The bull market's winning streak ended today. The Dow closed higher for 13 straight sessions through Wednesday, its longest series of positive closes since 1987. It was down 0.67% today. The Dow's longest-ever winning streak was 14 sessions, set in 1897, according to S&P Dow Jones Indices. The S&P 500 closed at 4537.41 today after hitting a bull market intraday high of 4606.13 at 9:45 am. Our 4600 yearend target is ahead of schedule. We are leaving it there for now, but targeting the top end of the 4800-5400 range by the end of next year.

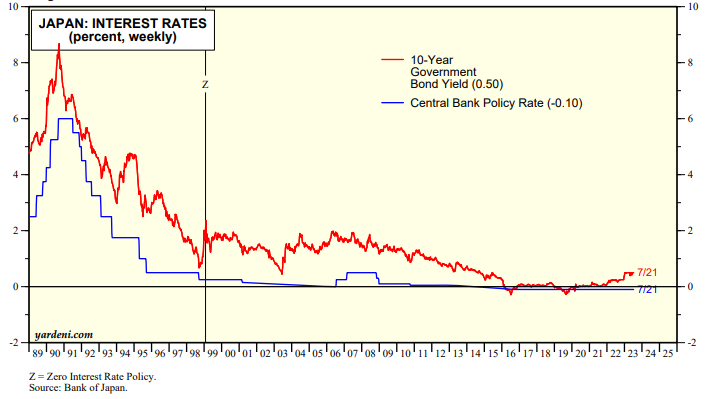

Weighing on the stock market was a rise in the 10-year US Treasury bond yield back over 4.00%. Some observers said that happened because Q2's real GDP growth rate of 2.4% (saar) was more than expected, raising the odds of more Fed tightening. That doesn't make sense since that was the latest number shown by the Atlanta Fed's GDPNow tracking model. Today's yield backup might have been a delayed response to Wednesday's hike in the federal funds rate. In addition, the Bank of Japan might widen its yield curve control bands tomorrow (chart).

Q2's GDP report showed that only exports and residential fixed investment were down. Capital spending was strong, while consumer spending growth slowed. The really good news was that the PCED price index increased 2.6% (saar) in Q2, compared with an increase of 4.1% during Q1. Excluding food and energy prices, the PCED increased 3.8%, compared with an increase of 4.9%.

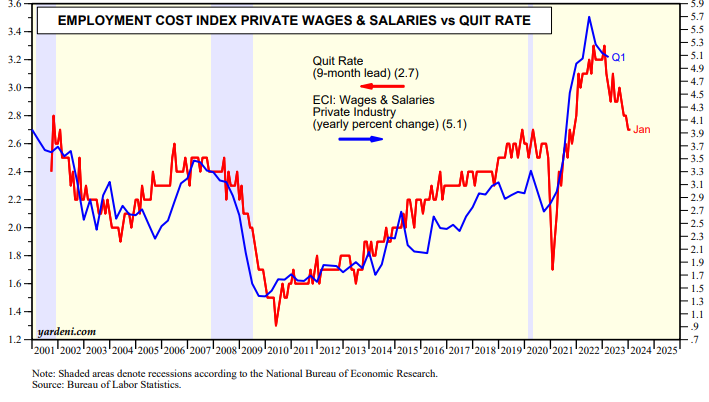

Tomorrow's PCED for June should confirm that inflation continued to moderate last month. In his presser on Wednesday, Fed Chair Jerome Powell said he'll be looking closely at tomorrow's Employment Cost Index (ECI) for Q2. The ECI's wages & salaries component on a y/y basis is highly correlated with the quits rate pushed ahead by nine months (chart). This relationship suggests that tomorrow's ECI should confirm that wage inflation is also moderating.