The week ahead is jampacked with employment indicators. The Fed started a new monetary easing cycle on September 18, cutting the federal funds rate by 50bps. The question now is how hard will it press on the gas pedal? Given last week's cooler-than-expected inflation print, the Fed will most likely retain its bias for easier monetary policy unless the labor market data are surprisingly strong. The consensus currently is for another rate cut following the November 5-6 FOMC meeting. The only question is will it be 25bps or 50bps? We are in the first camp.

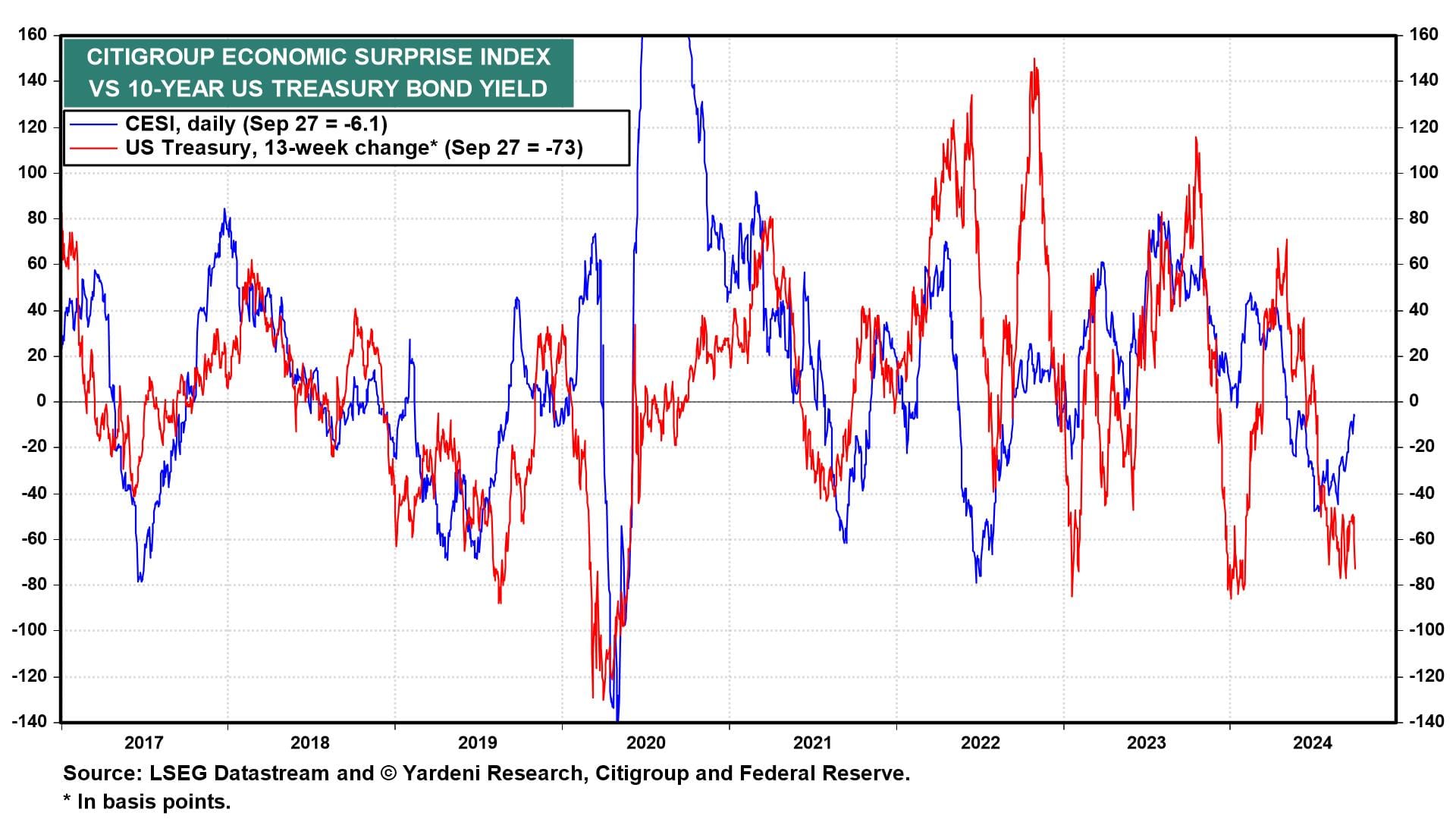

A continued cooling of the labor market would set the Fed up for even more aggressive interest-rate cuts, boosting bond prices and interest-sensitive stock prices too. If instead, the labor market indicators and other economic ones surprise to the upside, as we expect, bond yields would probably rise and so would cyclical stock prices (chart). Let's review what's in store this week:

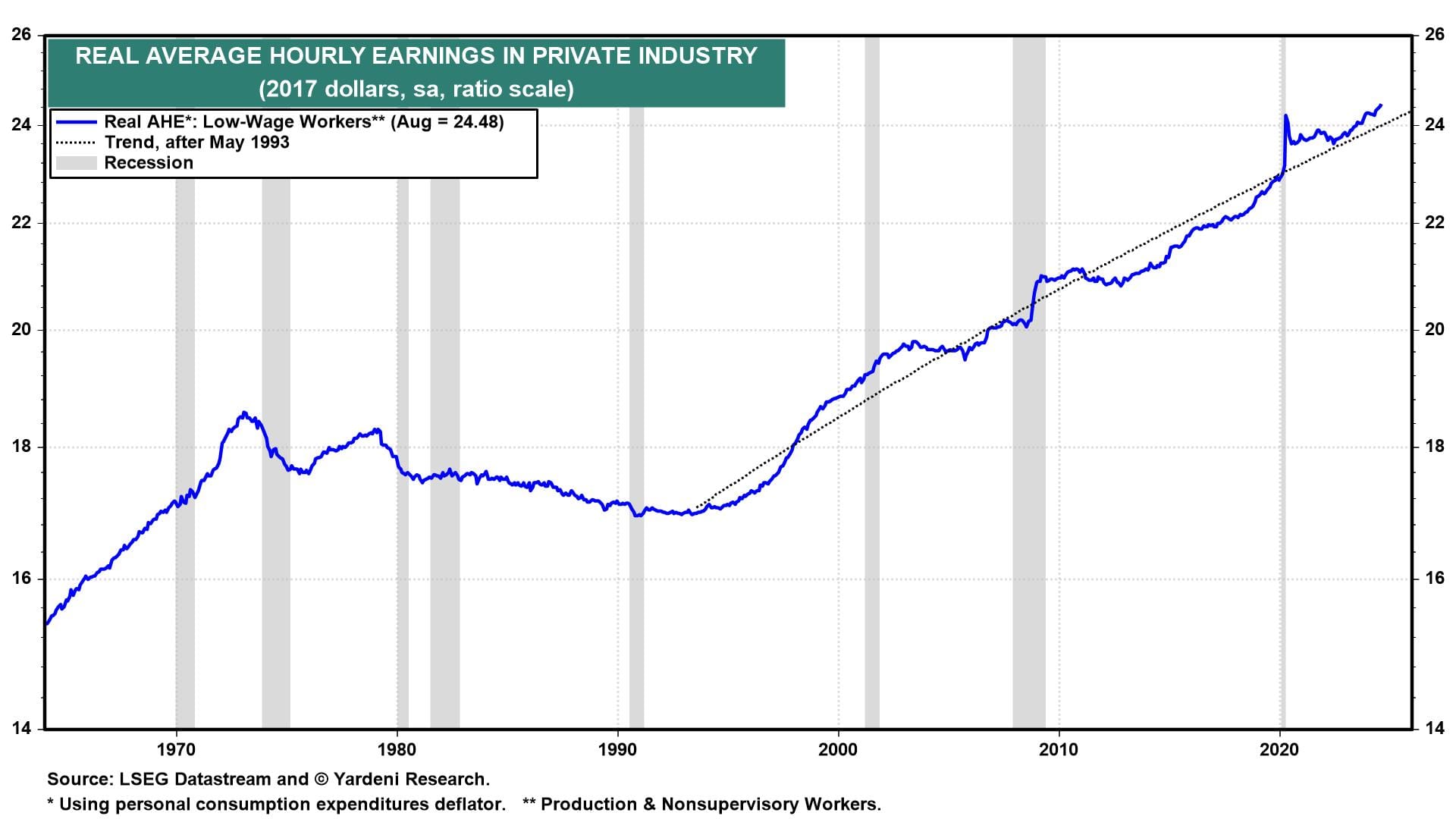

(1) Employment. September's employment report (Fri) should show that payrolls and real average hourly earnings rose to record highs. Even as monthly payroll growth has moderated to 116,000 over the past three months, the purchasing power of production and nonsupervisory workers (who make up about 80% of private industry payrolls) continues to increase as wages rise faster than prices (chart). In the aggregate, Americans' real incomes are rising thanks to productivity-driven real wage gains rather than brisk employment growth.