Fed Chair Jerome Powell's basic message during his press conference yesterday was that the Fed is in no hurry to lower interest rates, but the Fed still intends to lower them over time. So it's a dovish pause. That boosted stock, gold, and bitcoin prices today.

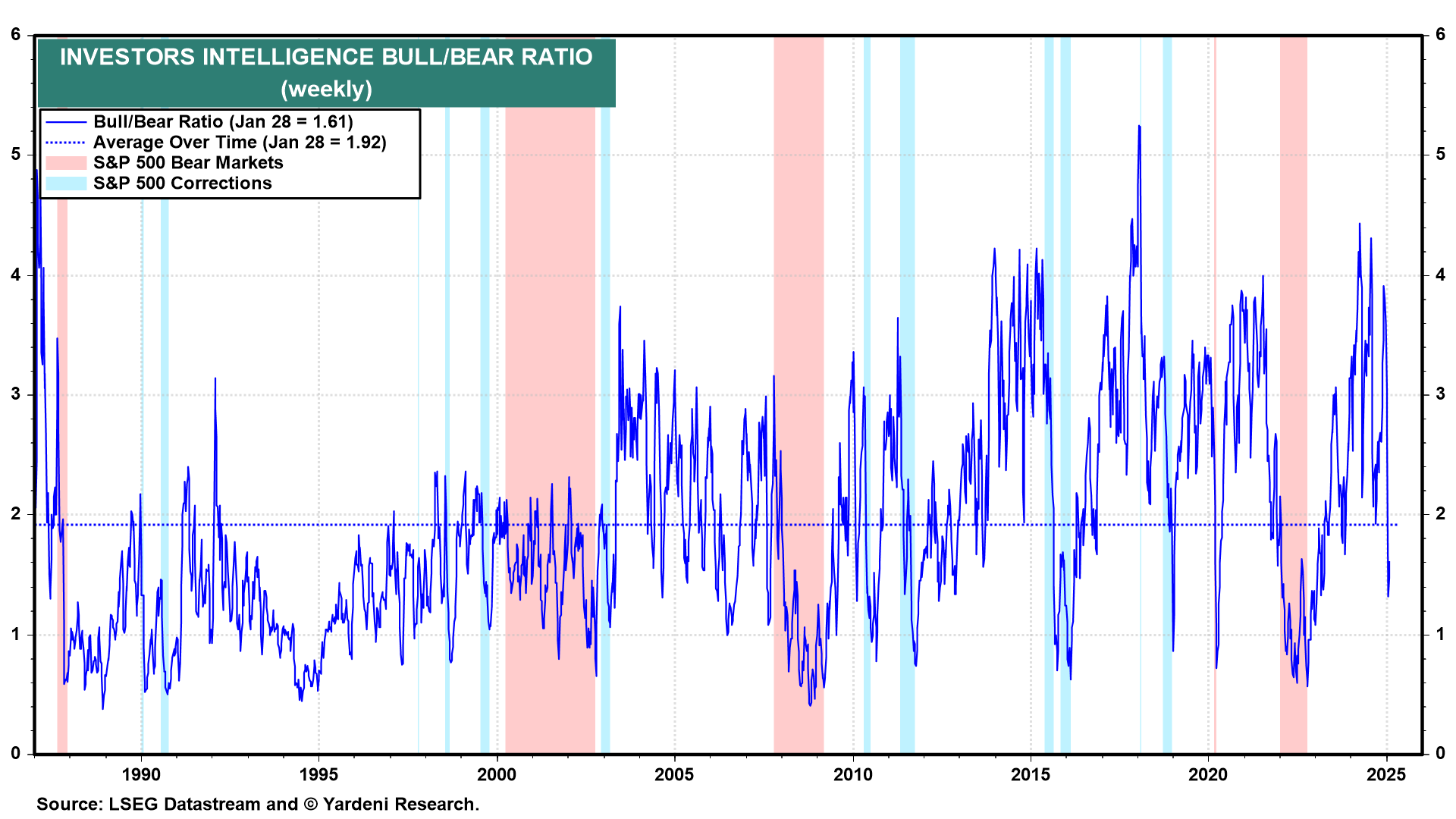

Meanwhile, Investors Intelligence Bull/Bear Ratio remained relatively low this past week. It was released yesterday morning before Powell's presser (chart). That's bullish for stocks, too, from a contrarian perspective.

Almost all of 2024 data have been released. The US economy surpassed almost everyone's expectations for the past three years except our own. We're looking for a strong 2025 as well. That's all consistent with our technology-led, productivity-driven Roaring 2020s outlook.

Let's review today's data: