After today's PPI, we won't be surprised if Fed officials plant a story in The Wall Street Journal over the weekend titled something like "Fed Officials Might Vote To Pause Rate Cutting Following Hot Inflation Data." The current consensus seems to be that the Fed will cut the federal funds rate (FFR) by 25bps on December 18. But it might be a "hawkish cut" with the FOMC's Statement and Summary of Economic Projections signaling a pause in rate cutting early next year.

If so, then Fed Chair Jerome Powell will amplify that signal at his December 18 presser. He certainly sounded somewhat less dovish on November 14 when he said, "The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully."

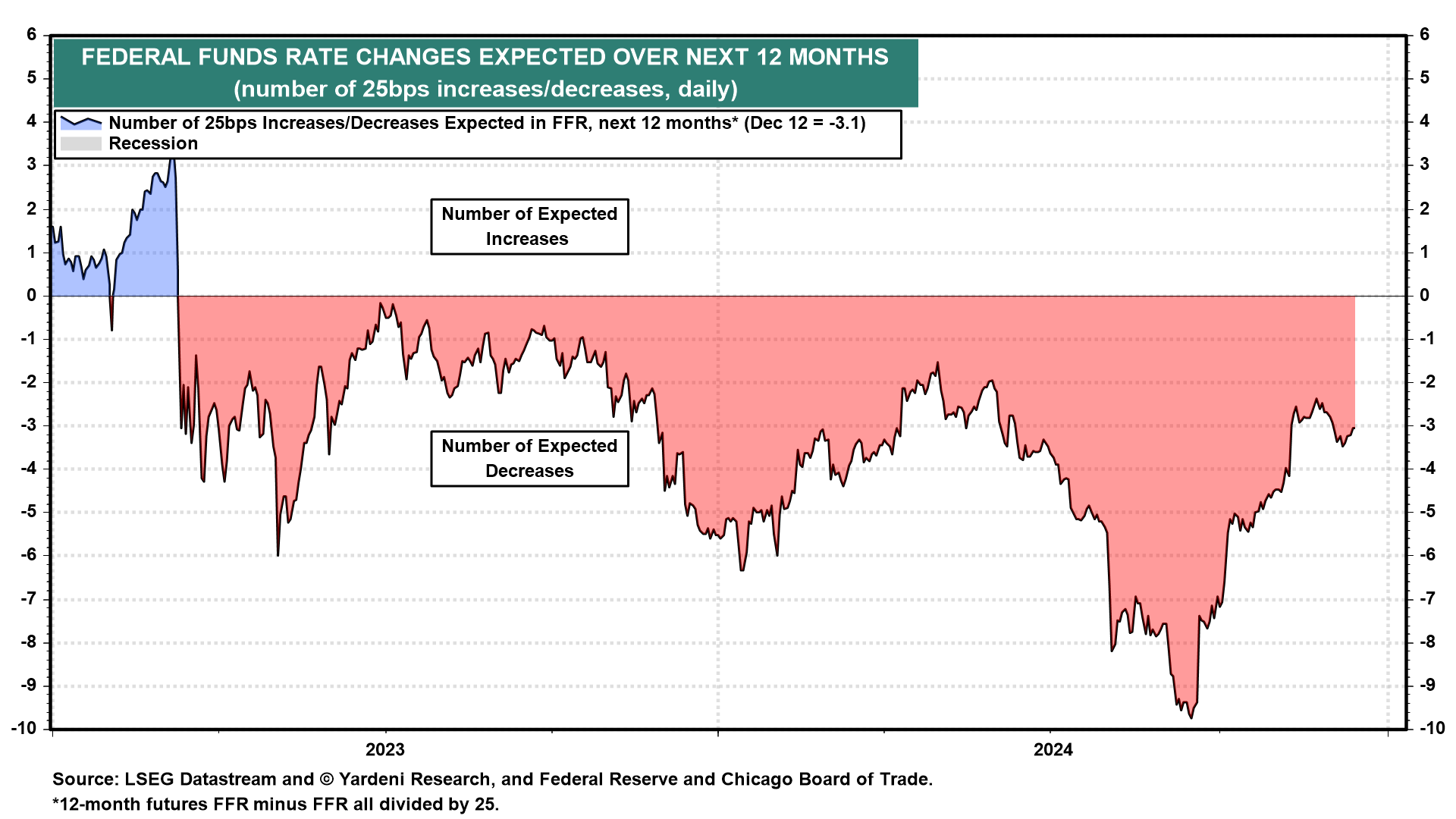

The FFR futures market currently is anticipating a 25bps cut next week and two more similar cuts next year (chart).

The Fed cut the FFR by 75bps since September 18. Two days before that happened, the 10-year US Treasury bond yield was 3.62% (chart). It has increased 70bps since then to 4.32% today. We anticipated that the Bond Vigilantes might fight the Fed because the economy is strong and inflation might stop moderating north of 2.0% because the Fed is easing too much, too soon. Another rate cut next week might push the bond yield higher, again.