This week, May's employment report (Fri) is likely to be the most important one. We expect the labor market cooled a bit last month, tempering wage growth but not signaling a looming employment-led recession. Less profit margin pressure from wage inflation should boost company earnings, while the solid jobs market should continue to fuel consumer spending. If so, that's bullish for stocks. Here’s what we’re watching:

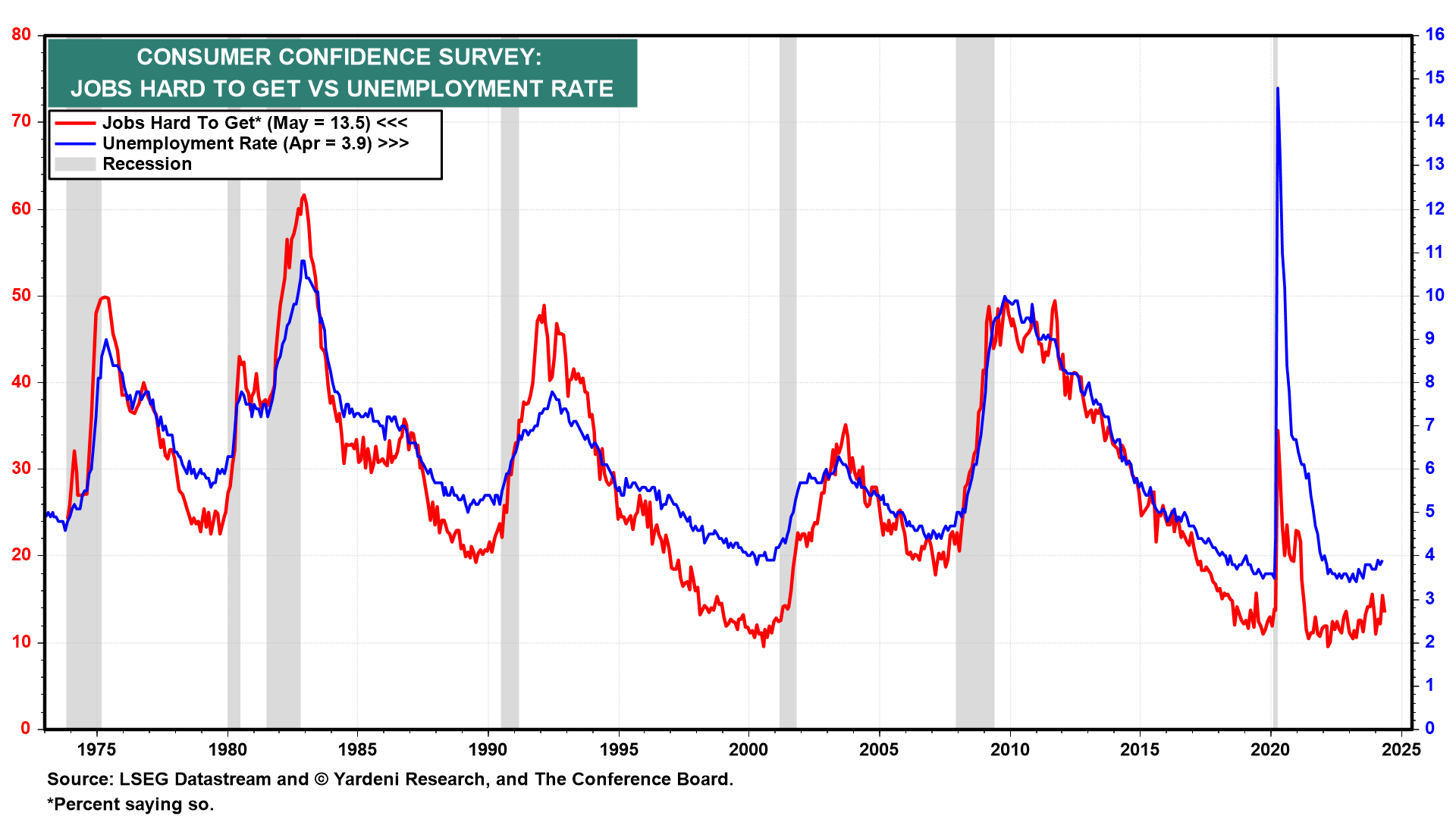

(1) Employment. Weekly initial unemployment claims have remained around 220,000, suggesting May’s unemployment rate will come in below 4.0% for the 28th straight month. This is confirmed by May's low reading of the "jobs-hard-to-get" series in the latest consumer confidence index survey (chart). The same survey showed that the "jobs plentiful" series edged down last month but remained relatively high. So April's JOLTS report (Tue) on job openings should tell the same story, in our opinion.

We estimate that payroll employment rose 150,000 to 200,000 last month to yet another record high.

(2) Wages. The decline in jobs plentiful over the past couple of years has weighed on wage inflation while keeping the unemployment rate subdued (chart). May's average hourly earnings (Fri) might have fallen below 4.0% last month.