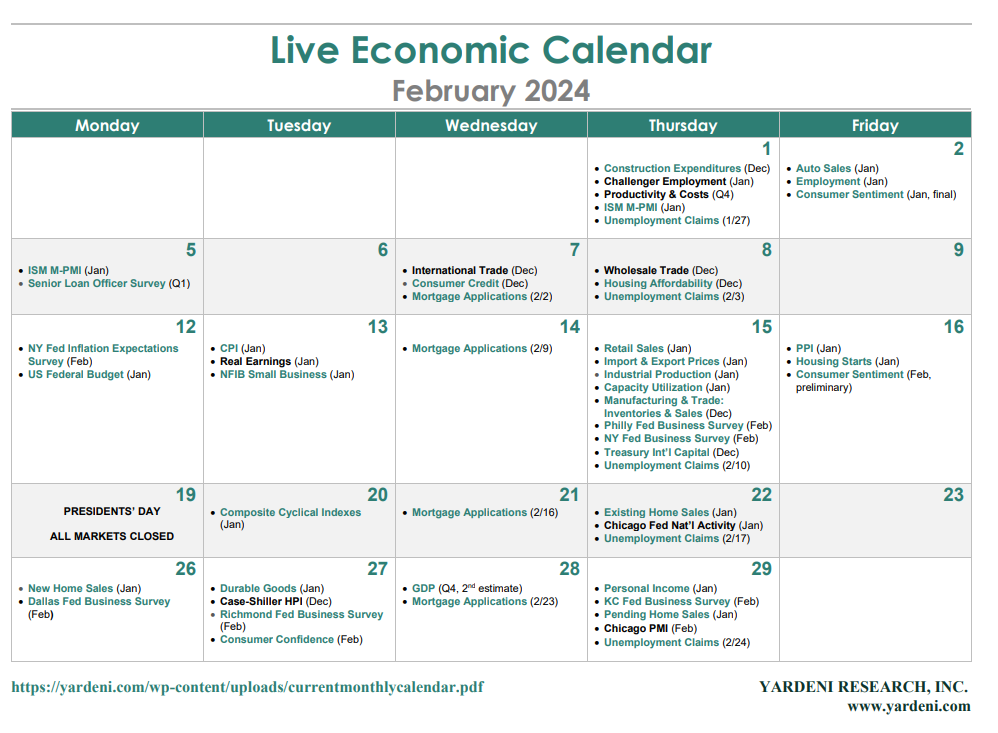

Powell & Co. would like to see more evidence that inflation is falling toward their 2.0% target. They should get more of it this week. January's headline and core CPI inflation rates (Tue) should be 0.2% and 0.3% m/m, and 3.0% and 3.8% y/y, according to the Cleveland Fed's Inflation Nowcasting model. We will be focusing on these inflation rates excluding shelter (chart). They are already at the Fed's 2.0% target.

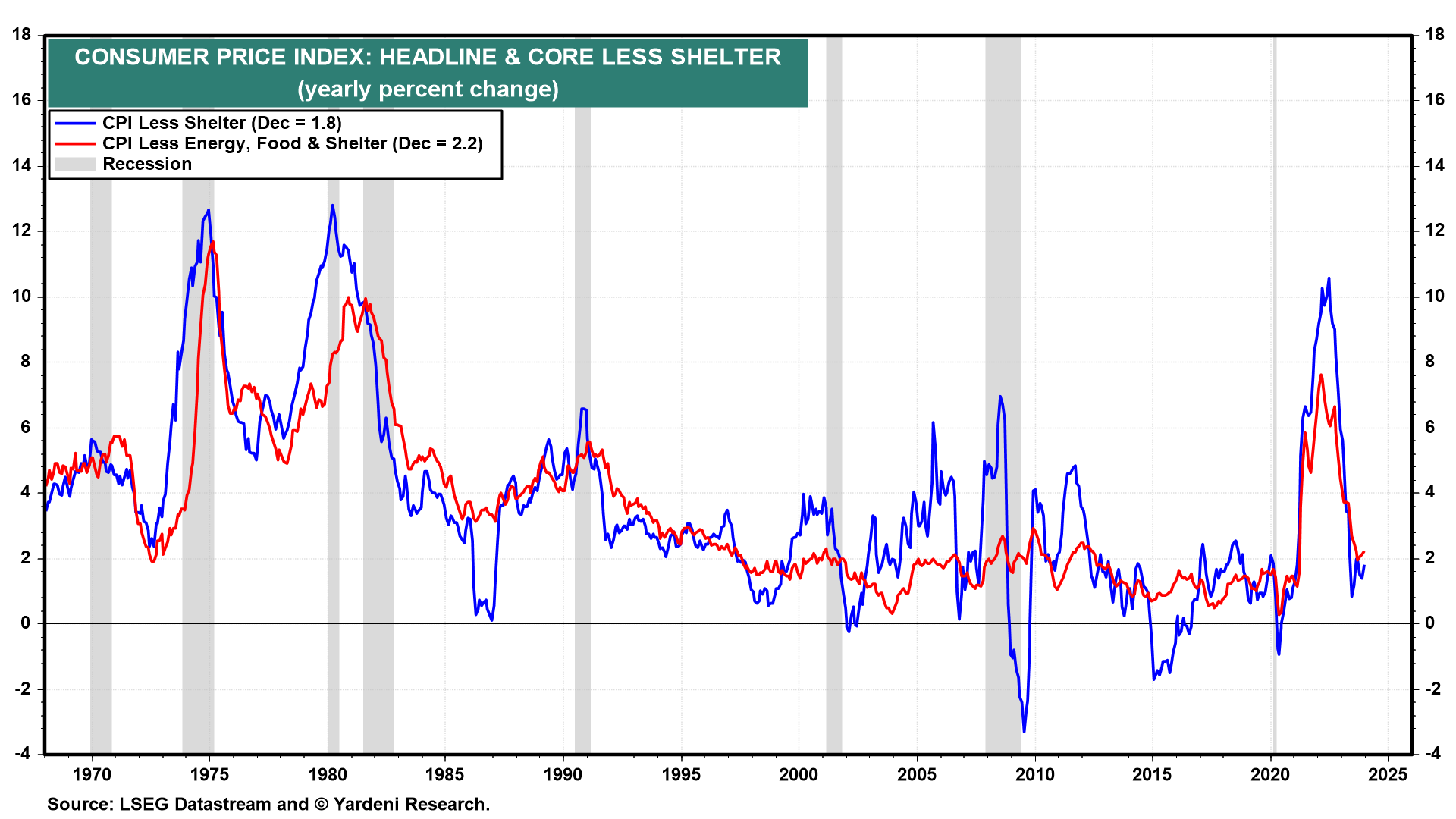

January's retail sales report (Thu) could be relatively weak. While payroll employment increased 0.2% during the month, the average workweek dropped 0.6%, while average hourly earnings rose 0.6%. This implies a weak 0.2% increase in private wages and salaries in personal income growth (chart).

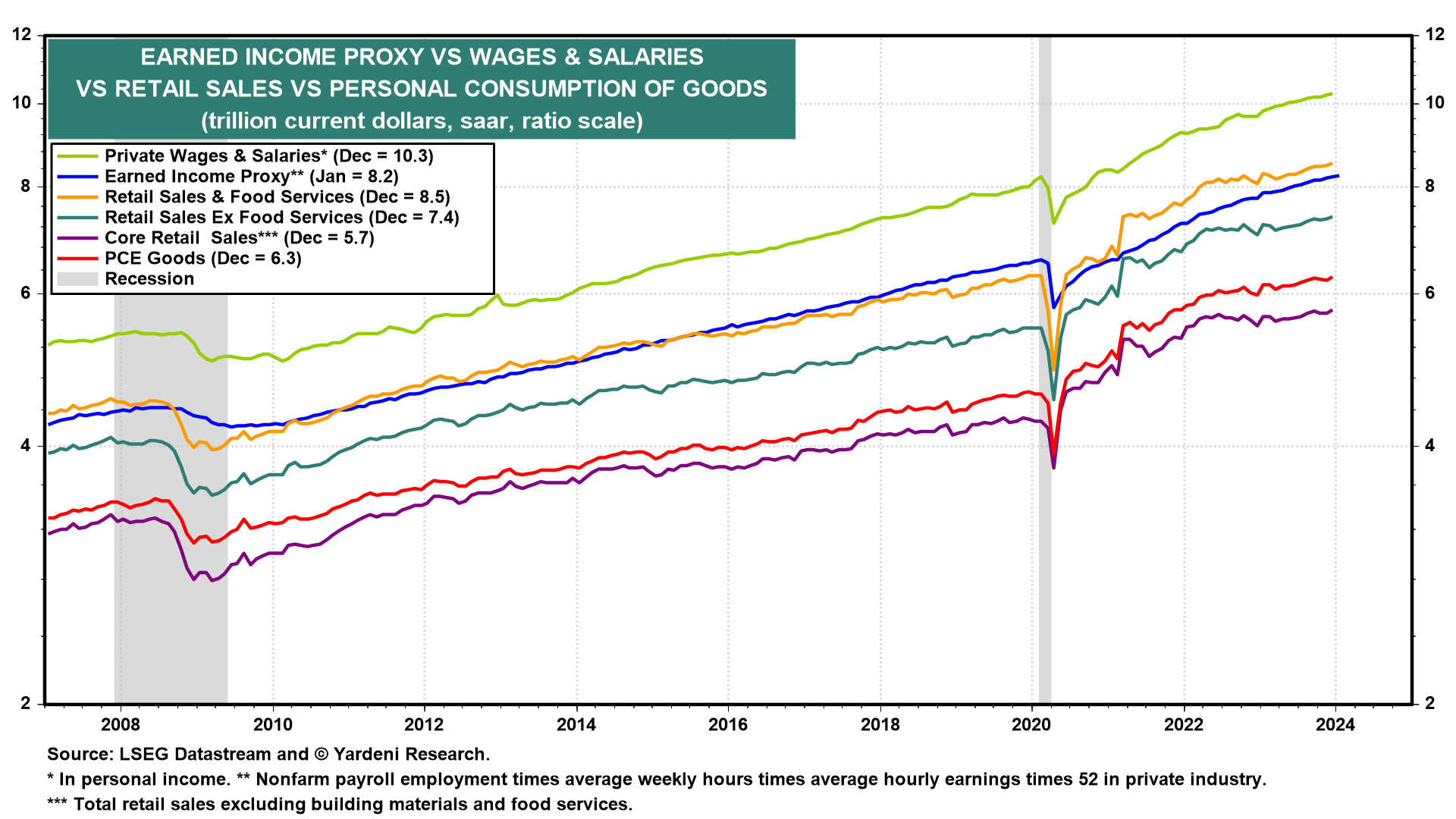

In addition, January's auto sales skidded down to 15.0 million units (chart).

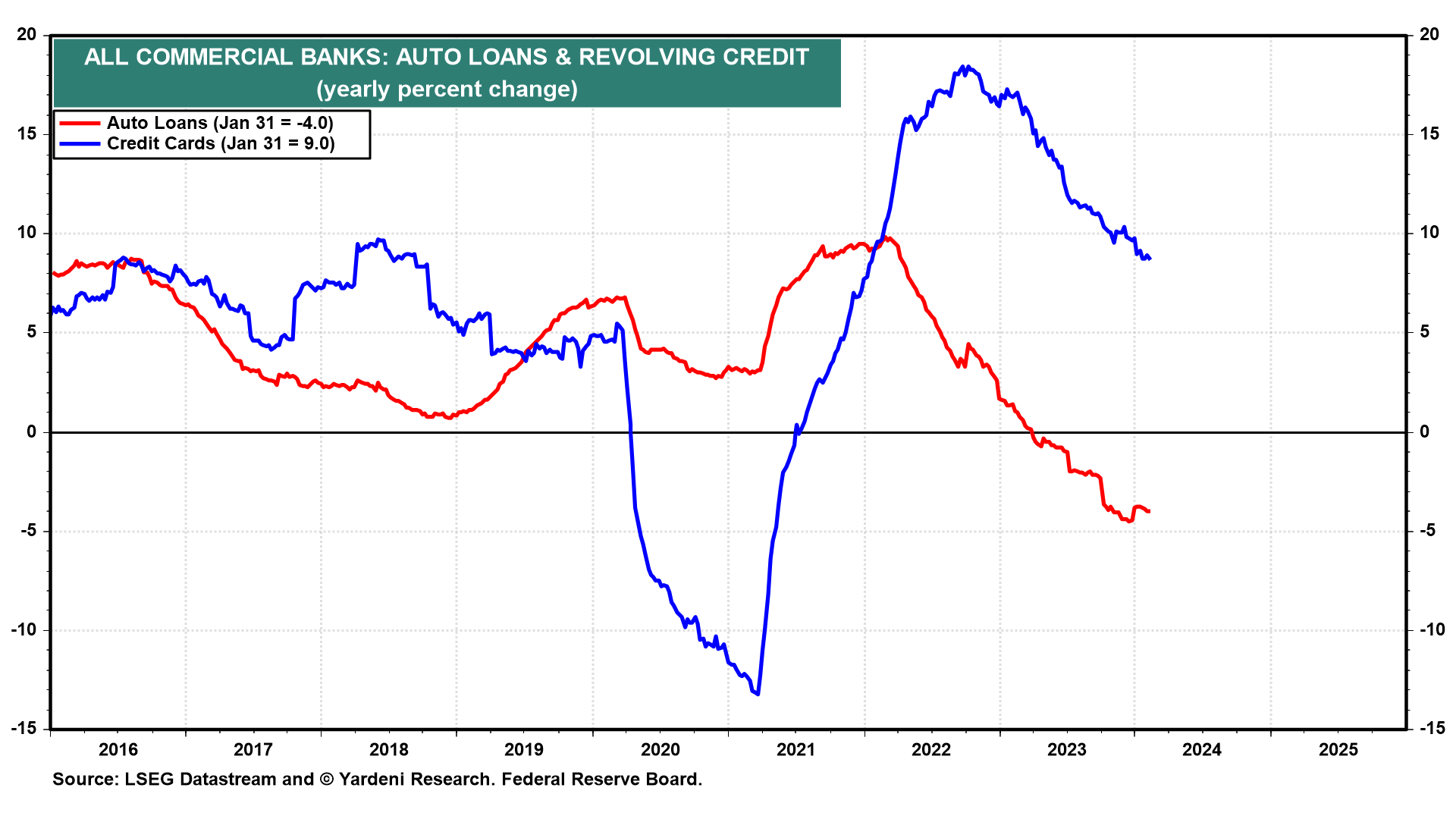

The weakness in auto sales is consistent with the 4.0% y/y decline in auto loans held by commercial banks through the January 31 week (chart). On the other hand, credit card balances reported by commercial banks was still up 9.0% y/y through the January 31 week (chart).

January's industrial production (Thu) probably fell slightly according to the month's 0.5% decline in average manufacturing weekly hours worked.

On balance, it should be a good week for stocks and bonds as the inflation indicators--including January's PPI (Fri) and February's inflation expectations (Mon)--confirm that inflation continues to moderate, while the economy is growing albeit more slowly.