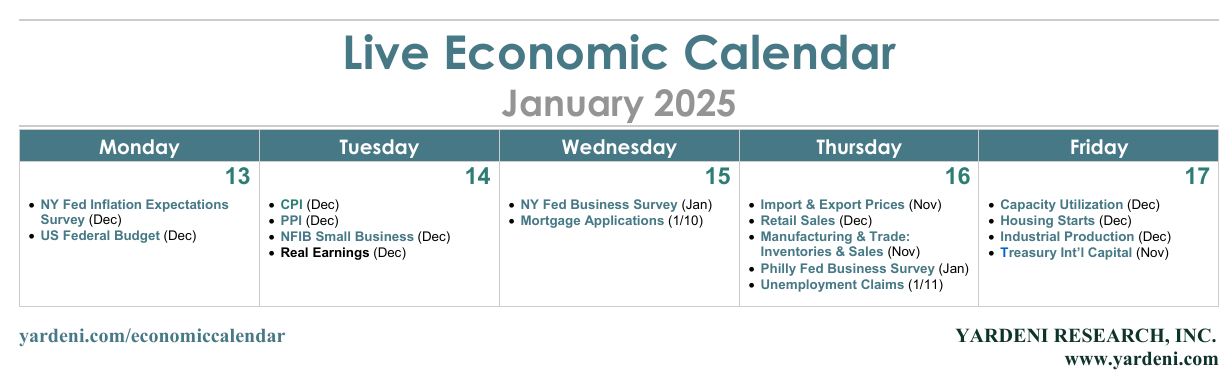

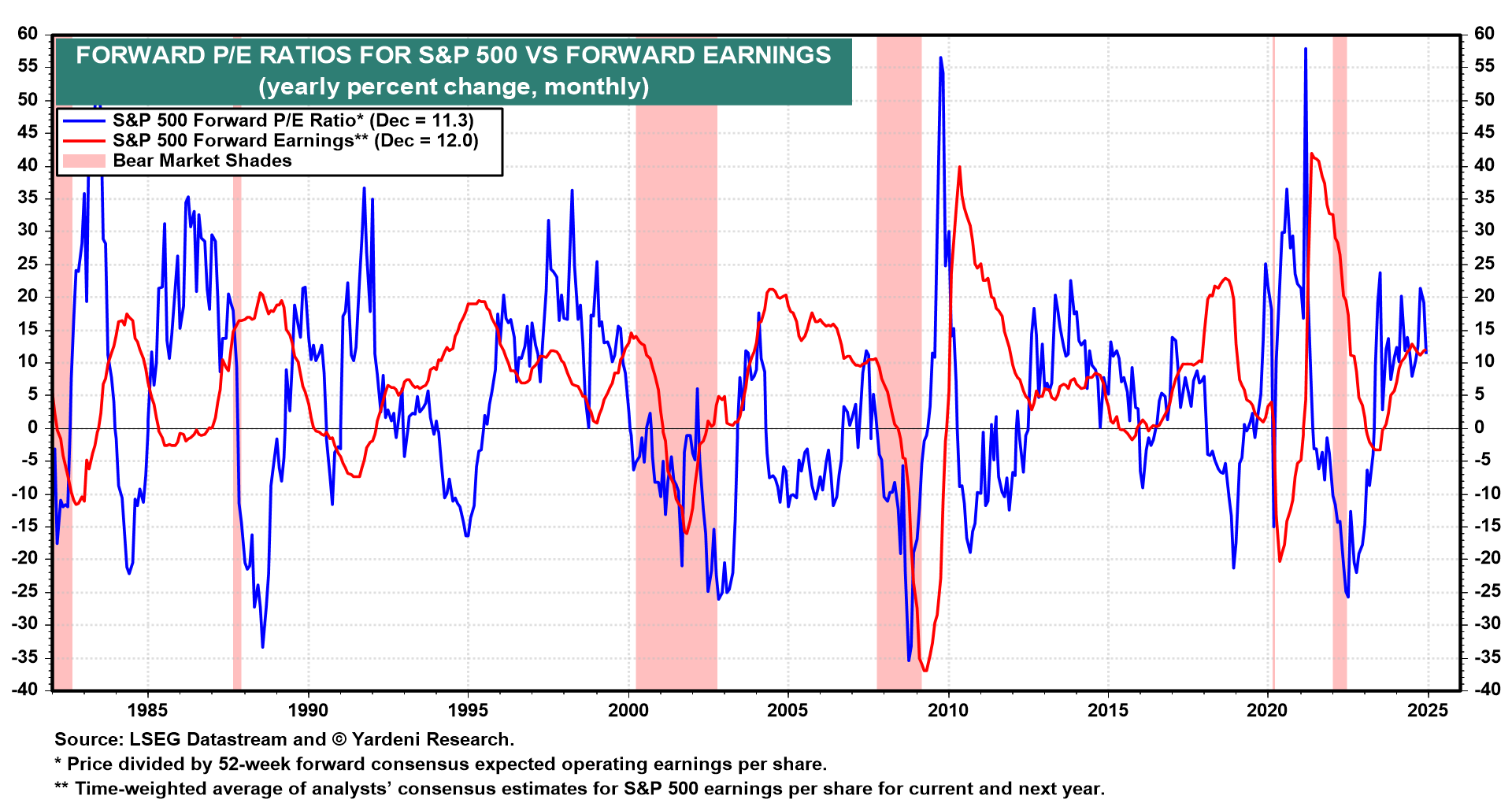

The week ahead is packed with inflation, consumer, and manufacturing indicators. Long-term Treasury yields could climb closer to 5.00% this week if fears about stickier inflation intensify. We're expecting solid updates on consumer spending. In addition, Q4's S&P 500 bank earnings reported late in the week should be strong and counterbalance any hit to stock valuations from higher yields (chart).

Here's more on what we are expecting this week:

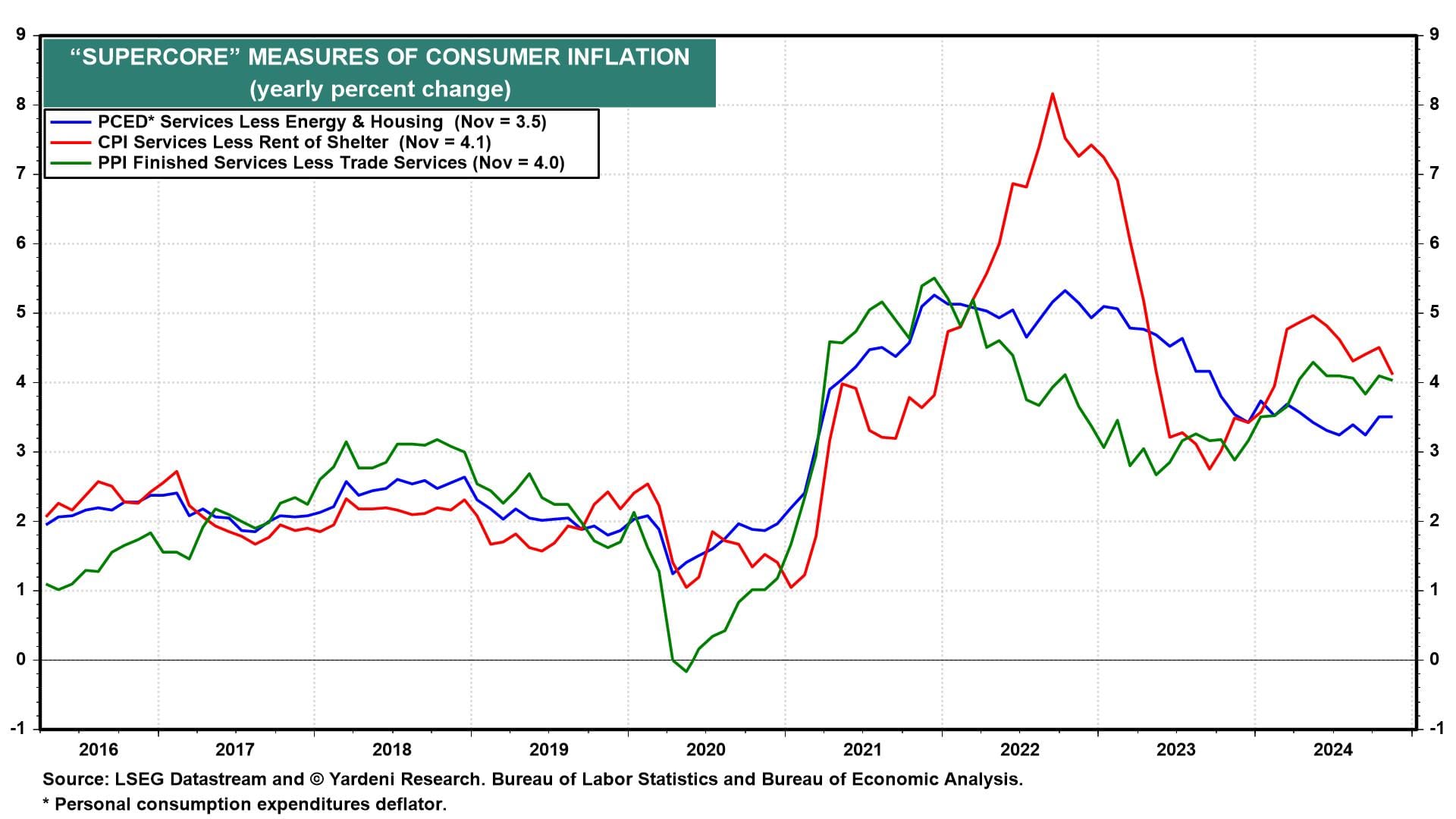

(1) Inflation. According to the Cleveland Fed's Inflation Nowcast, December's headline and core CPI (Tue) are projected to be up 0.38% and 0.27% m/m, respectively. That would put the y/y readings at 2.9% and 3.3%. December's CPI and PPI (Tue) are likely to show core consumer services inflation remains stuck well above 2.0% (chart).