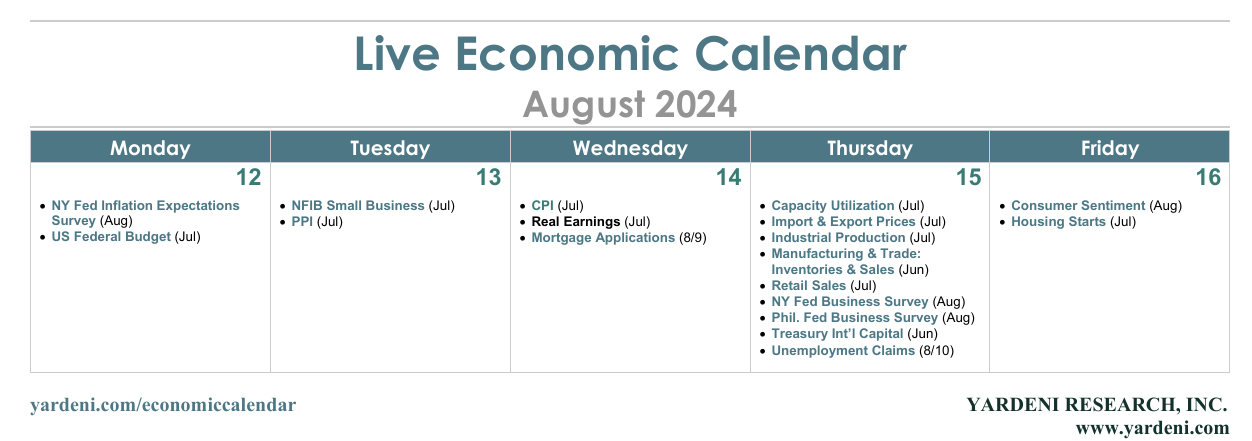

The week ahead is packed with economic reports. In addition, more Fed talking heads are likely to opine on last week's financial markets volatility and the monetary policy outlook. As market prognosticators debate the speed and size of coming interest rate cuts, the most important indicators are likely to be those closely tied to the Fed's dual mandate. Here's what we're watching this week:

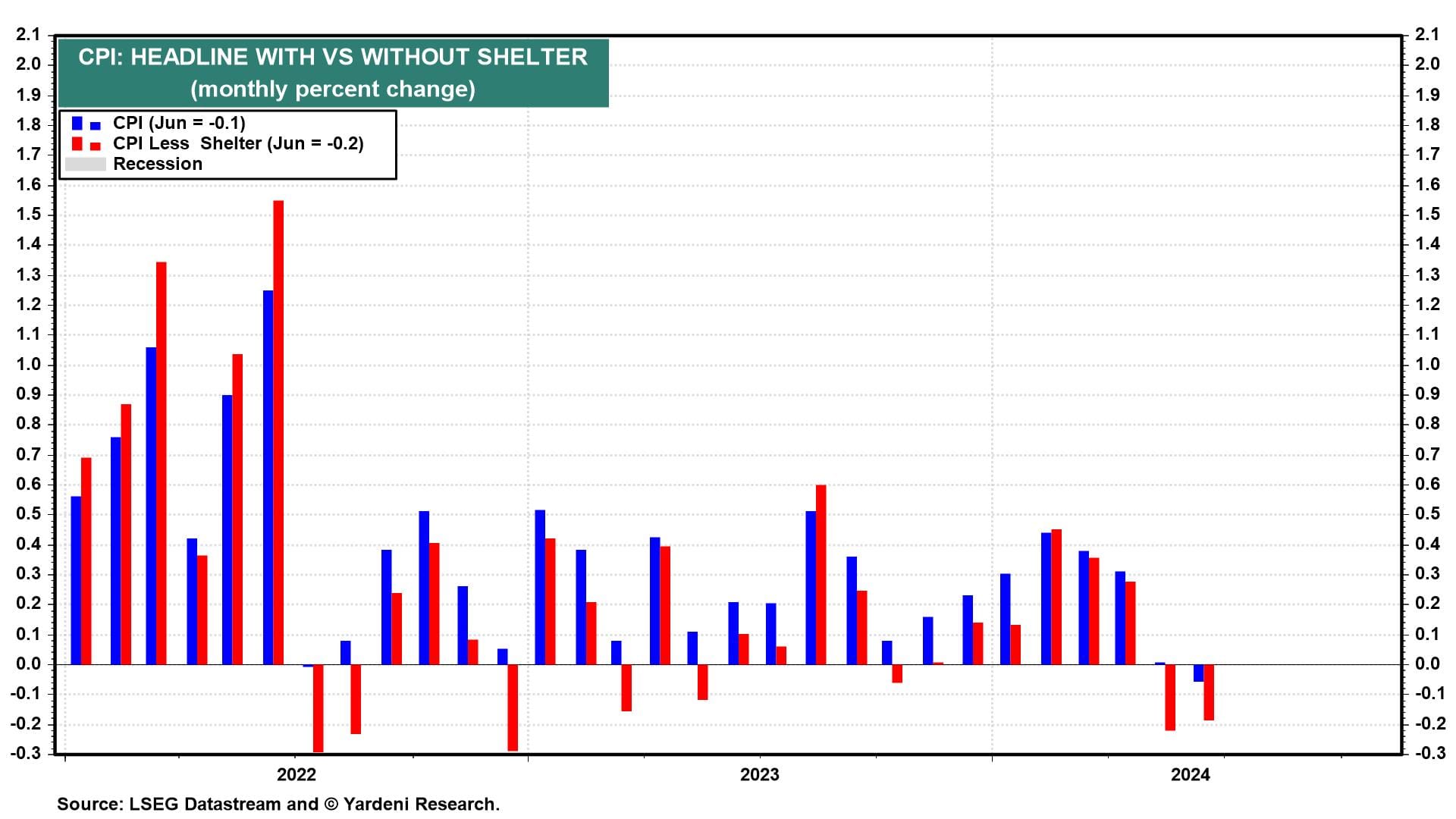

(1) CPI. July's CPI (Wed) is likely to show less progress in moderating inflation than over the past couple of months. The Cleveland Fed’s Inflation Nowcasting model forecasts that the headline and core CPI rose 3.01% and 3.33% y/y (0.24% and 0.27% m/m) last month. We don't see this as a sign that inflation is no longer moderating because low monthly readings in the back half of 2023 make the y/y comparisons harder this year (chart).

FOMC officials are aware of these “base effects.” It would take a significant upward CPI surprise to knock them off course from a 25bps cut in the federal funds rate in September. A much cooler reading would also likely keep them set for a quarter-point cut, but it would make the chorus of Fed watchers calling for more rate cuts much louder.

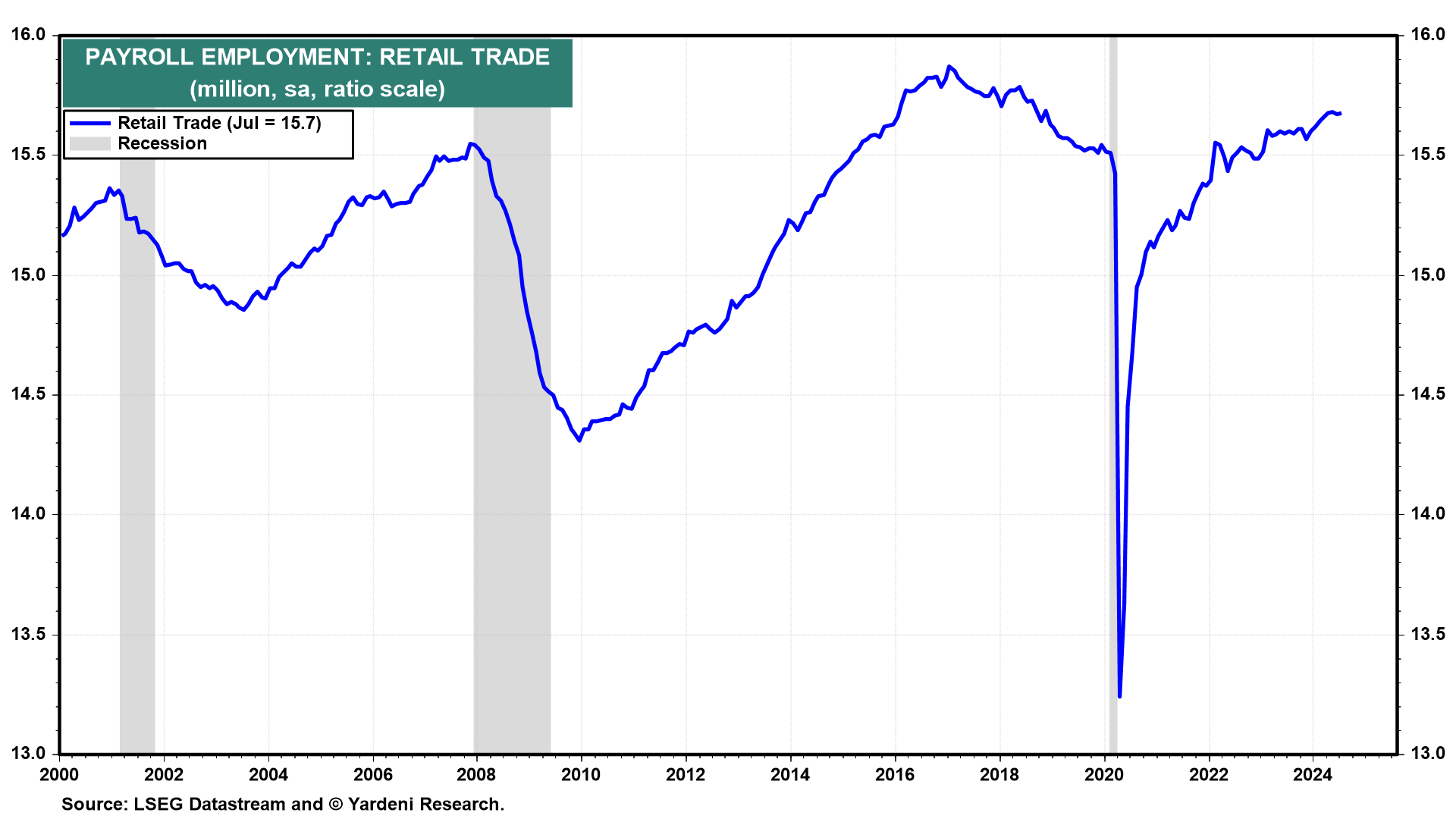

(2) Retail sales. July's retail sales (Thu) likely fell as a shorter workweek weighed on our Earned Income Proxy for private industry wages and salaries. However, we believe the decline in working hours was weather related, and the retail trade sector still added 4,000 payrolls in July back toward its cycle high (chart). Both of these developments suggest retail sales remains on its upward trend (chart).