The Dot Plot thickens! Other than another FOMC meeting, it's a slow week ahead for economic indicators. The committee's statement is widely expected to pass on another rate hike, but suggest that there could be another one at the November meeting. All eyes will be on the Summary of Economic Projections (SEP), which is updated quarterly and includes the "Dot Plot," which shows the range of the committee's forecasts of the federal funds rate (FFR).

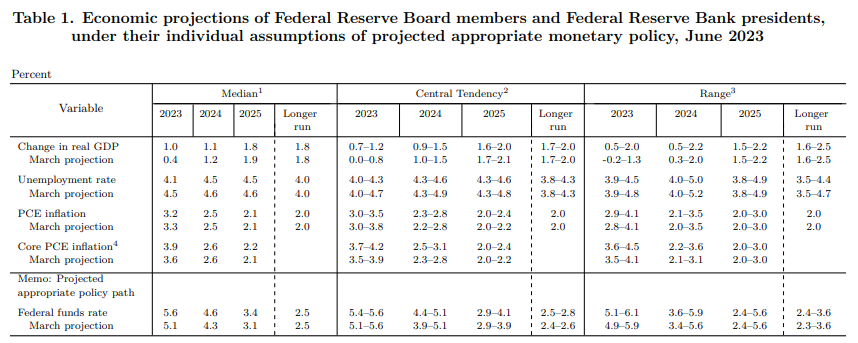

The table below is from June's SEP. It shows the median estimates for real GDP, unemployment, headline and core PCED inflation, and the FFR. Here are a few observations to keep in mind when the latest SEP is released on Wednesday:

(1) Notice that the FFR estimate for this year was raised from 5.1% to 5.6% at the June meeting, implying one more rate hike this year--"one-and-done." That isn't likely to change.

(2) June's SEP showed a 100bps drop in the FFR next year to 4.6%. We expect that will be raised closer to 5.6% in line with the Fed's "higher-for-longer" mantra. Convincing the markets that the Fed is in no rush to lower interest rates would be a restrictive measure that could reduce the need for any more rate hikes.

(3) During August, the headline and core PCED inflation rates were 3.3% and 4.2%. June's SEP anticipated these rates will fall to 3.2% and 3.9% by the end of this year. Those estimates probably won't change much in September's SEP.