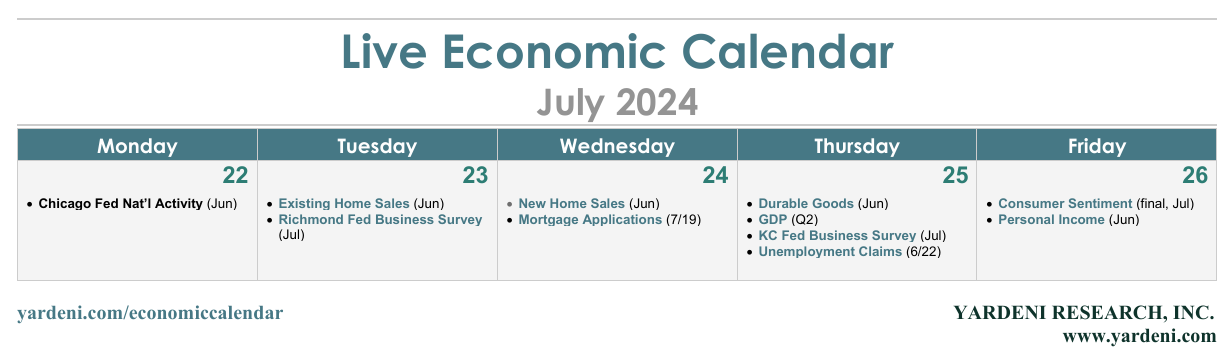

The week ahead is jampacked with key economic indicators, including the first read on Q2's real GDP and June's PCED inflation rate. We're expecting robust economic growth and further progress toward the Fed's 2.0% inflation target. The latest regional business survey might also confirm our forecast that the goods-producing sector is entering a rolling recovery. Here's our outlook for the incoming data, which should be positive on balance for both stocks and bonds:

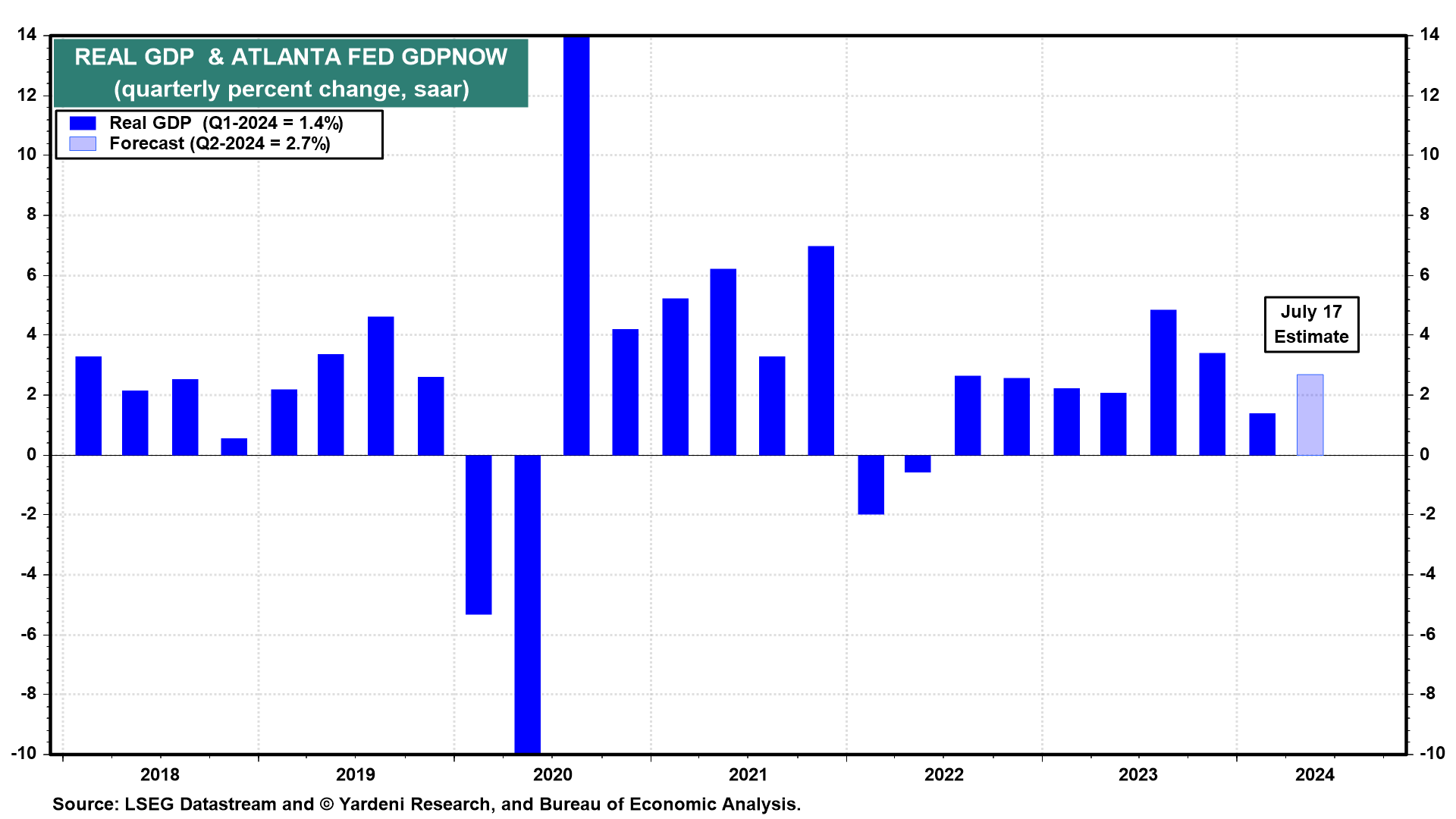

(1) GDP. The Atlanta Fed's GDPNow model is tracking Q2's real GDP (Thu) rising 2.7% (saar), which would be a solid increase from Q1's 1.4% (chart). Real final sales to private domestic purchasers, which excludes government purchases and the trade balance, is expected to come in at 2.5%. The model sees real personal consumption expenditures (PCE) growth of 2.1% (saar) and real gross private domestic investment at a blistering 8.9%.