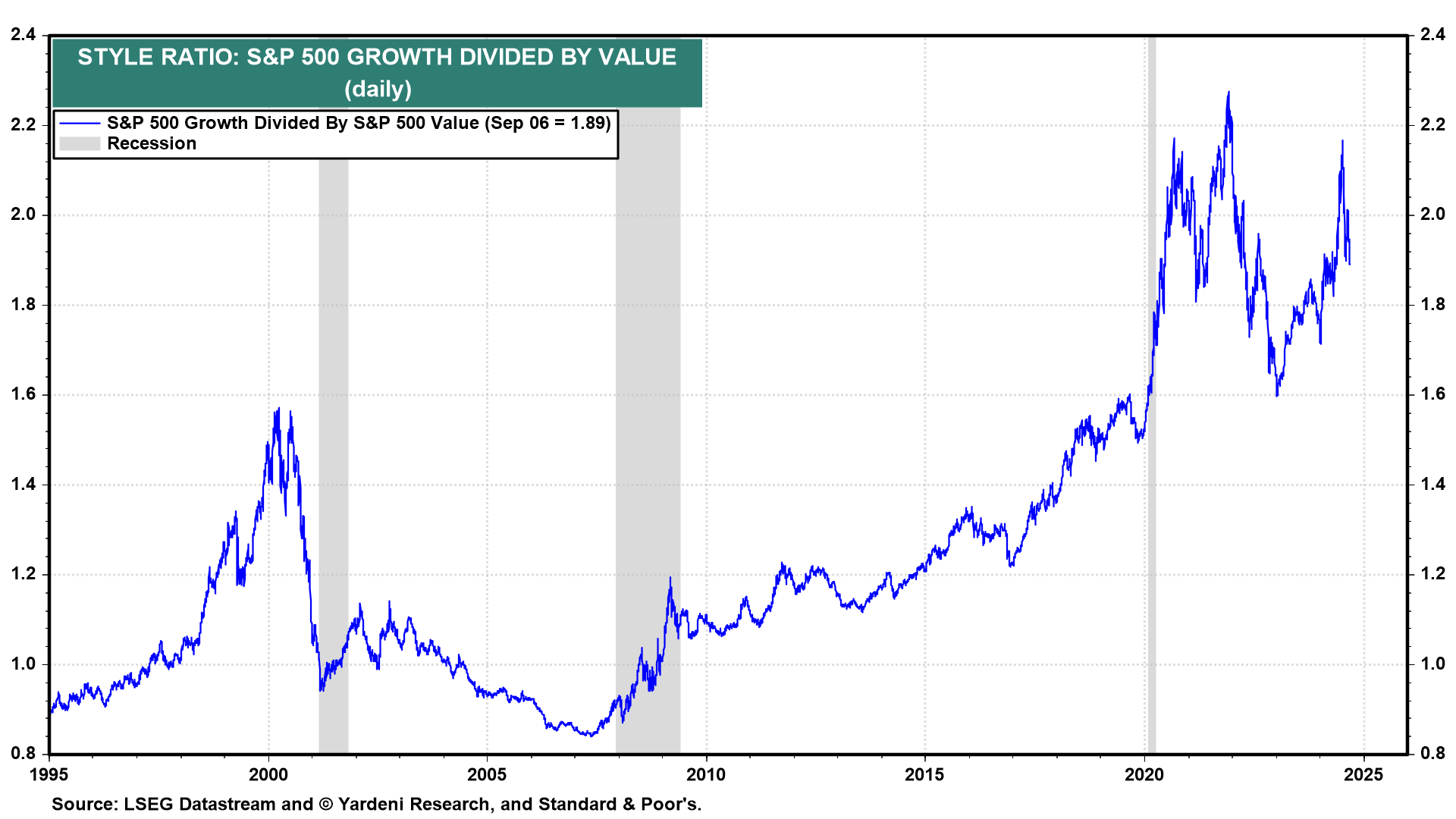

This week's economic indicators will be primarily focused on inflation. Barring any unexpected surprises on the inflation front, the financial markets may care more about the few labor market indicators. The FOMC entered the blackout period ahead of its September meeting yesterday, sparing markets from an extra source of volatility. We expect the combination of a normalizing hiring, inflation, and interest rate environment (a.k.a. Immaculate Disinflation) will broaden the stock market's breadth. Value stocks could outperform growth stocks, especially Financials, for a while (chart).

Here's what we're watching this week:

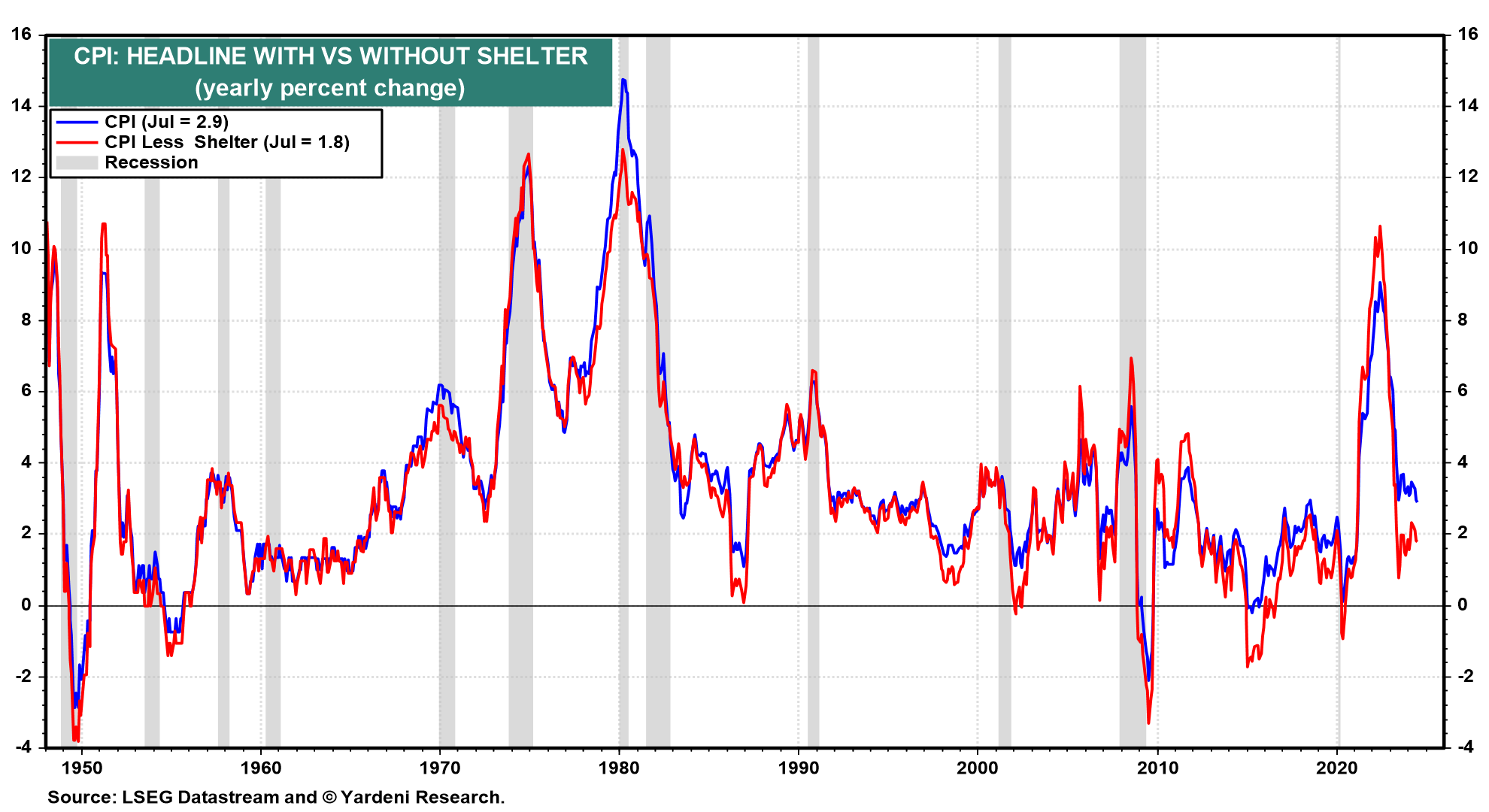

(1) CPI. August's CPI (Wed) should continue to show progress in moderating inflation. The Cleveland Fed’s Inflation Nowcasting model forecasts that the headline and core CPI rose 2.6% and 3.2% y/y (0.20% and 0.26% m/m) last month. That would be the lowest headline CPI print since February 2021. As measured rents incorporate disinflating new market rents, the CPI inflation rate should continue to fall. Without shelter, the headline index was already down to 1.8% y/y in July (chart).

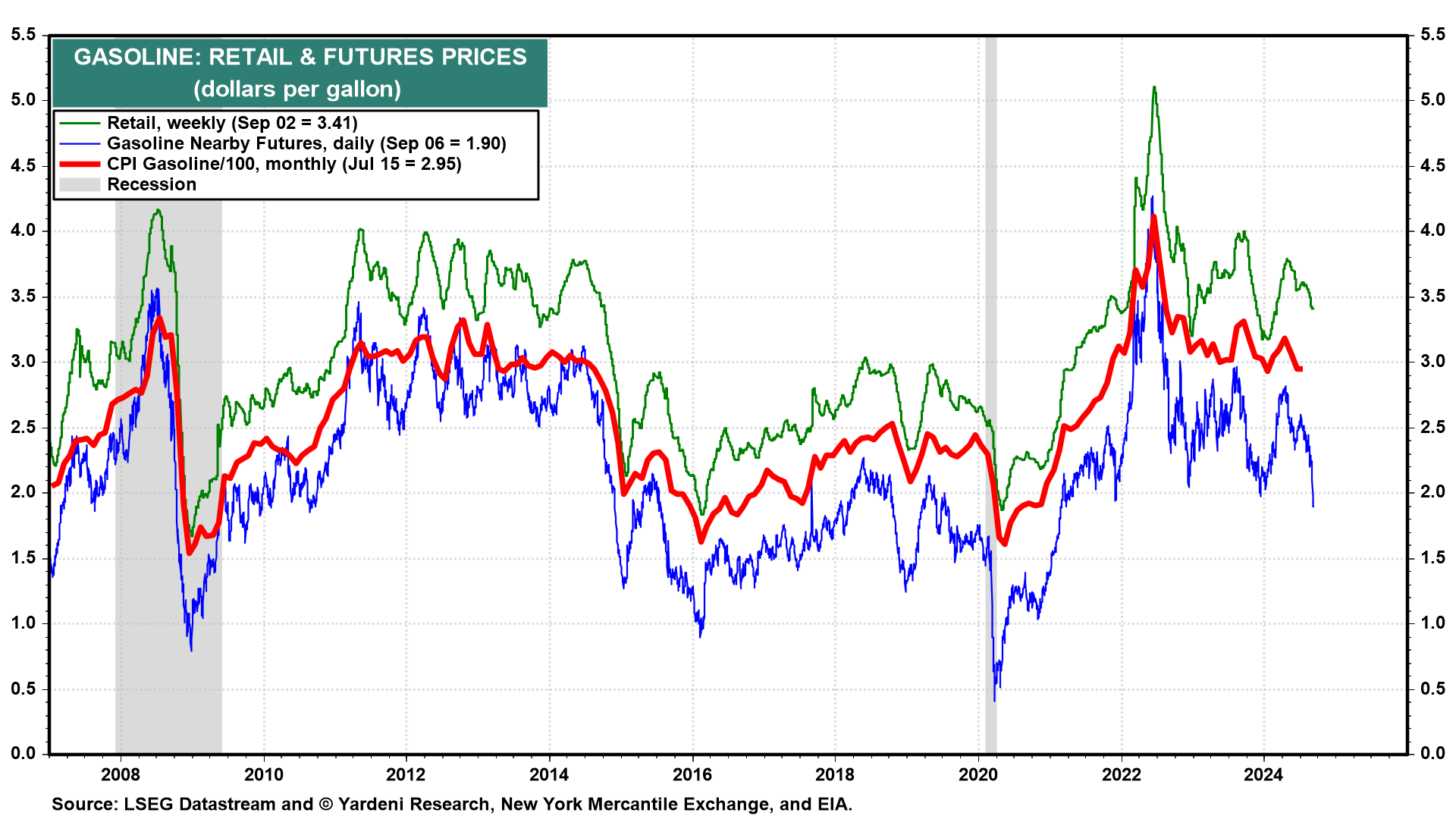

Adding downward pressure on US inflation are falling gasoline prices (chart).