Two months ago at the World Economic Forum in Davos, Microsoft CEO Satya Nadella said, "All I know is, I'm good for my $80 billion" regarding the $500 billion Stargate AI announcement. His comments followed the emergence of DeepSeek's R1 large language model and chatbot, which was supposedly trained at much lower cost than state-of-the-art models built in the US.

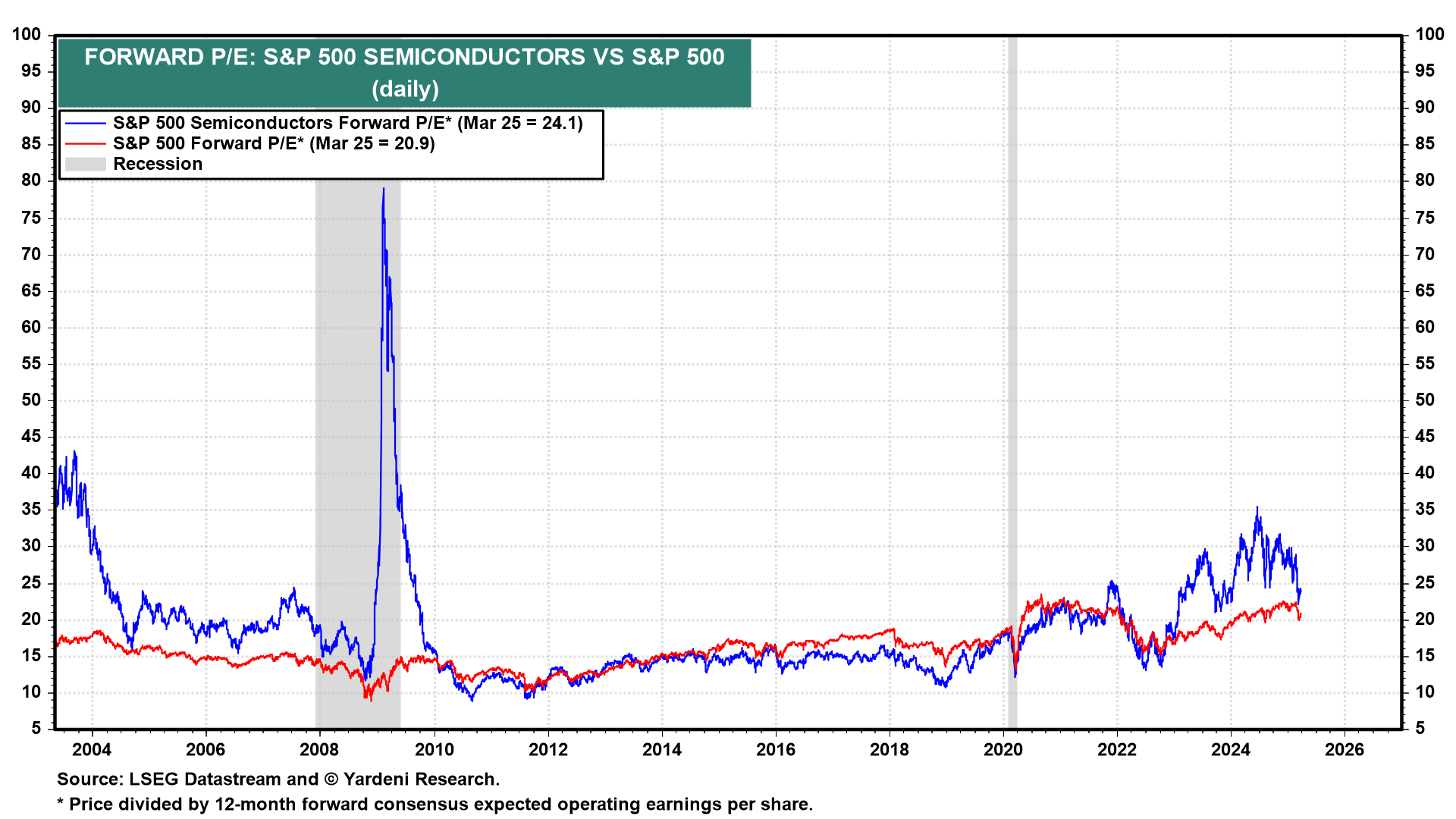

A February note from TD Cowen analysts stated that Microsoft was backing out of data center leases, as questions were arising about the necessity of so much spend on AI infrastructure. Today, those TD analysts reported that Microsoft walked away from two gigawatts’ worth of projects over the last six months after cutting back support for new model training by OpenAI. Nvidia fell 5.7%, and the PHLX Semiconductor index fell 3.3% on the news today. The semiconductor sector now has mostly erased its valuation premium versus the rest of the stock market that had built up since ChatGPT's release on November 30, 2022 (chart).

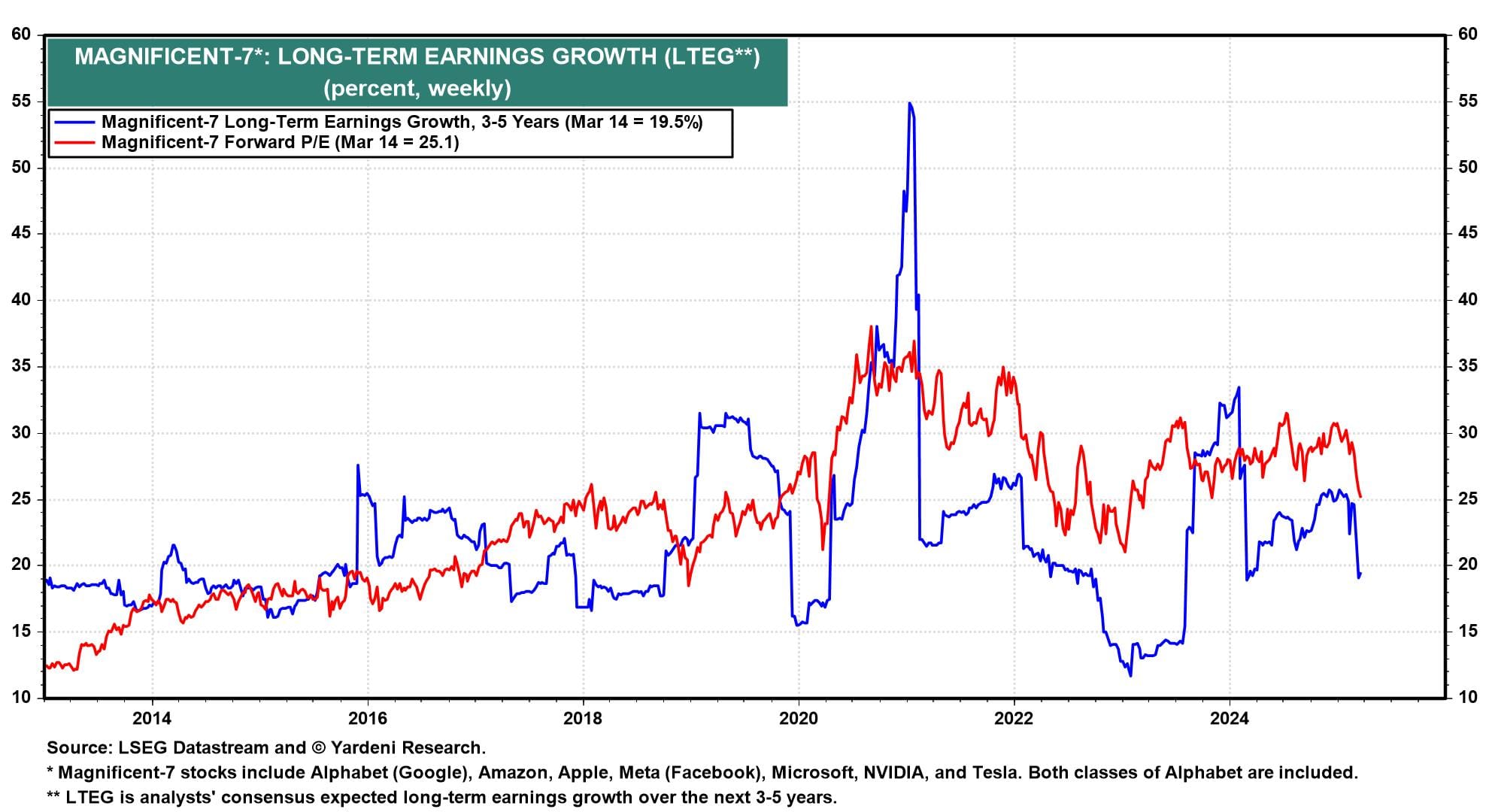

We've opined that DeepSeek would be a net positive for AI demand, as cheaper training and model proliferation helps non-tech companies adopt AI and boost productivity. Perhaps there was a mini-bubble built up on AI euphoria. But since the Magnficent-7 stocks' long-term earnings expectations and valuation multiples already have realigned closer to historical averages without a bear market or recession, we think further downside for the AI trade is limited (chart). Notably, the ex-Mag 7 ETF (XMAG) was down just 0.7% today and is still up 1.5% on the year. The broader market is holding up relatively well.

Speaking of bubbles, tariffs may be inflating them in various commodities, especially copper. Historically, copper prices have signaled strong economic growth, particularly vis-a-vis demand from China. Now copper is hitting record highs on tariff turmoil.

The copper nearby futures price hit a record $5.374 per pound today before finishing around $5.24. Copper is up 30% ytd, with half of those gains coming since President Trump's February 25 executive order on copper's national importance (chart). Originally, the EO asked for a Commerce Department report on potential copper tariffs by November, but Bloomberg reported today that they may be coming in a matter of weeks.

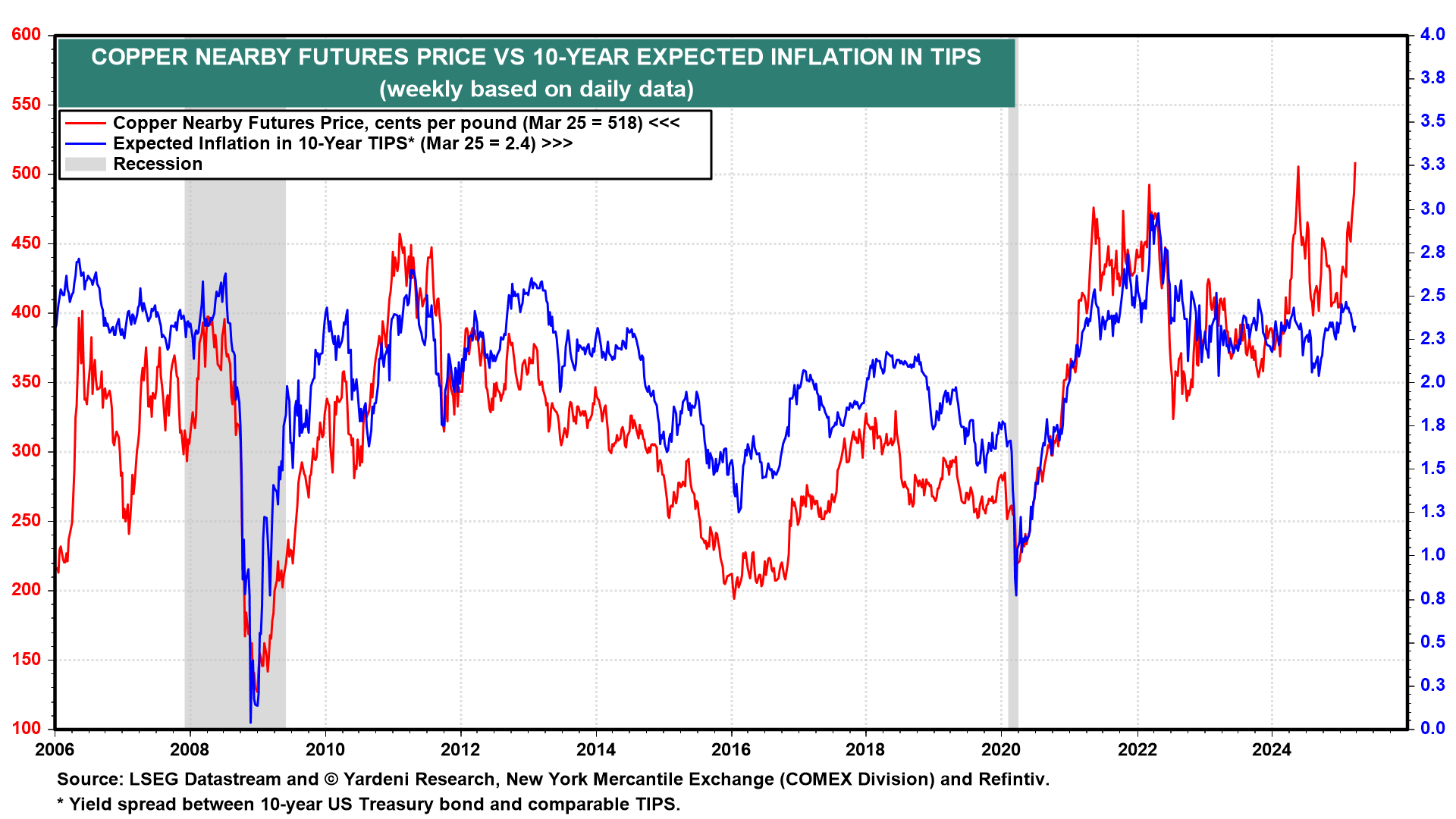

As producers front-run potential tariffs by building inventories, prices rise. This will filter into PPI and CPI goods prices in the coming months. The recent rise in copper prices and impact on headline inflation will likely boost inflation expectations in the bond market. Historically, copper and breakeven inflation have a close relationship, suggesting upside to nominal Treasury yields in the coming weeks (chart).

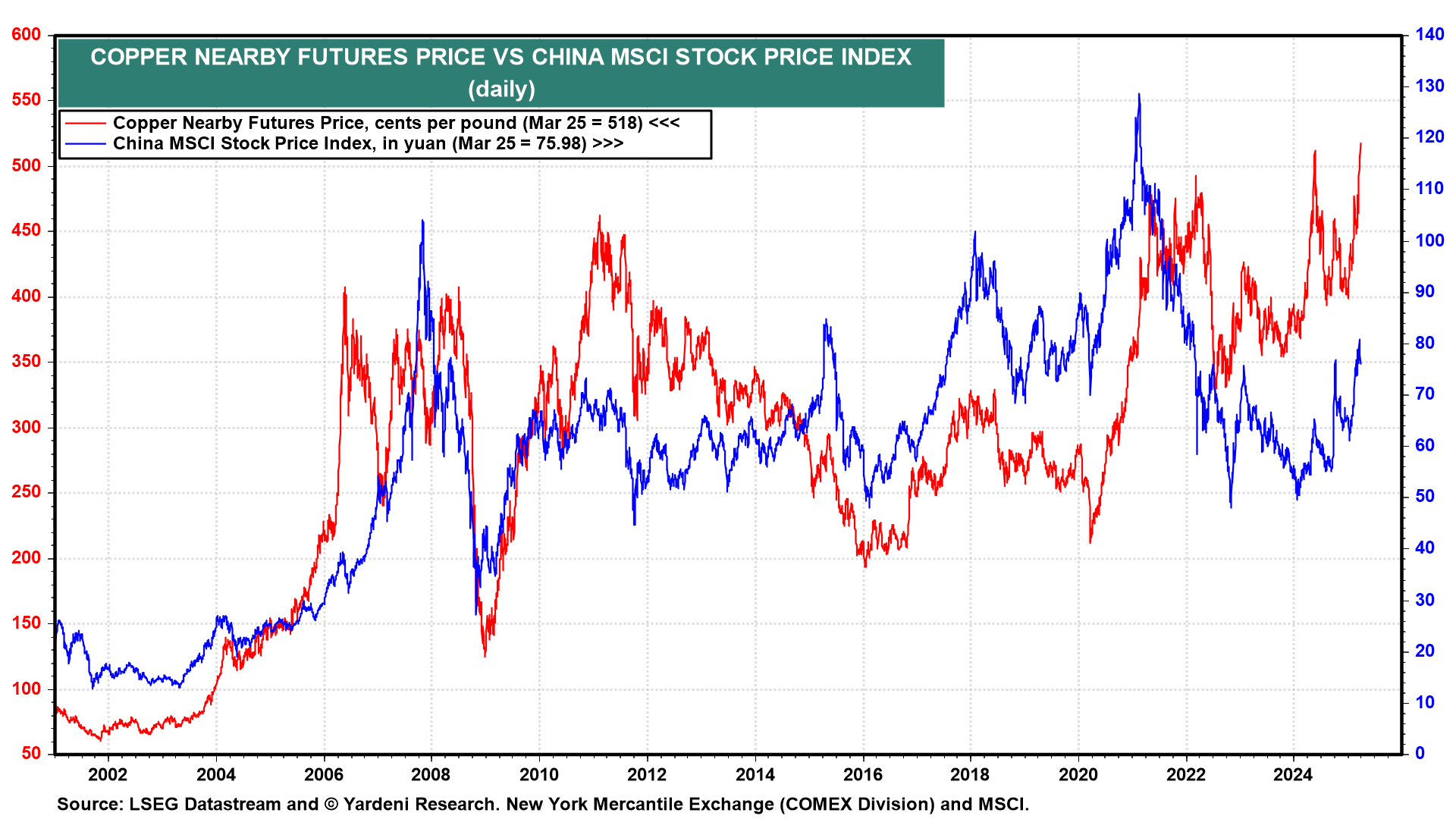

That's not to say that tariffs are the sole driver of copper's climb. Stimulus measures in China and subsidies for renewable energy, electric vehicles, and AI have boosted demand significantly. For instance, EVs are much more reliant on copper than ICE vehicles (that run on gas). So we are not surprised to see Chinese stocks and copper prices taking off at the same time (chart).

But this calls into question the AI selloff. Copper is inextricably tied to AI and energy infrastructure. So if rising demand is helping to push copper prices to new record highs, can the AI fervor really be overdone? It seems unlikely.