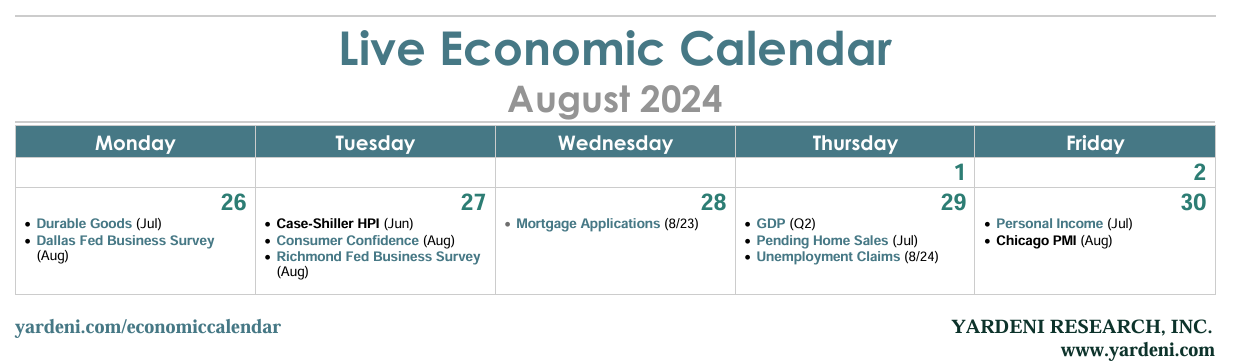

This week will include the first clues on the economy's performance in August. We're expecting to see confirmation of ongoing labor market strength in the month's consumer confidence survey (Tue) and initial unemployment claims (Thu). Some of August's improvement should be a bounce back from July's weather-depressed economic activity, which may be reflected in July's personal income release (Fri). July's consumer spending (Fri) might surprise to the upside (as did retail sales). July's PCED inflation rate (Fri) is unlikely to ruffle the Fed's dovish feathers.

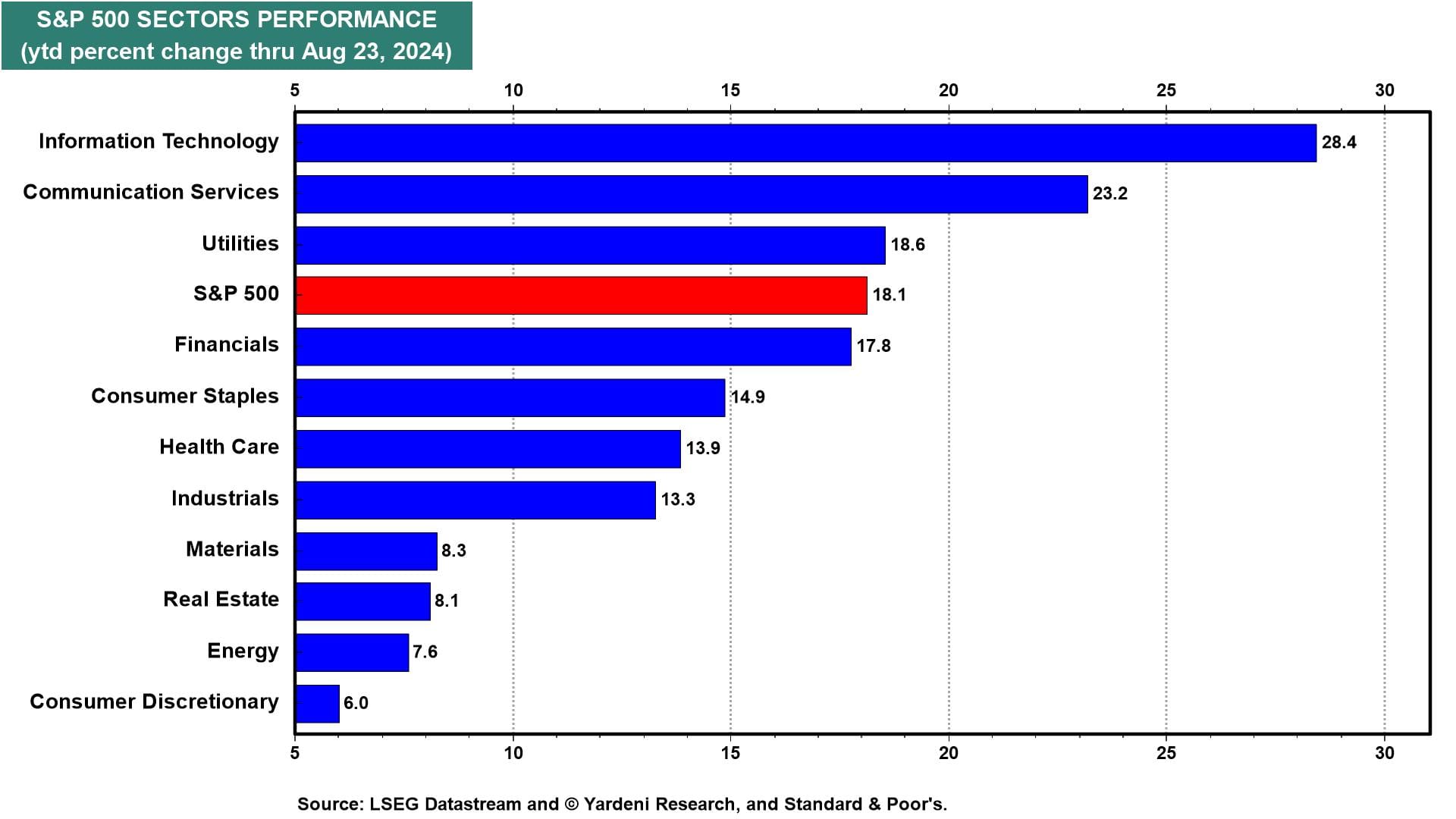

More of August's economic data in coming weeks should be stronger-than-expected and lift the 10-year Treasury yield back above 4.00%. The yield curve spread could turn positive in the next few weeks. This could be a bullish signal for cyclical sectors such as S&P 500 Financials, Industrials, and Materials, which could outperform the S&P 500 over the rest of this year after underperforming it ytd (chart).

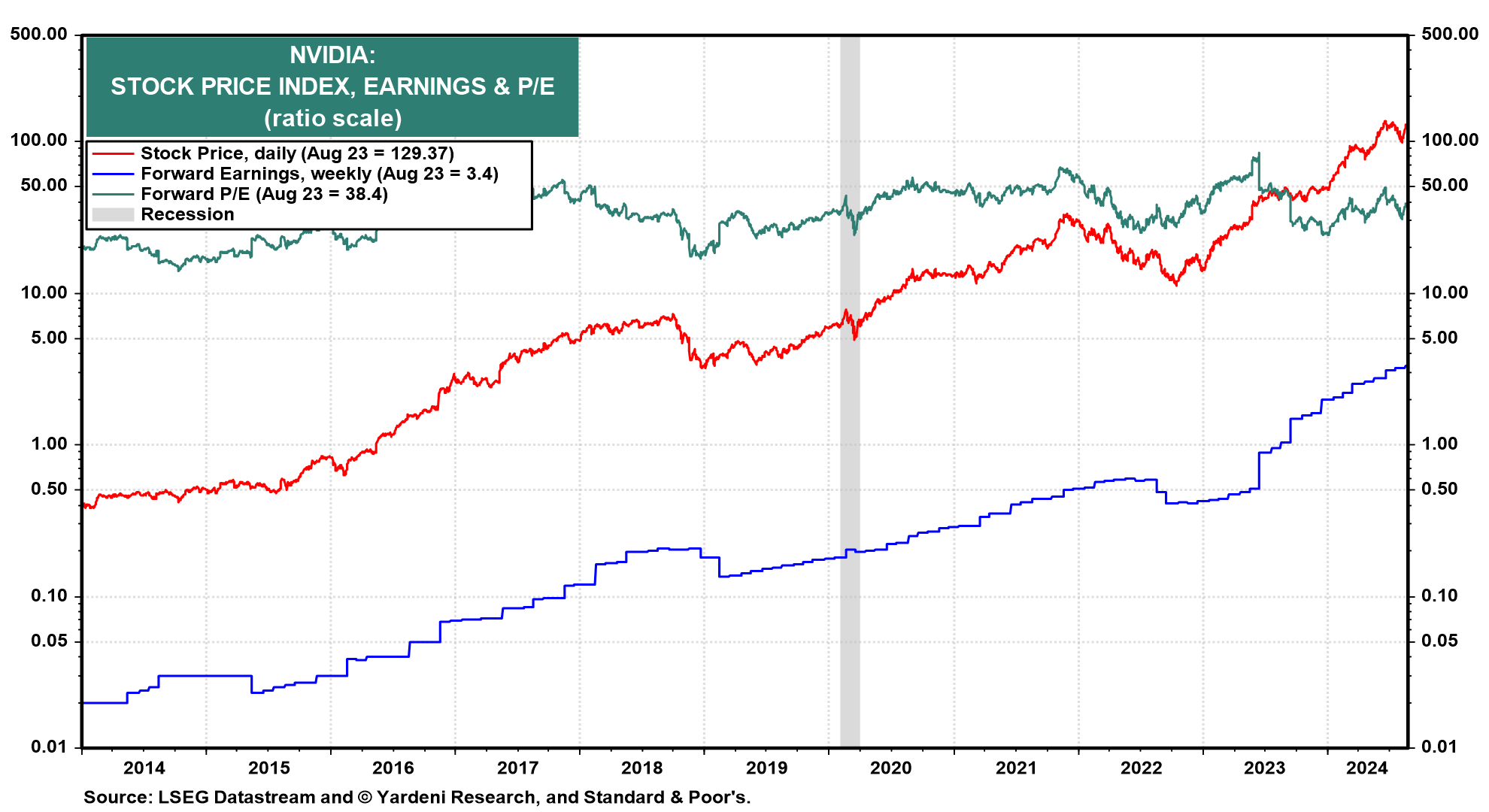

The economic news this week should be overshadowed by Nvidia's earnings report on Wednesday after the close. Here's more on what we expect in the week ahead:

(1) Nvidia. Nvidia is up more than 1,000% since the stock market's low on October 12, 2022 (chart). Its forward earnings per share has risen roughly 813% in that time. Those earnings are a function of AI investments by mostly other large-cap tech companies, making Nvidia the fulcrum of not only the AI trade but a big portion of the entire stock market rally. While we don't do single-stock forecasts, we think Nvidia's earnings will begin to be supported by rising demand from other tech and many non-tech companies in the S&P 493 (ex-Magnificent-7).

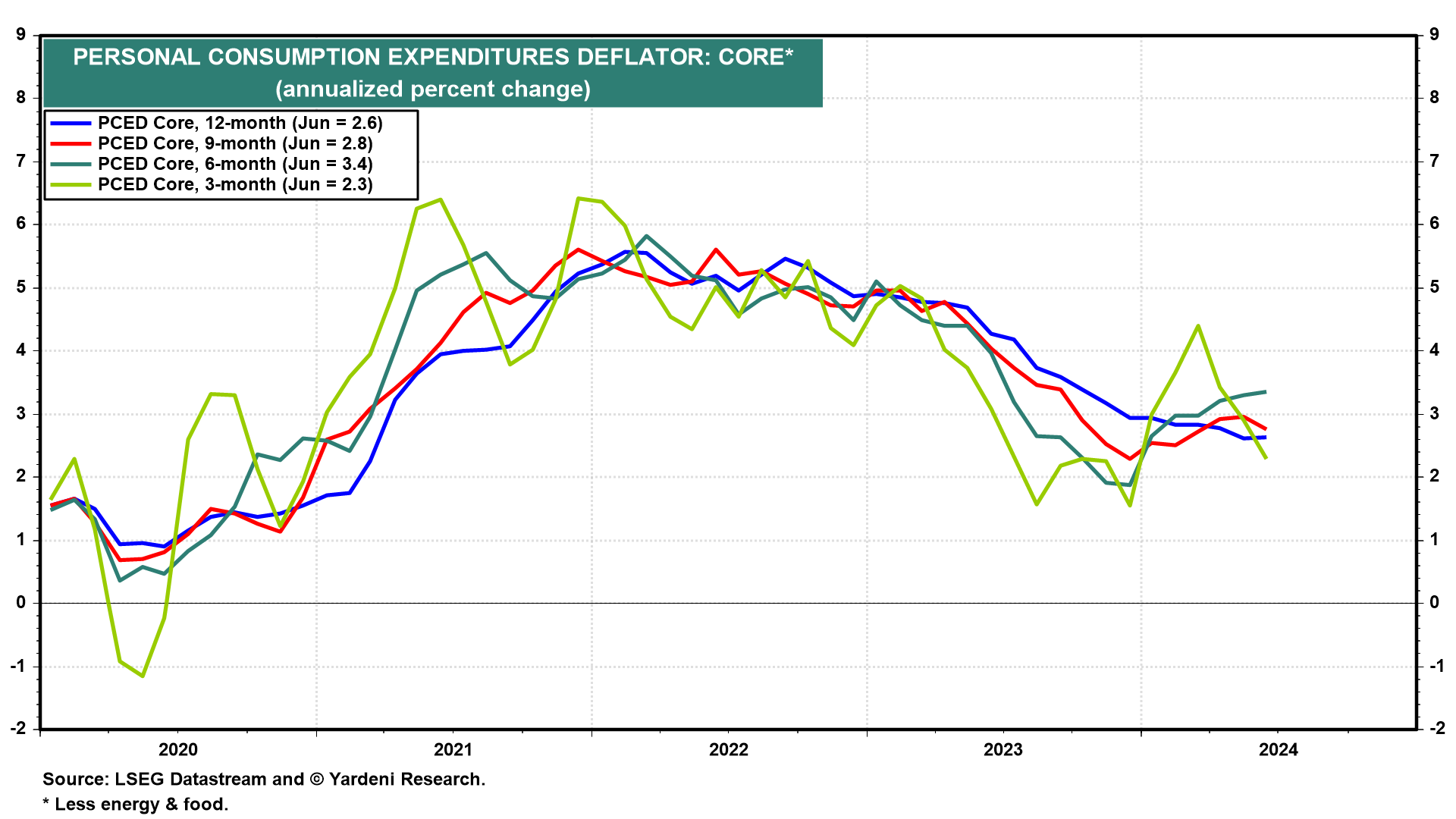

(2) PCED inflation. The Fed and the financial markets should be pleased by July's PCED, which should confirm that inflation is nearing 2.0%. The core PCED is already running at a 2.3% annual pace over the past three months (chart). We expect that will fall to 2.0% in Q4.

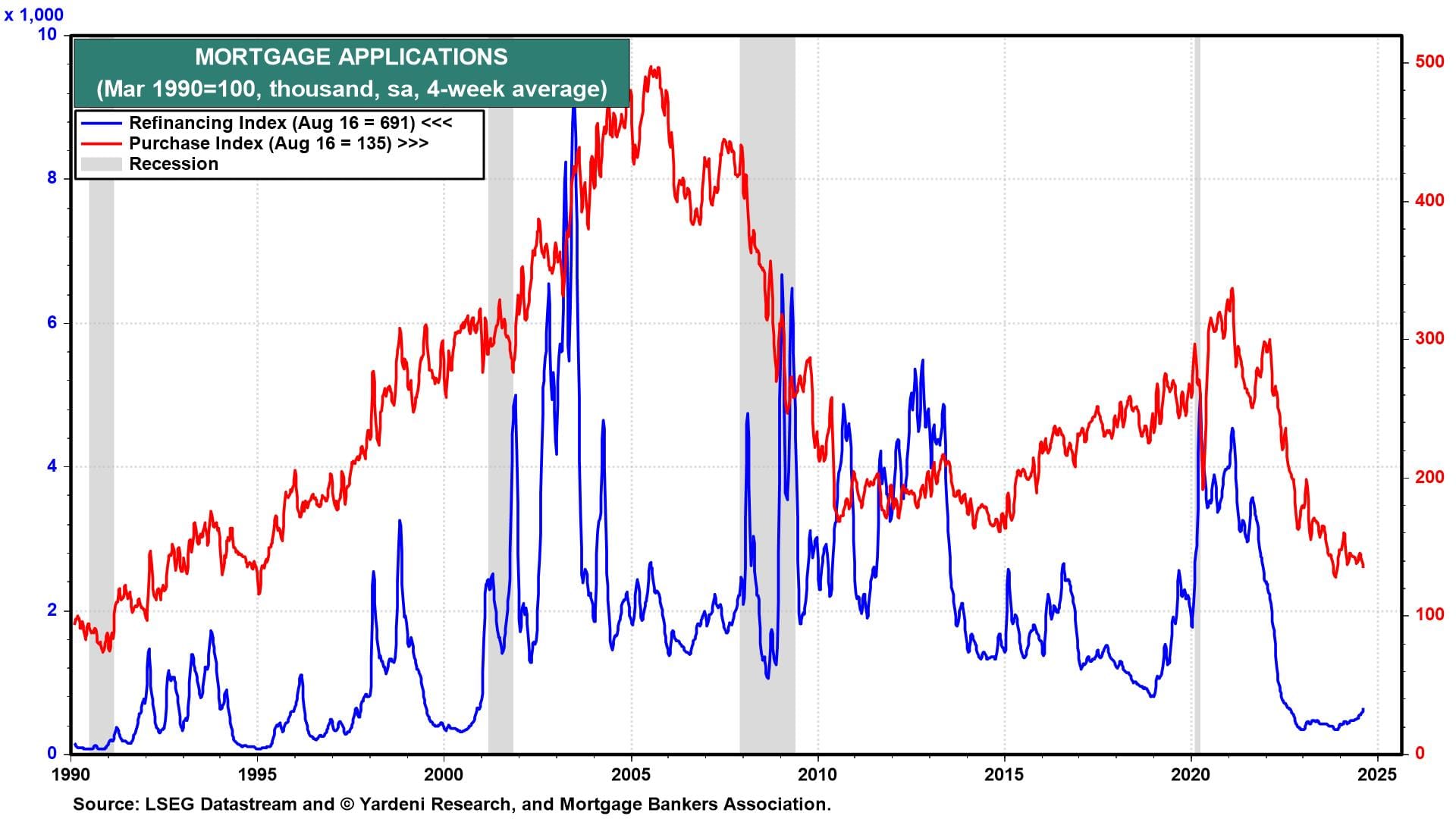

(3) Housing. The average rate on new 30-year fixed-rate mortgages has declined from 7.89% last October to 6.46% last week. Mortgage applications (Wed) have remained depressed, while refinancings have only started to pick up recently (chart). We expect that both will rise, and that July pending home sales (Thu), a measure of signed contracts for existing single-family homes, will increase after rising 4.8% in June.

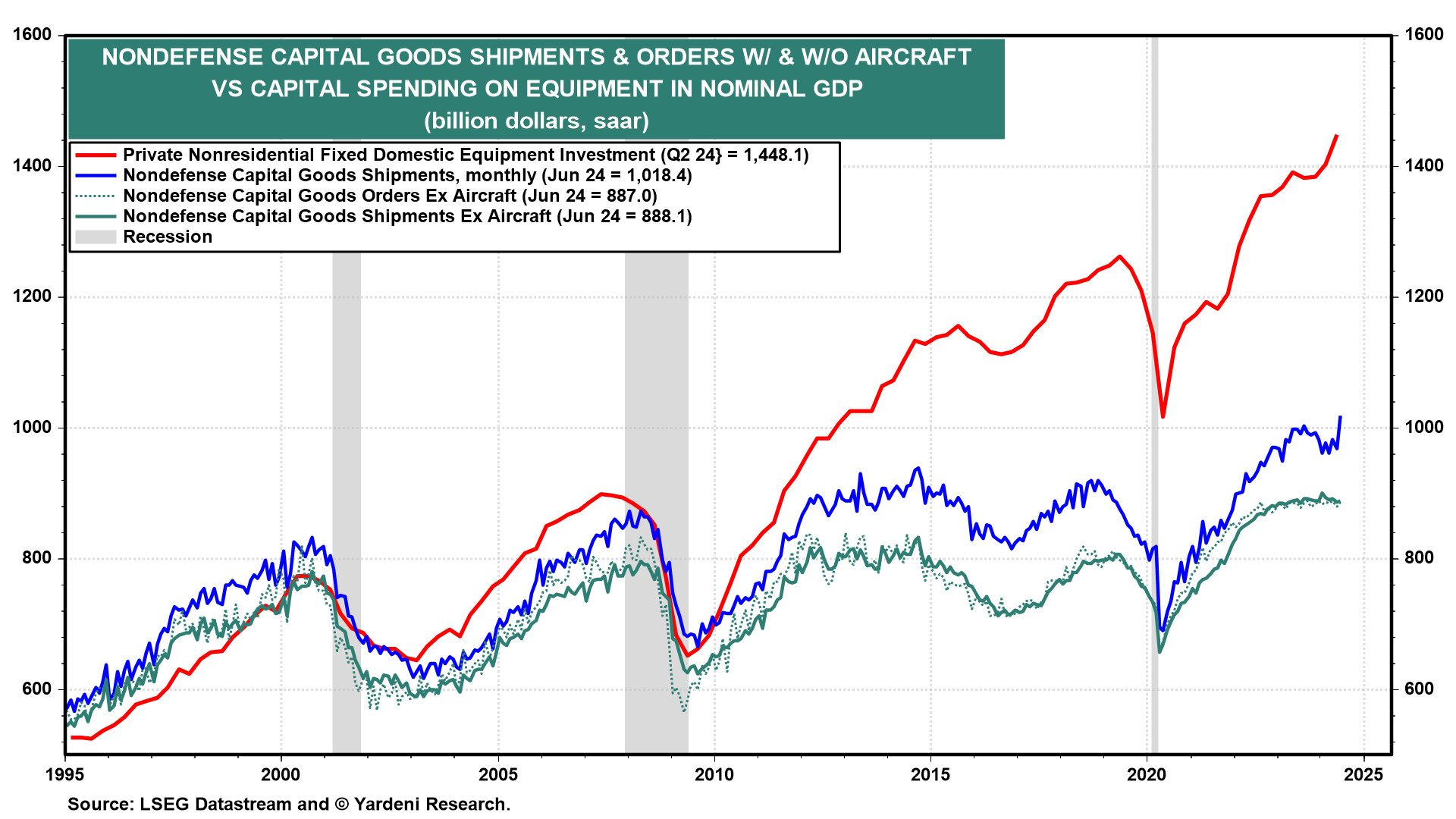

(4) Durable goods. July's durable goods orders (Mon) is likely to remain flat as it has been for the past couple of years. Shipments of nondefense capital goods including aircraft hit a new record high in June (chart). Nevertheless, this series no longer closely tracks capital equipment spending in GDP, which rose to a record high during Q2.