This week's inflation indicators should show that it continues to moderate toward the Fed's 2.0% target. Also, this week's initial unemployment claims (Thu) will be for the same week that October's payroll employment report will reflect. That should provide a sense of how Hurricane Helene (and some workers' strikes) might have impacted the next monthly jobs report. Of course, we will continue to monitor developments in the Middle East.

Here's more on what we're watching on the home front:

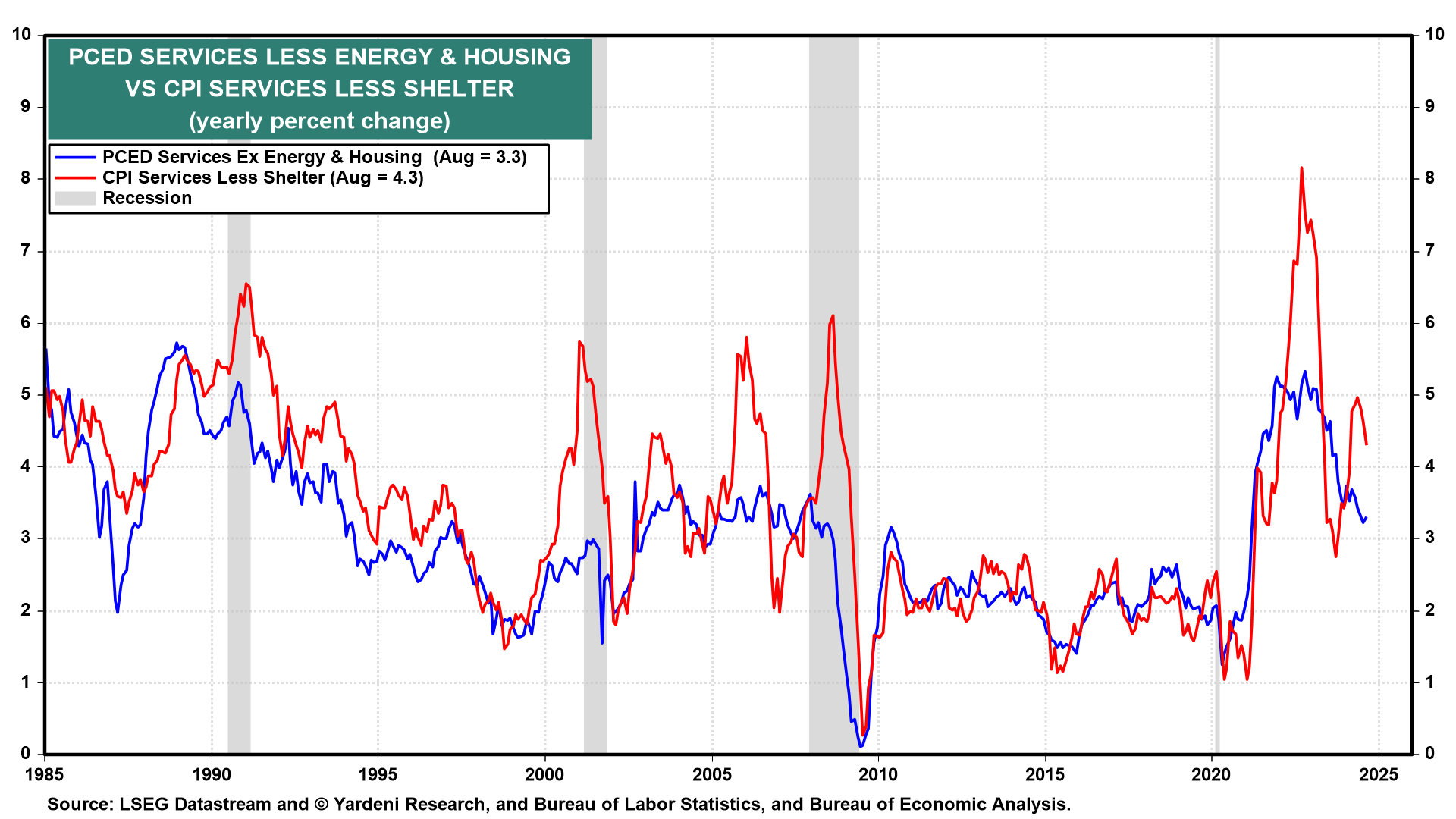

(1) Inflation. September's CPI (Thu) should show headline inflation falling closer to 2.0%. The Cleveland Fed’s Inflation Nowcasting model projects that the headline and core CPI rose 2.3% and 3.1% y/y (0.11% and 0.27% m/m) last month. However, core services inflation likely remained elevated above 4.0% (chart). The so-called "supercore" inflation rate remains sticky.

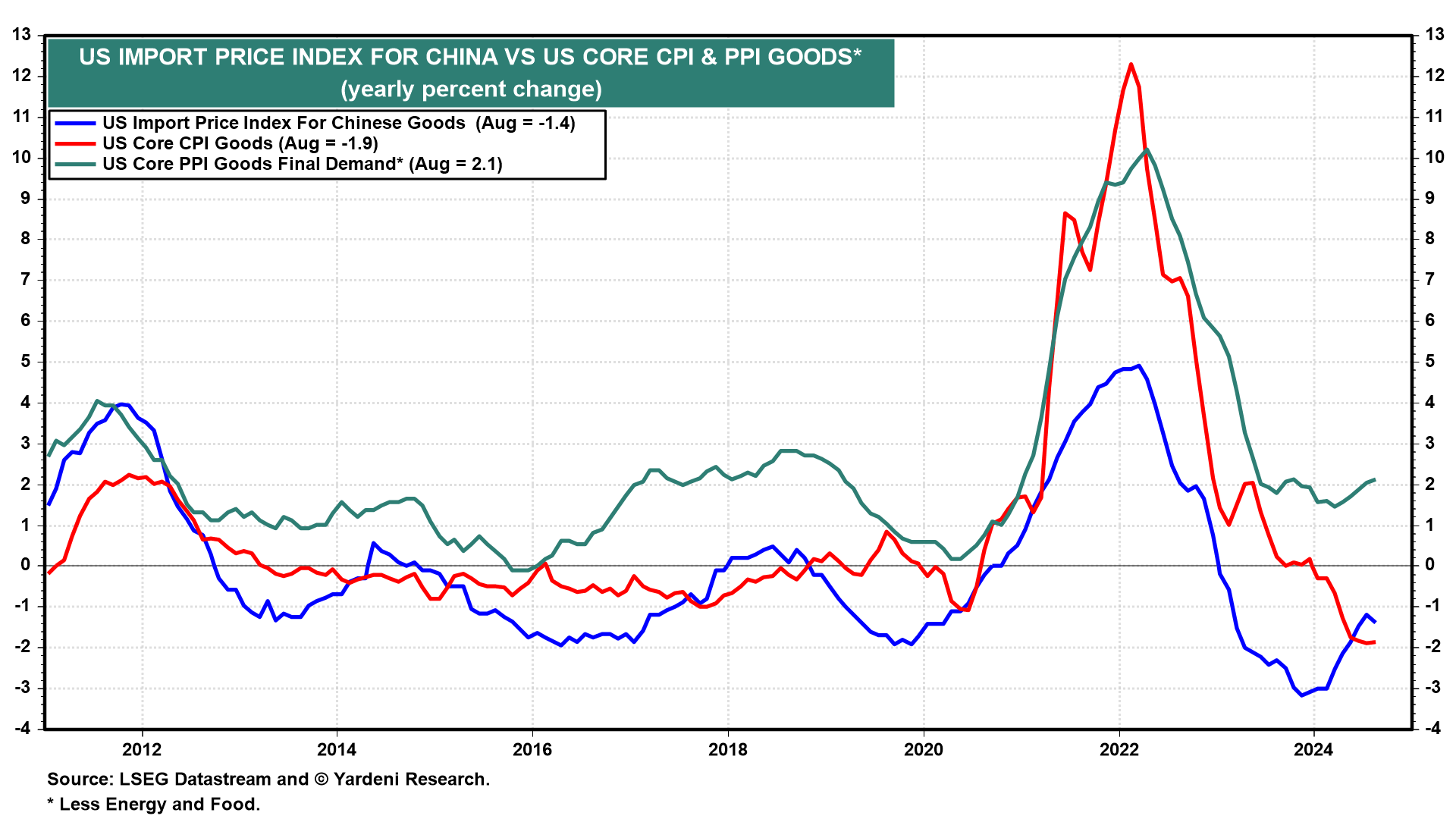

Services inflation is likely to become a hotter topic. If China's stimulus measures and the longshoremen's wage increase raise import prices, goods PPI (Fri) and goods CPI inflation rates may rebound after several months of deflation (chart). The escalating conflict between Iran and Israel threatens higher oil and gasoline prices as well. Rebuilding from Hurricane Helene and other extreme weather events will likely prove inflationary, too.

We've been disinflationists since mid-2022, expecting that inflation would fall to 2.0% without a recession. However, the Fed's "mission accomplished" 50bps-rate cut on September 18 may prove to be premature if services inflation remains sticky and goods inflation heats up.