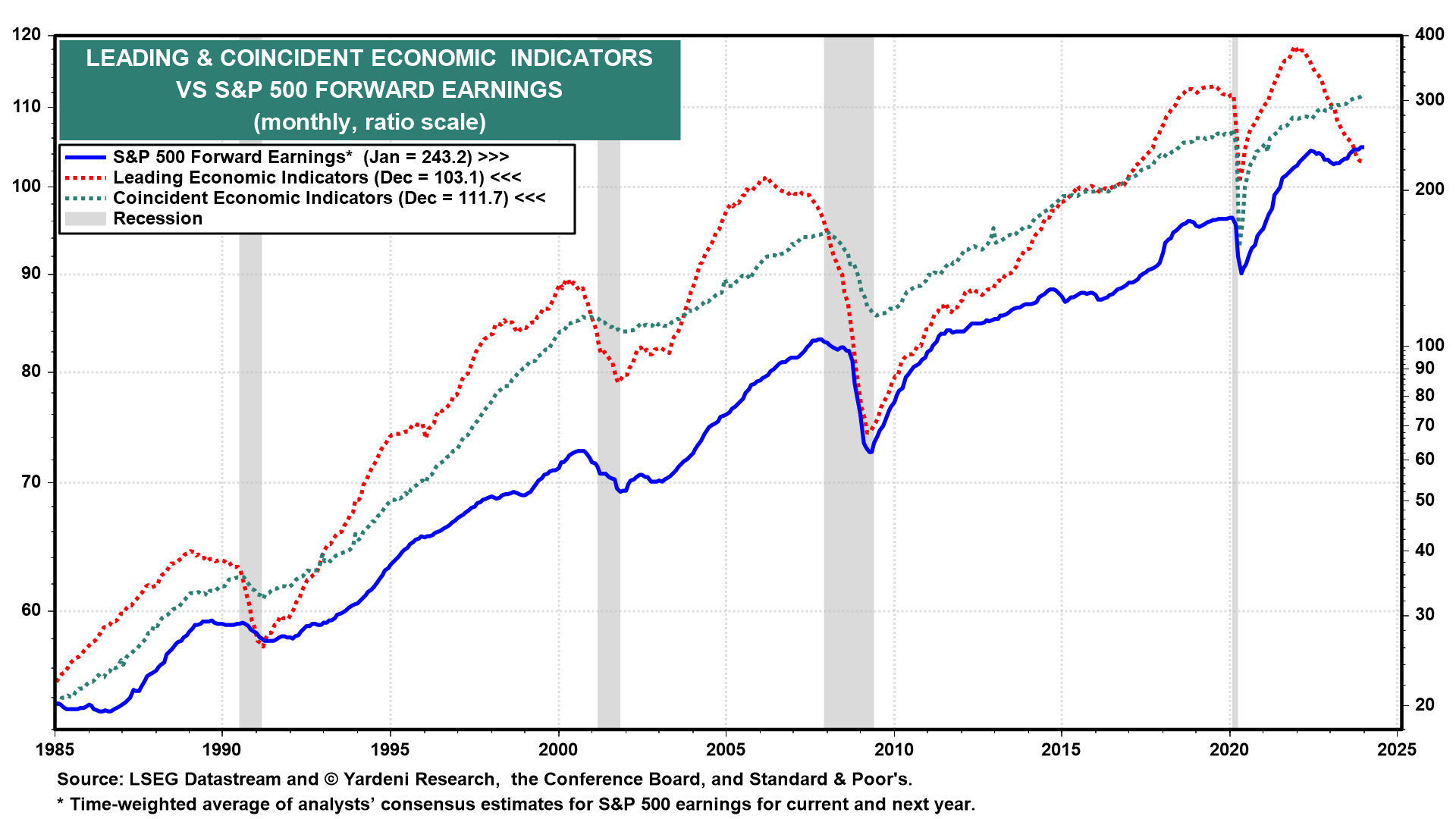

A better leading indicator recently has been the S&P 500 forward earnings (chart). In the past, it didn't do a good job of predicting recessions, but this time it did do a good job of confirming our view that economic growth was improving during the spring of 2023, when recession fears were particularly elevated.

One of the 10 components of the LEI is the S&P 500. It has been one of the more accurate leading economic indicators (chart). It bottomed on October 12, 2022, and is up 39.9% since then, also discrediting recession forecasts.