The economic week ahead will include lots of economic indicators, which on balance should show that the pace of economic activity improved during May. June's regional business surveys for the New York and Philly Fed districts will also be released. The BIG number should be initial unemployment claims. Here's our take:

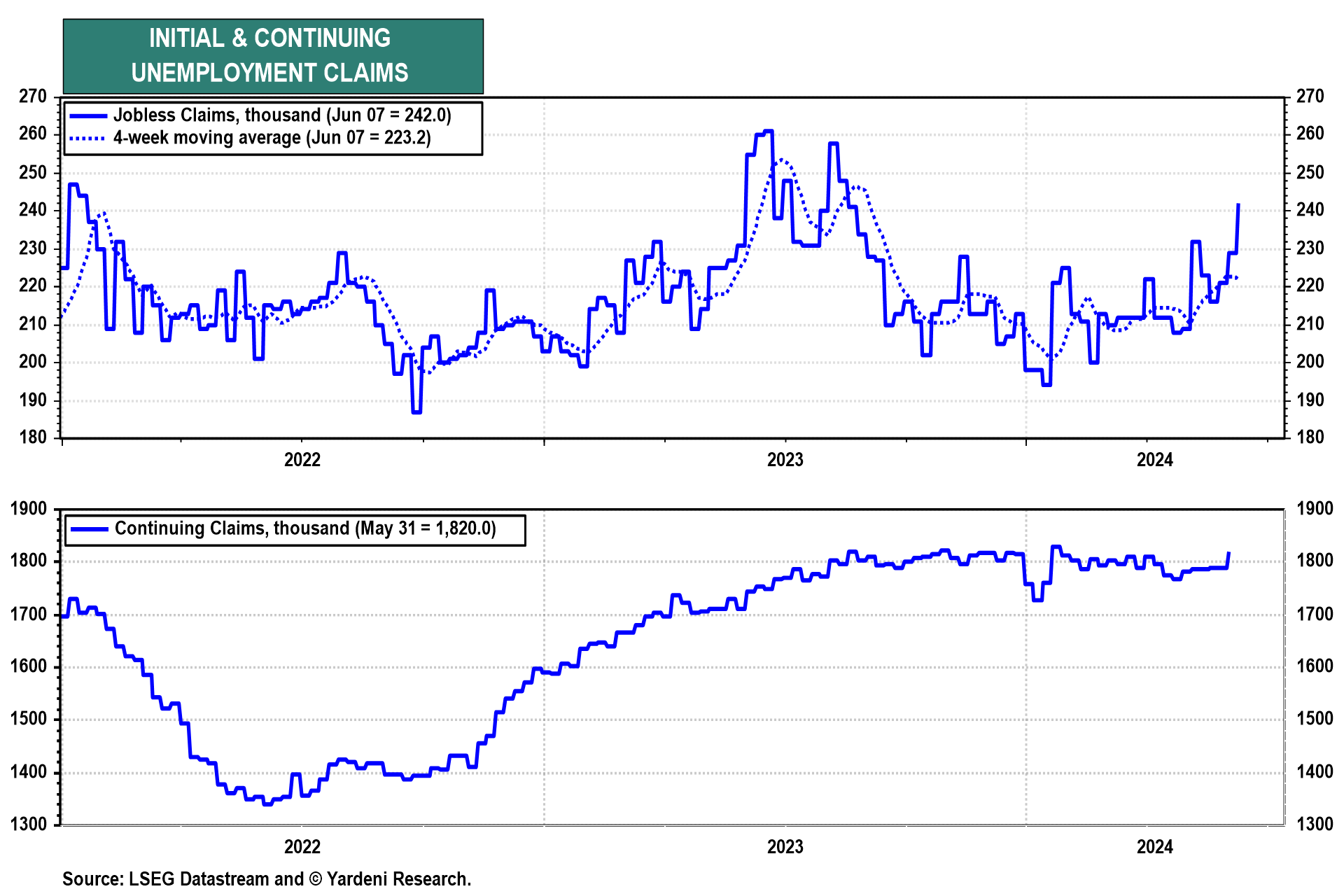

(1) Unemployment claims. Jobless claims (Thu) jumped over the past three weeks through the week of June 8 (chart). Continuing claims also jumped during the June 1 week. Both did the same when comparing seasonally unadjusted data this year to last year. Thursday's report should be an important one in determining whether the labor market is or is not getting weaker and could move the bond yield lower or higher. We are in the latter camp.

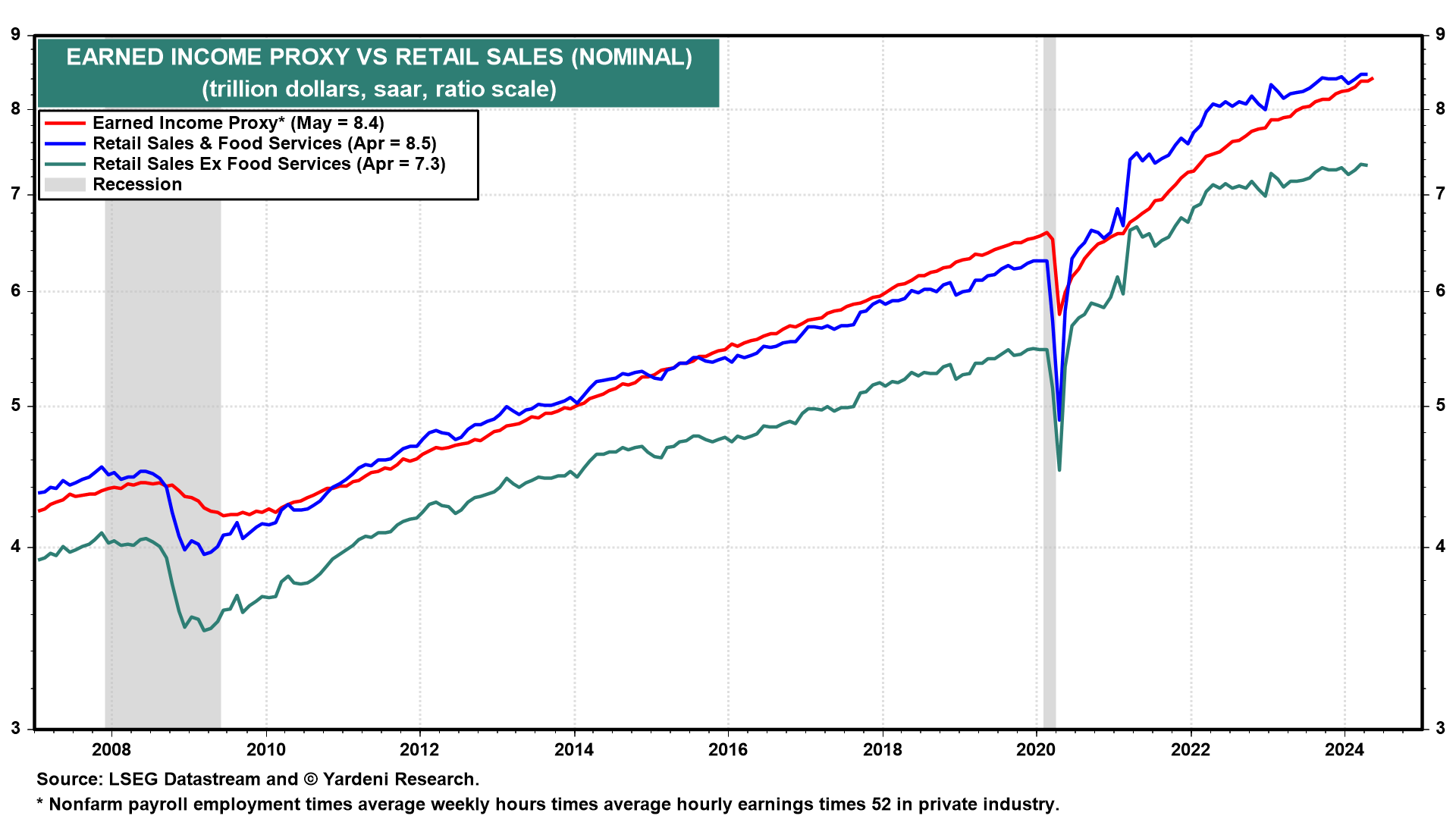

(2) Retail Sales. May's retail sales report (Tue) should register a solid gain after flattening in April. That's supported by the new record high in our Earned Income Proxy for private industry wages and salaries, which rose 0.6% thanks to a 0.4% m/m increase in average hourly earnings and the addition of 229,000 private payrolls during the month (chart). May's 13,000 increase in retail trade employment corroborates our upbeat outlook.

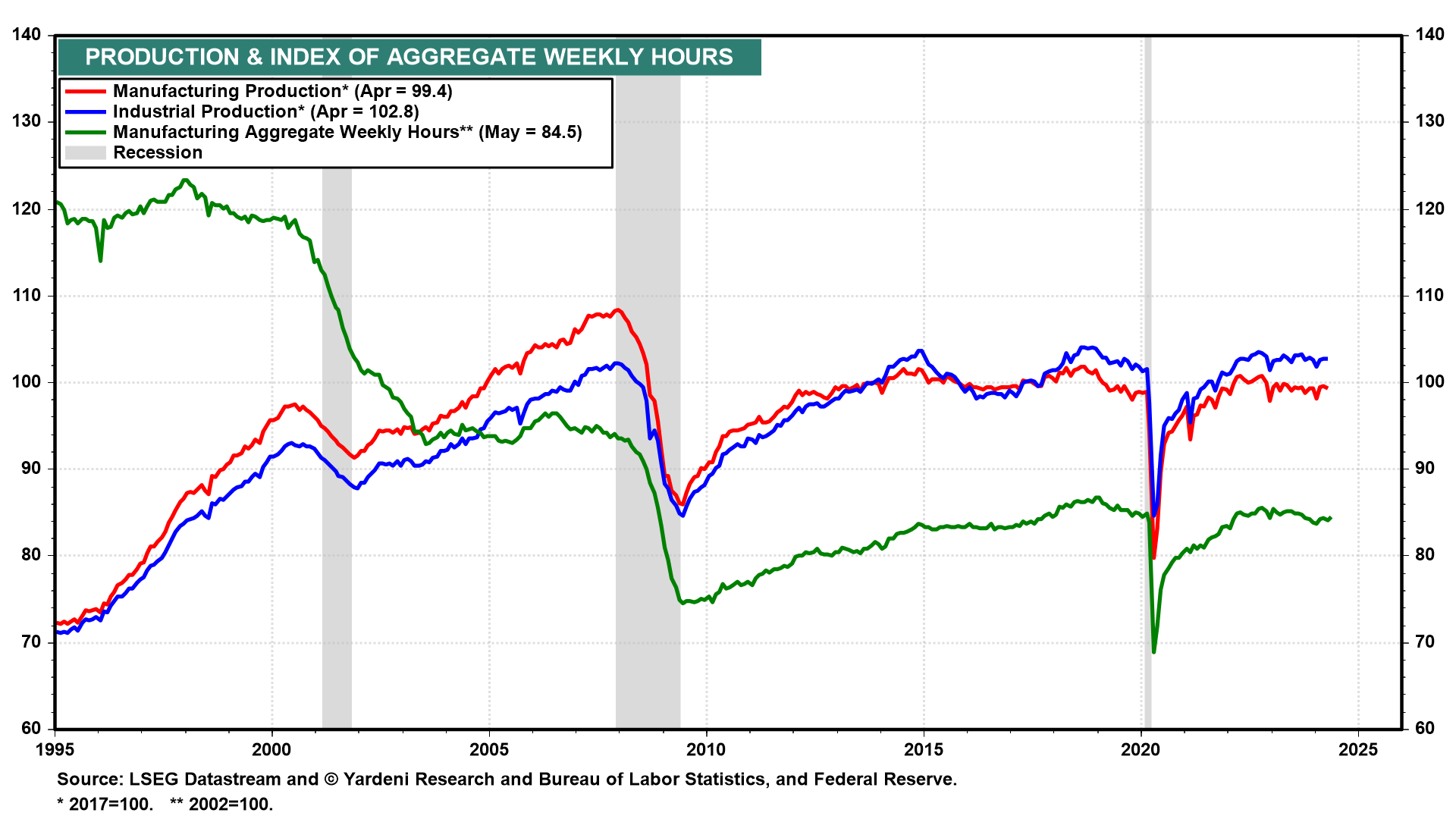

(3) Industrial production. Manufacturing aggregate weekly hours rose 0.5% m/m in May, which suggests that headline industrial production (Tue) also rose solidly after it was unchanged in April (chart). This series has been flat over the past couple of years.