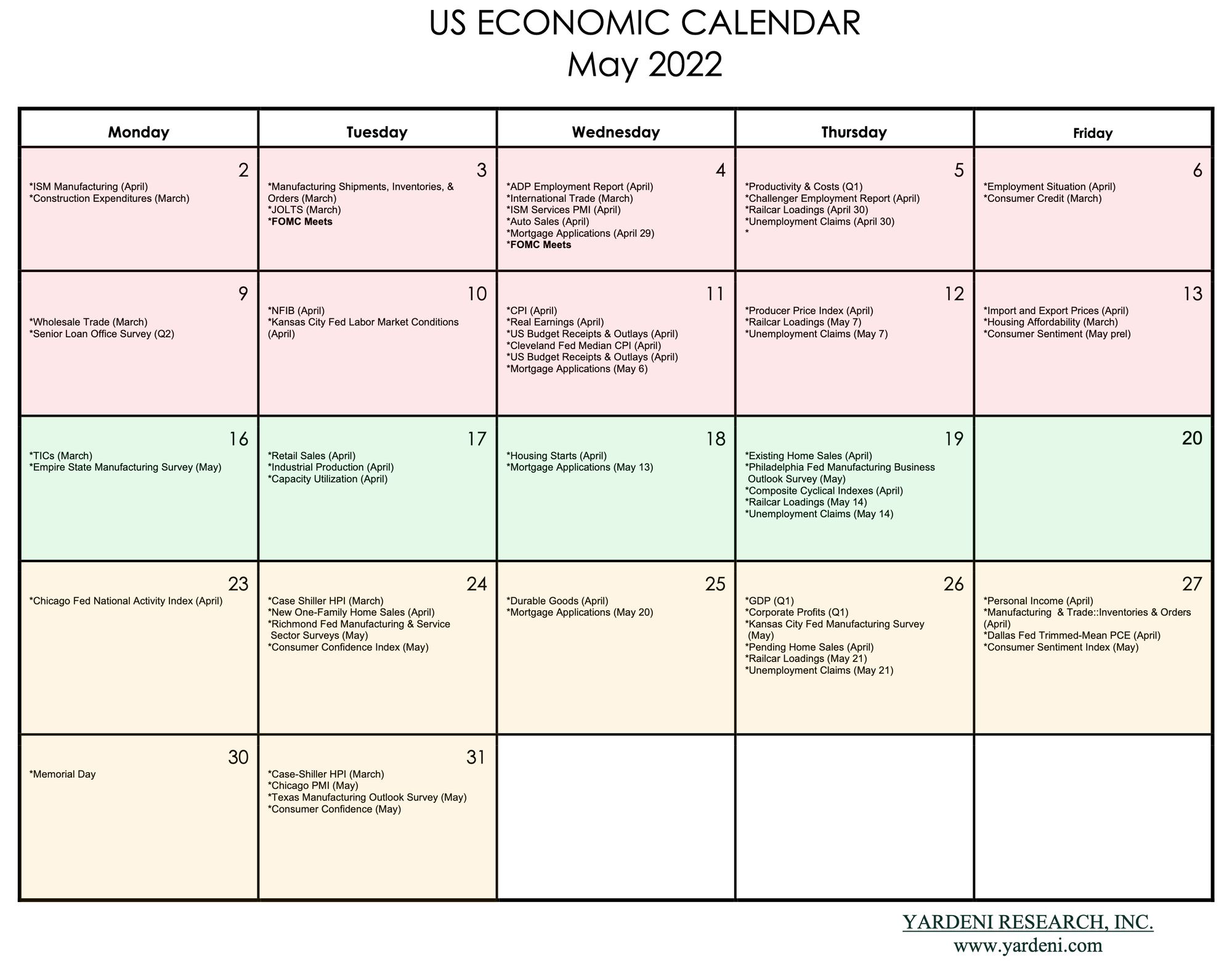

It is a big week ahead, promising to provide lots of insights into the strength/weakness of the US economy. Two Fed regional business surveys—for NY and Philly—will be released for May.

Released for April will be retail sales, industrial production, home sales, existing home sales, and the Index of Leading Economic Indicators (LEI). Collectively, they’re are likely to show that the economy is growing but at a relatively slow pace.

Some of the indicators (particularly retail sales and the LEI) are likely to heighten recession fears, which could lift bond prices. Such heightened fears would likely have a mixed impact on stocks, i.e., they would suggest less Fed tightening ahead but weaker corporate earnings.

We will also be watching March TIC (Treasury International Capital) data for confirmation of our expectation that record capital inflows are boosting the value of the US dollar.