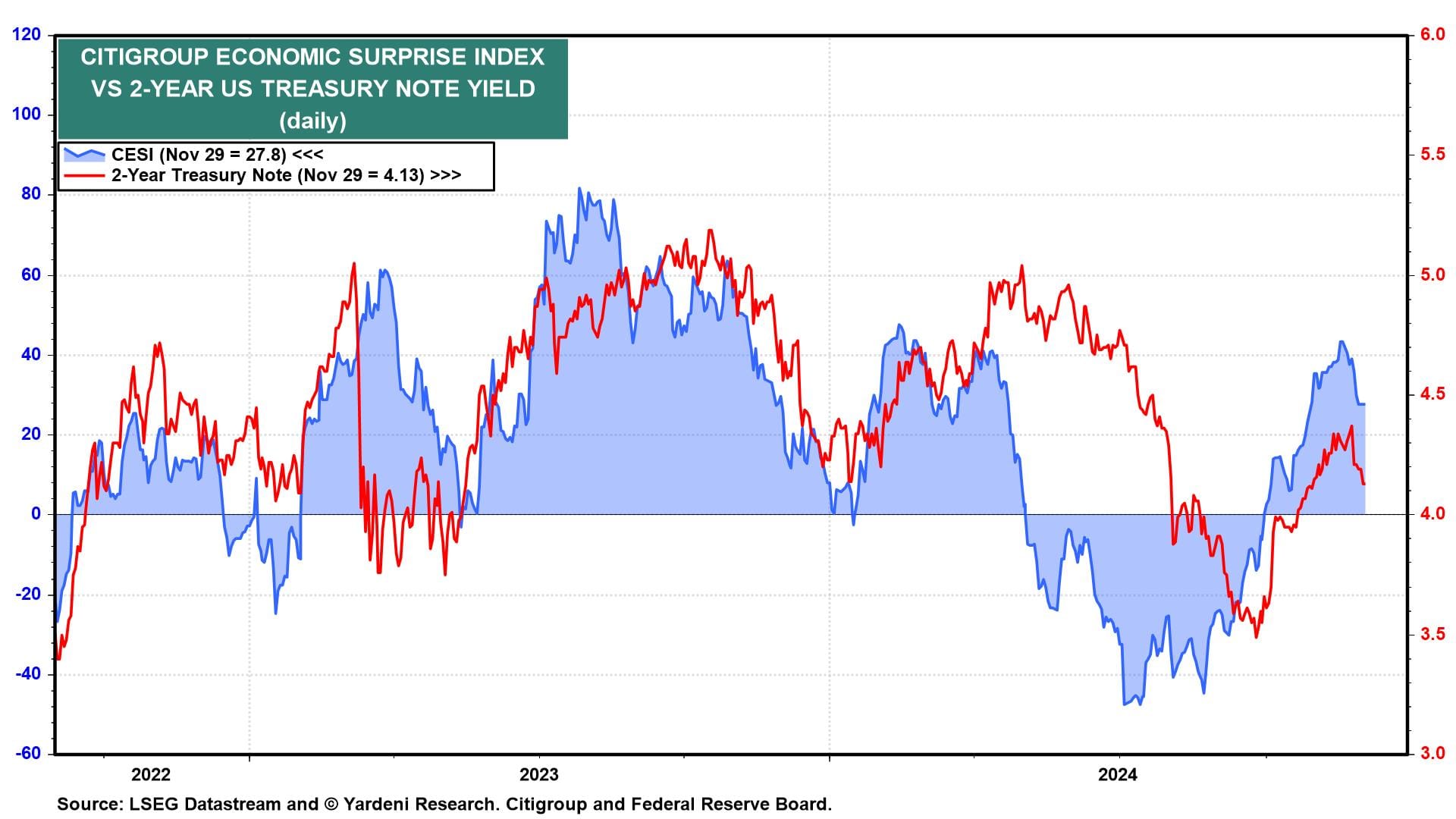

We expect to see more animal spirits during the economic week ahead. It is chock-full of updates of labor market indicators, as well as soft data (i.e., surveys) on business in the manufacturing and services sectors. The grand finale will be November's employment report on Friday. We are expecting this week's indicators to beat expectations, boosting the Citigroup Economic Surprise Index and sending yields a bit higher (chart). While hurricanes and union strikes depressed October's readings, we believe analysts are underestimating the economy's positive reaction to Trump 2.0 and easier Fed policy.

Here's what we're watching:

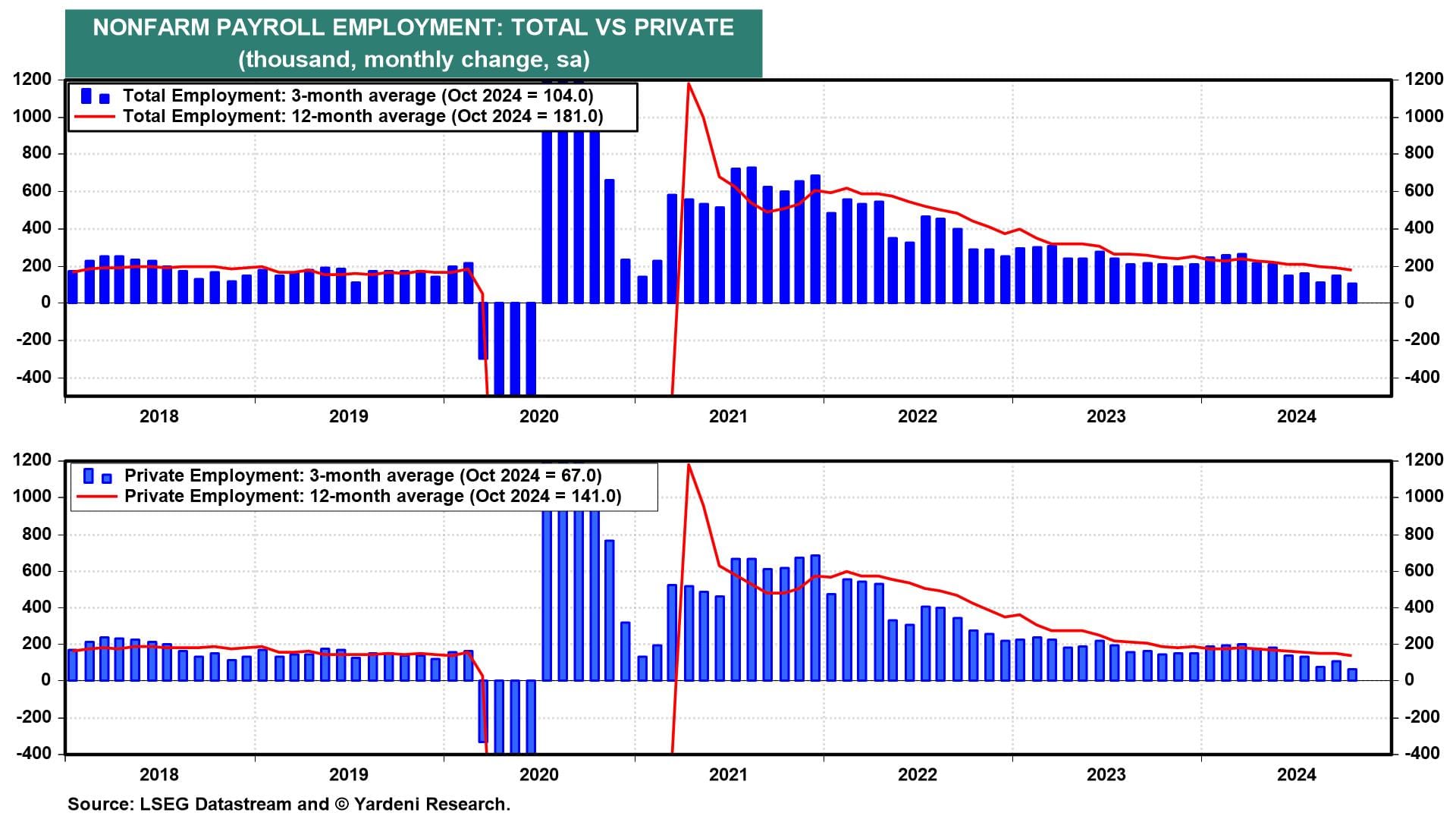

(1) Employment. We expect November's employment report (Fri) will show payrolls rose by more than 250,000. There were 33,000 Boeing workers returning from strikes, and coming back to work at Boeing's suppliers and after Hurricane Milton. We are expecting additional hiring attributable to the revival of animal spirits following Trump's big win and his promises to cut the corporate tax rate and implement deregulation. This should lead to better payroll gains into year-end. In fact, we think the 3-month gain in payroll employment could increase from 104,000 through October to 200,000 by January's employment report (chart).