Artificial intelligence, and all the capital spending that comes along with it, is here to stay. Nvidia reported today that its sales last quarter rose 78% y/y to $39.3 billion, and management’s revenue guidance of $43.0 billion (+/- 2%) for the current quarter was above the consensus estimate of $41.8 billion. Moreover, the company laid out plans to get its new Blackwell chips to market in size, easing worries that there might be delays in production or sales.

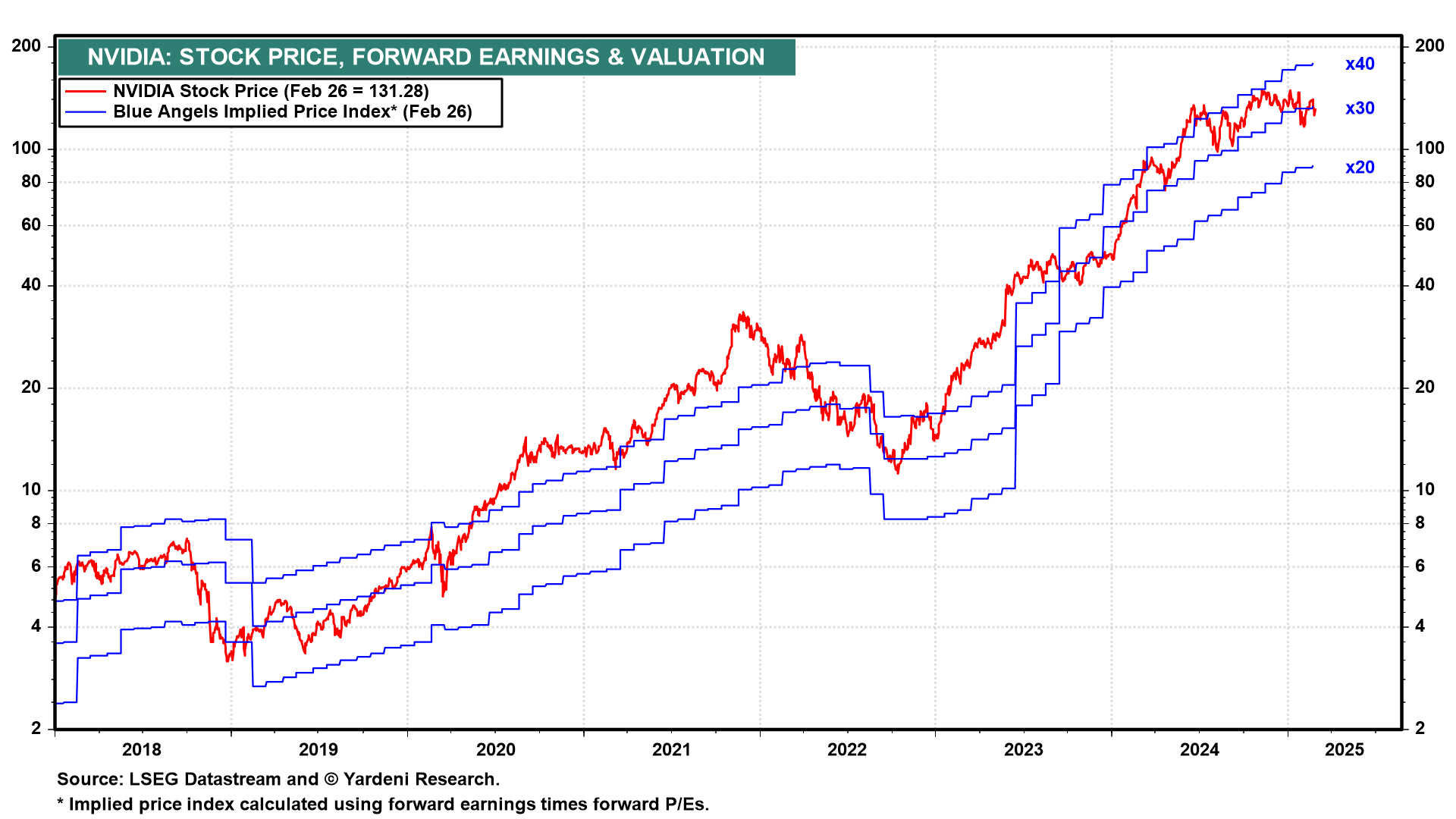

Nvidia's share price was up in afterhours trading after rising 3.7% during the day. We expect it to continue rising over the rest of this year after plateauing for the past six months (chart).

The emergence of DeepSeek's lower-cost AI model in late January raised concerns that the Magnficent-7's huge expenditures on R&D, semiconductors, data centers, and energy would be scaled back. Rumors that Microsoft was cancelling a couple of data center leases spooked the markets earlier this week. We've opined that DeepSeek is not a threat and, if anything, is a bullish catalyst for AI demand and therefore overall AI spending. The incredible demand for Nvida's premier AI chips confirms our assessment.

Consider some other developments from Nvidia's earnings report and how they interplay with the economy and the rest of the stock market: