We wish you a great Thanksgiving Day tomorrow with your family and friends. We thank you for your interest in our research service. We are thankful that 2023 has turned out to be a better year than 2022, as we predicted. The S&P 500 is up 18.7% ytd following last year's decline of 19.4%. We will be thankful if 2024 is another good year for the market, as we expect.

Today, the S&P 500 resumed its recent rally that started on October 27. It closed at 4556.62, which is smack dab on the downward resistance line connecting the January 3, 2022 record high and the July 31 high for 2023 so far (chart).

We are expecting an upside breakout above the resistance line as inflation continues to moderate led by falling gasoline prices (chart).

Oil prices fell today suggesting that November will be another month of moderating inflation. The OPEC+ meeting scheduled for November 26 was postponed to November 30, suggesting the cartel is having trouble agreeing on production cuts to stop the slide in oil prices since late September.

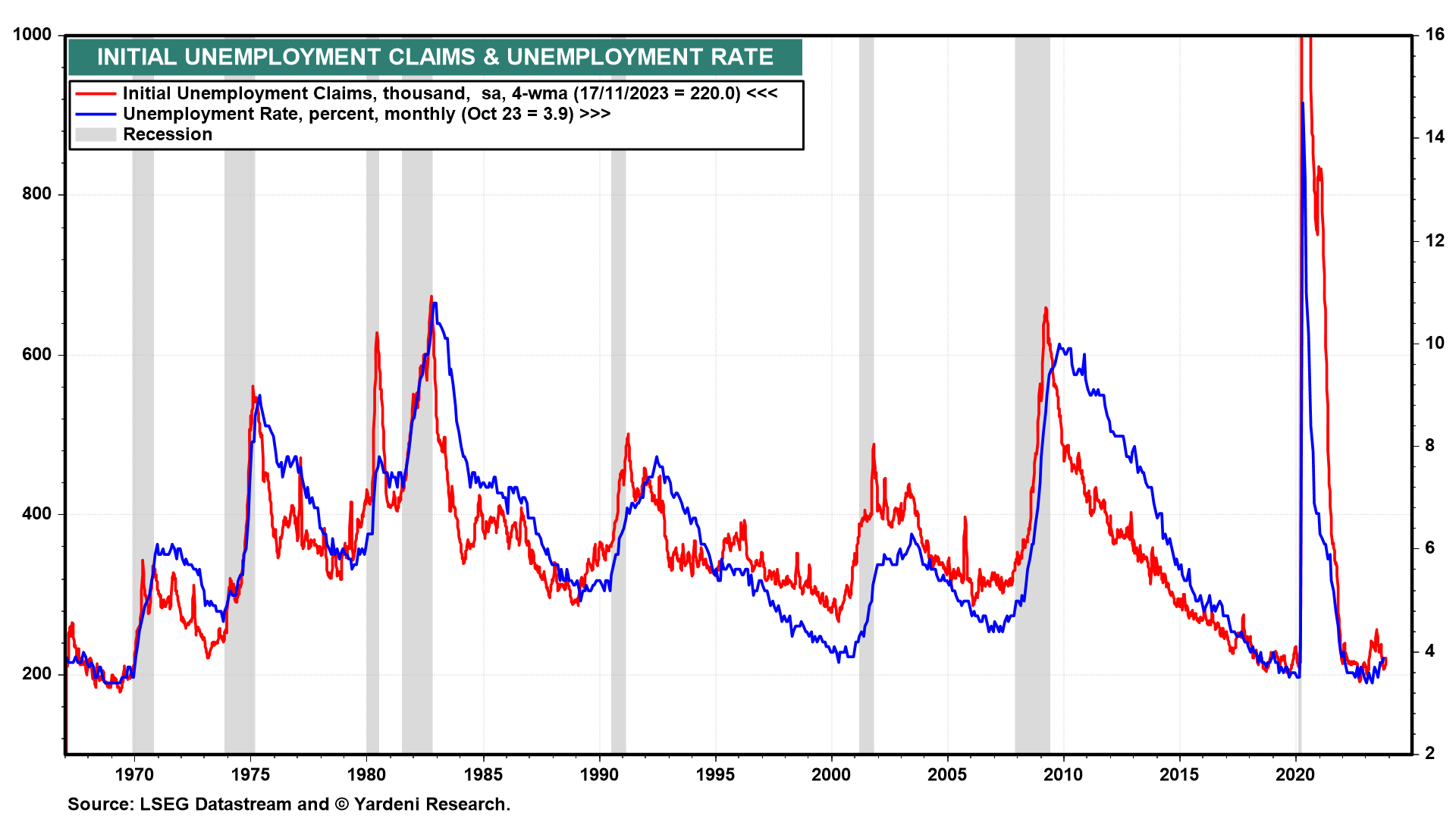

Meanwhile, today's report on initial unemployment claims showed a drop of 24,000 to 209,000 for the week ended November 18. The decline more than reversed the jump in the prior week, which had lifted claims to a three-month high (chart). So the labor market remains robust.

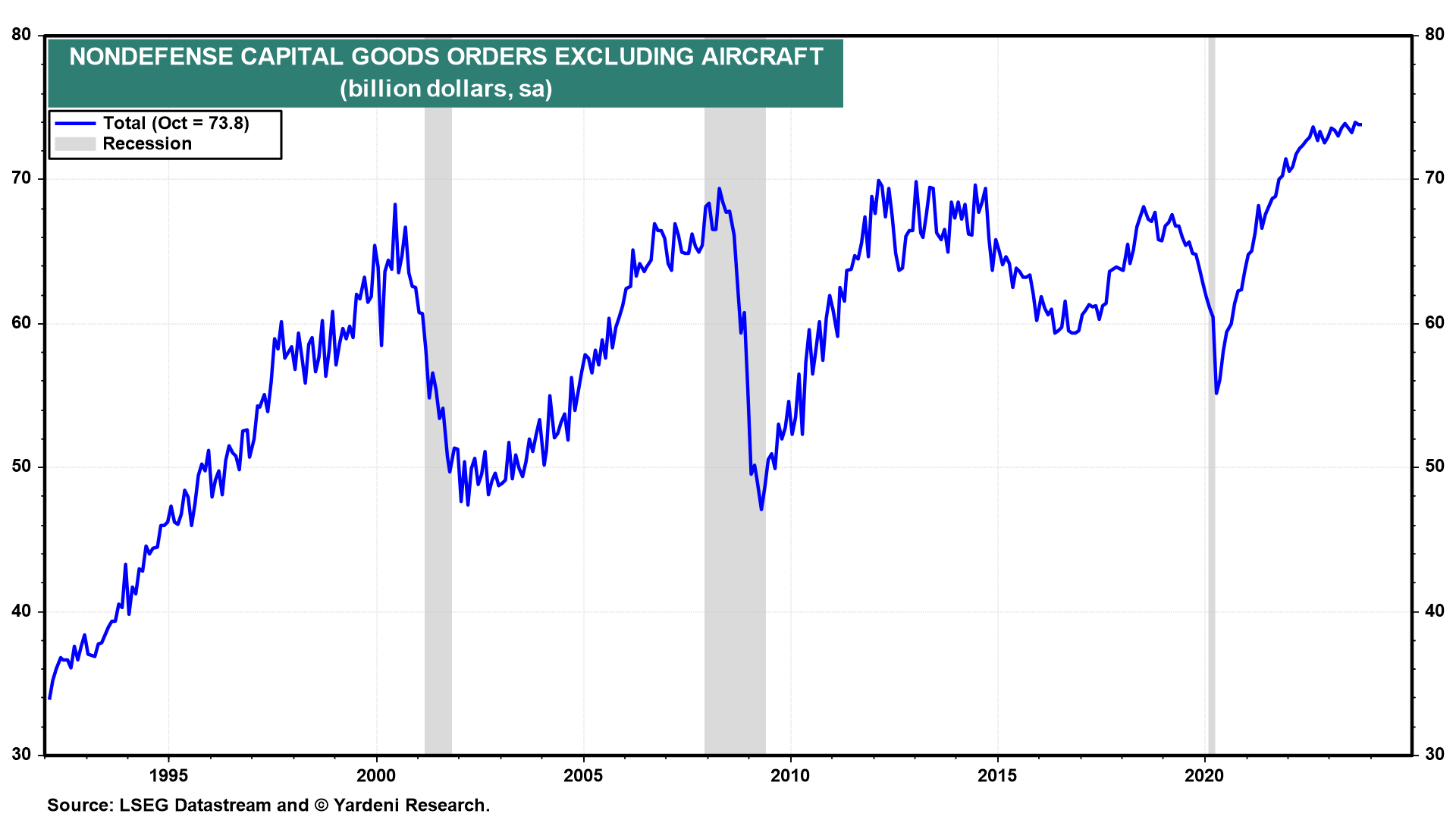

Also out today was October's nondefense capital goods orders which has been zigzagging to new record highs all year (chart). It edged down 0.1% m/m in October, which isn't bad considering the depressing impact of the autoworkers' strike.