On June 1, JPMorgan Chase CEO Jamie Dimon said that “fiscal stimulation is still in the pocketbooks of consumers. They are spending it.” We agree: Consumers have about $1 trillion in excess saving thanks to the government’s pandemic relief checks that weren’t spent. They’ve been dipping into that pool of money to offset the weakness in the purchasing power of their paychecks, which have been eroded by inflation. They also charged lots of their spending in March. On Tuesday, we will see if they continued to do so in April.

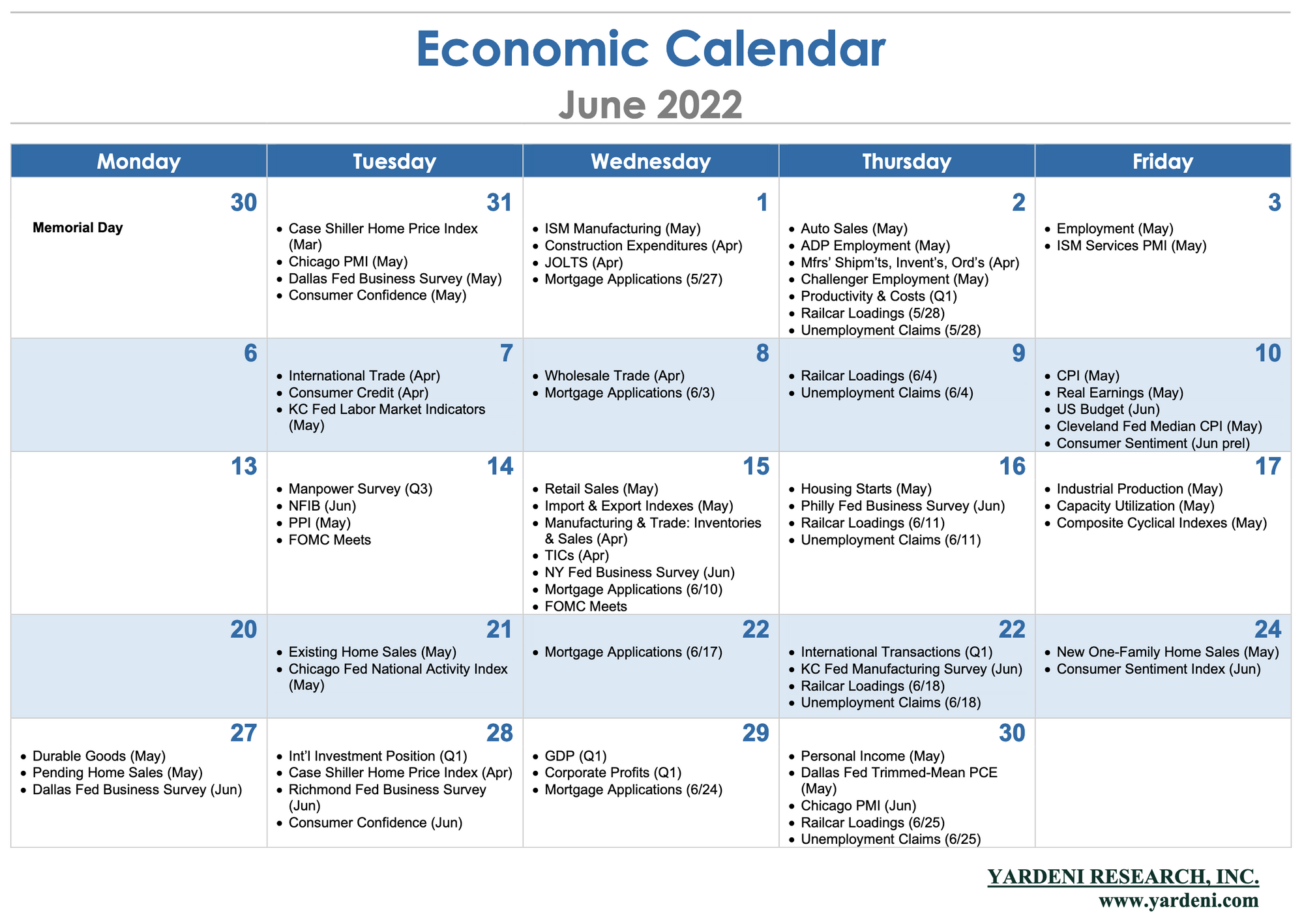

On Friday, May’s CPI might show that inflation is eroding consumers’ purchasing power at a slower pace. However, there is likely to be little relief in the costs of gasoline, groceries, and rent. Wednesday’s weekly mortgage applications are likely to fall, as they have been doing since the start of this year, as buying homes has become less affordable, which has also been driving up rents.

Uncle Sam has benefited the most from inflation, as we are likely to see on Friday when the June federal budget report is released. Federal tax receipts have been soaring along with inflation.