President Donald Trump invoked his inner President Ronald Reagan today in a virtual speech at the World Economic Forum in Davos, Switzerland. But his asks amounted to a taller order than just "tear down this wall." During his address, Trump demanded lower interest rates (not just in the US, but globally), called on OPEC to lower oil prices, and urged that the Russia-Ukraine war must end as soon as possible. He also warned that foreign companies either produce in America or pay tariffs.

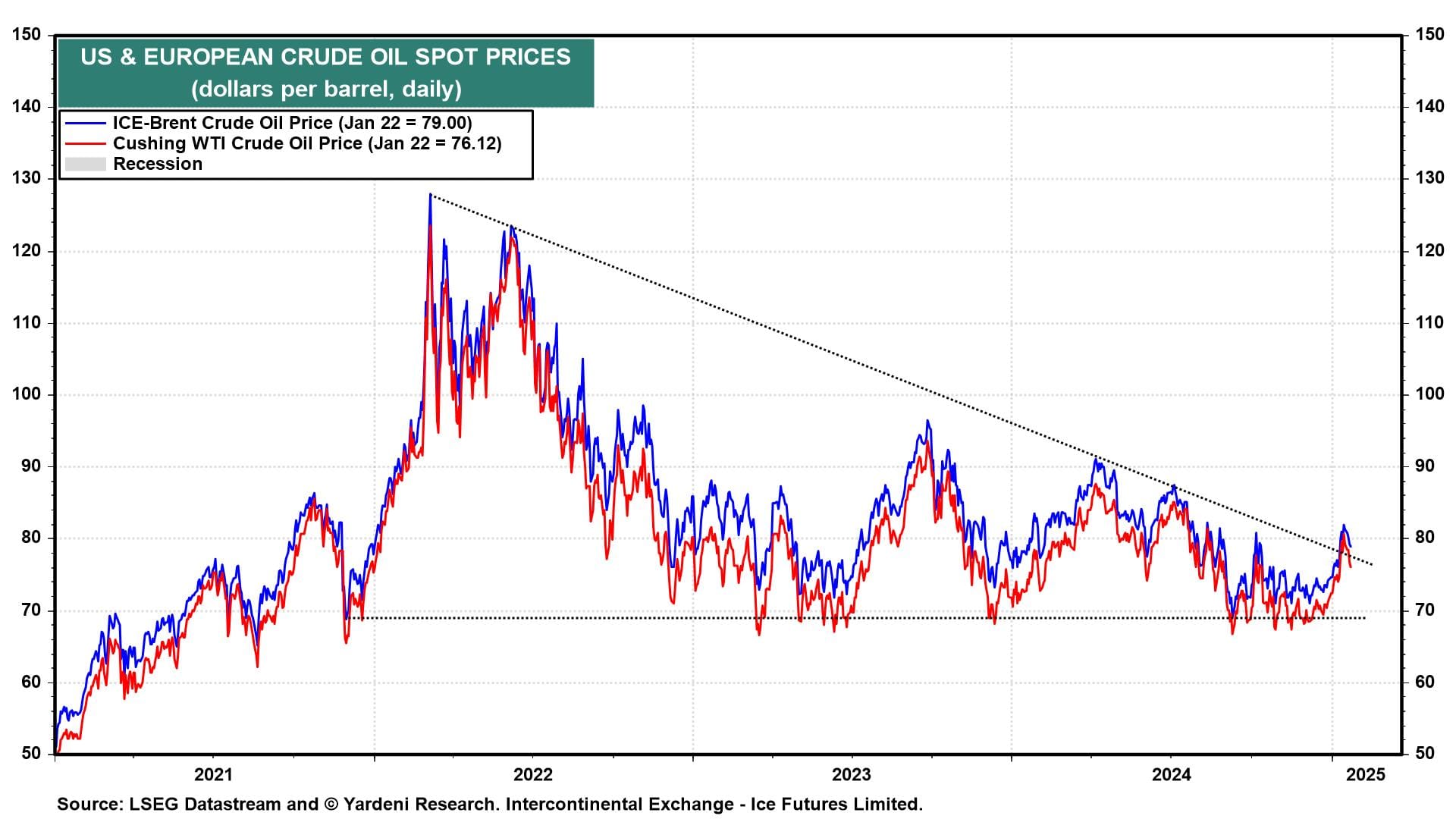

During Trump 1.0, the President also demanded that the Fed lower interest rates. Perhaps it gives dovish Fed Governor Christopher Waller a bump in his shadow campaign for Fed Chair, 2026. The stock market took the comments in stride, as the S&P 500 reached a new record high of 6,118. But the biggest impact of Trump 2.0 so far has been in the oil market. A barrel of WTI crude is down from $80 on January 15 to $75 today, erasing its gains from the Biden administration's last-minute added sanctions on Russia (chart). We think there's room for crude prices to fall further.

Shifting from Davos to the US, today's economic data were positive on balance. Here's more:

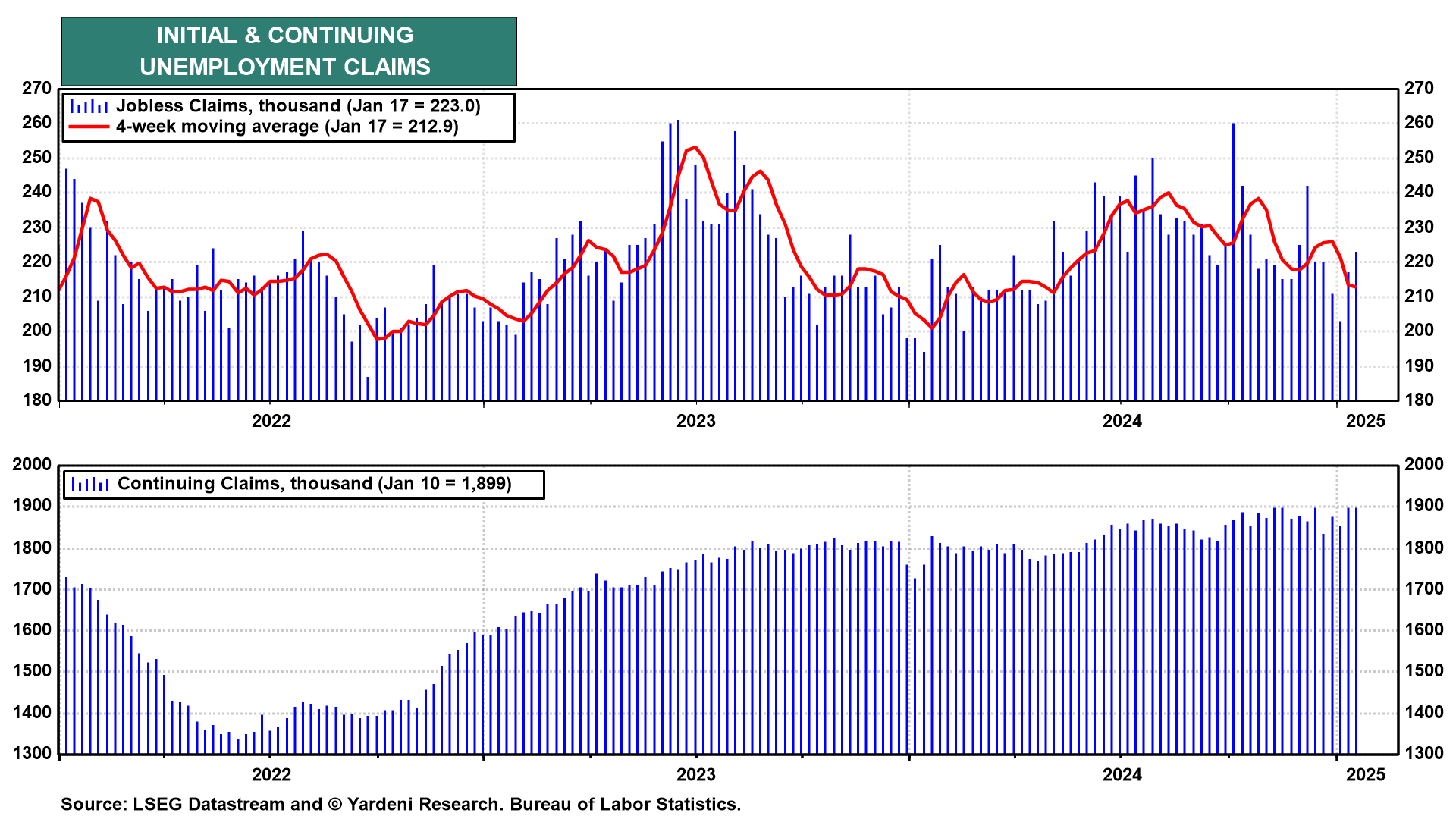

(1) Unemployment claims. Initial jobless claims remained low last week, increasing by 6,000 to 223,000 (chart). Continuing claims edged up to their highest level since 2021, which grabbed some headlines.

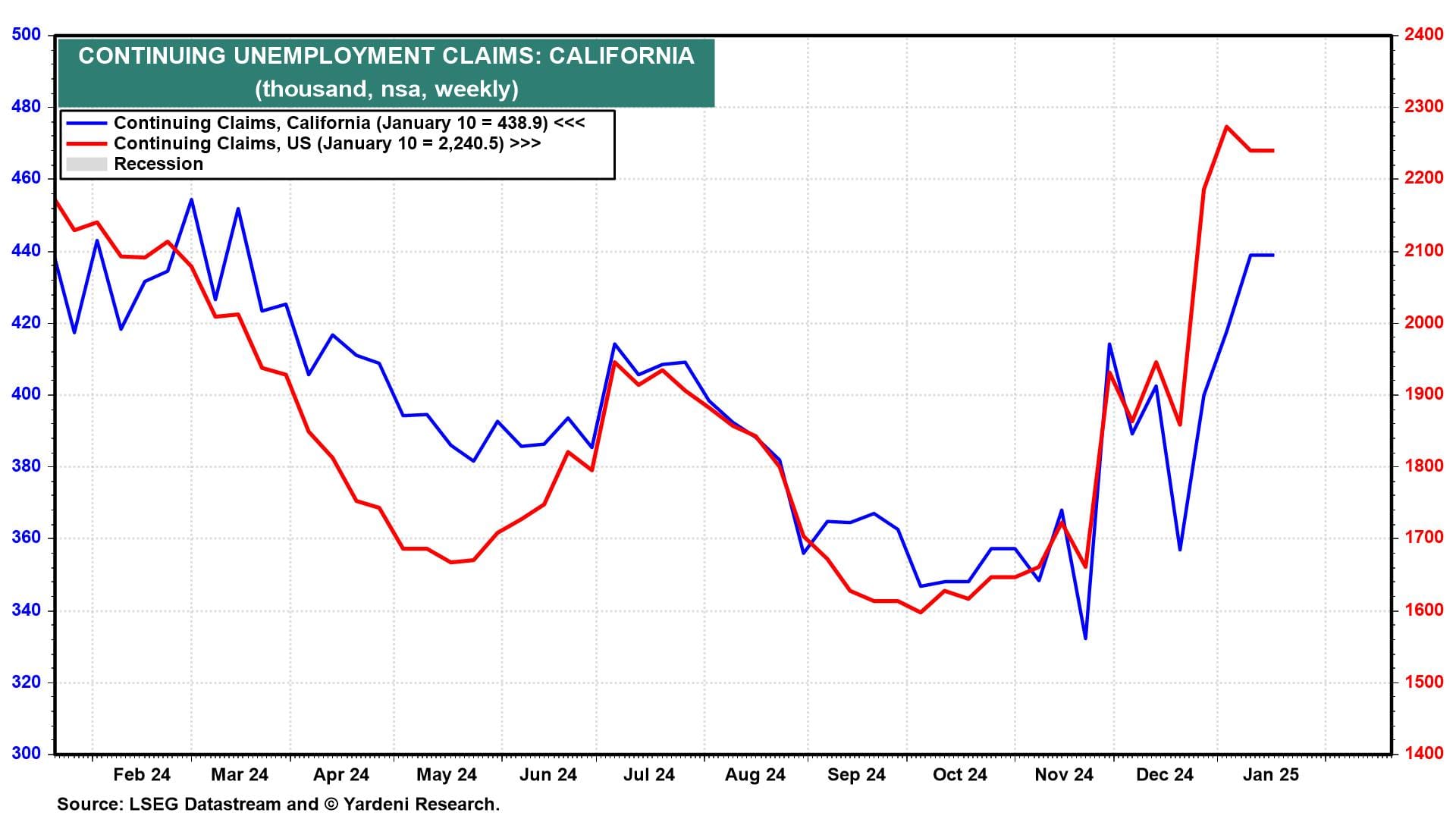

While continuing claims rose by 46,000 to 1,899,000 (sa), on a non-seasonally adjusted basis they fell 32,804. The jump in seasonally adjusted claims appears to be caused by the fires in California, where they rose 25,613 (nsa) and were by far the largest state increase (chart). It's likely that continuing claims increase next week as the period captures more of the fires' impact.

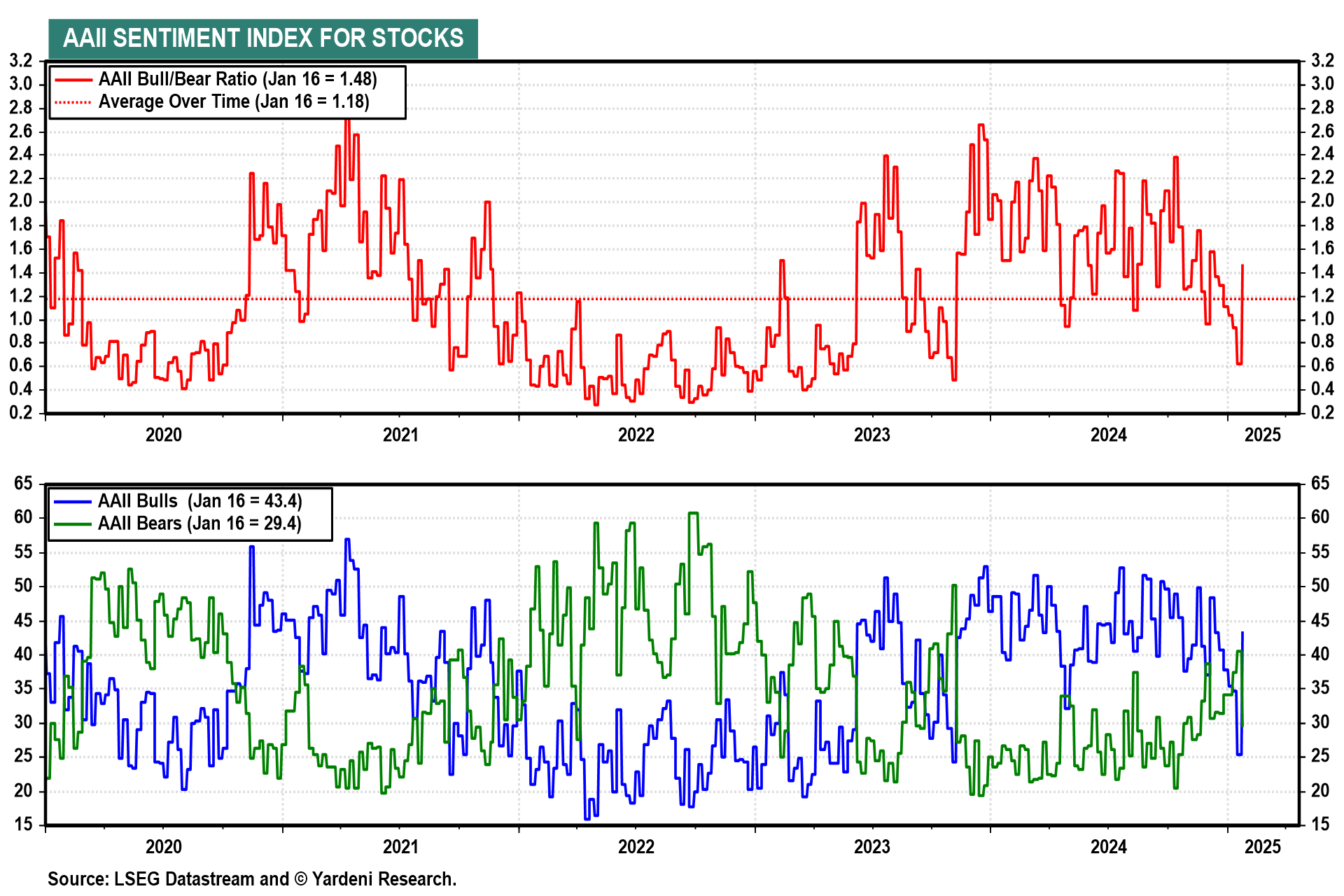

(2) Sentiment. Bulls in the AAII sentiment survey jumped by 18 points, from 25.4% to 43.4%, for the week ended Wednesday (chart). That was the largest weekly increase since November 2023.

Better-than-expected earnings from US banks and the lack of Day 1 tariffs from President Trump likely restoked animal spirits. Analysts have raised their Q4-2024 earnings growth expectations from 8.2% to 9.1% y/y. We raised our estimate from 10.0% to 12.0%.

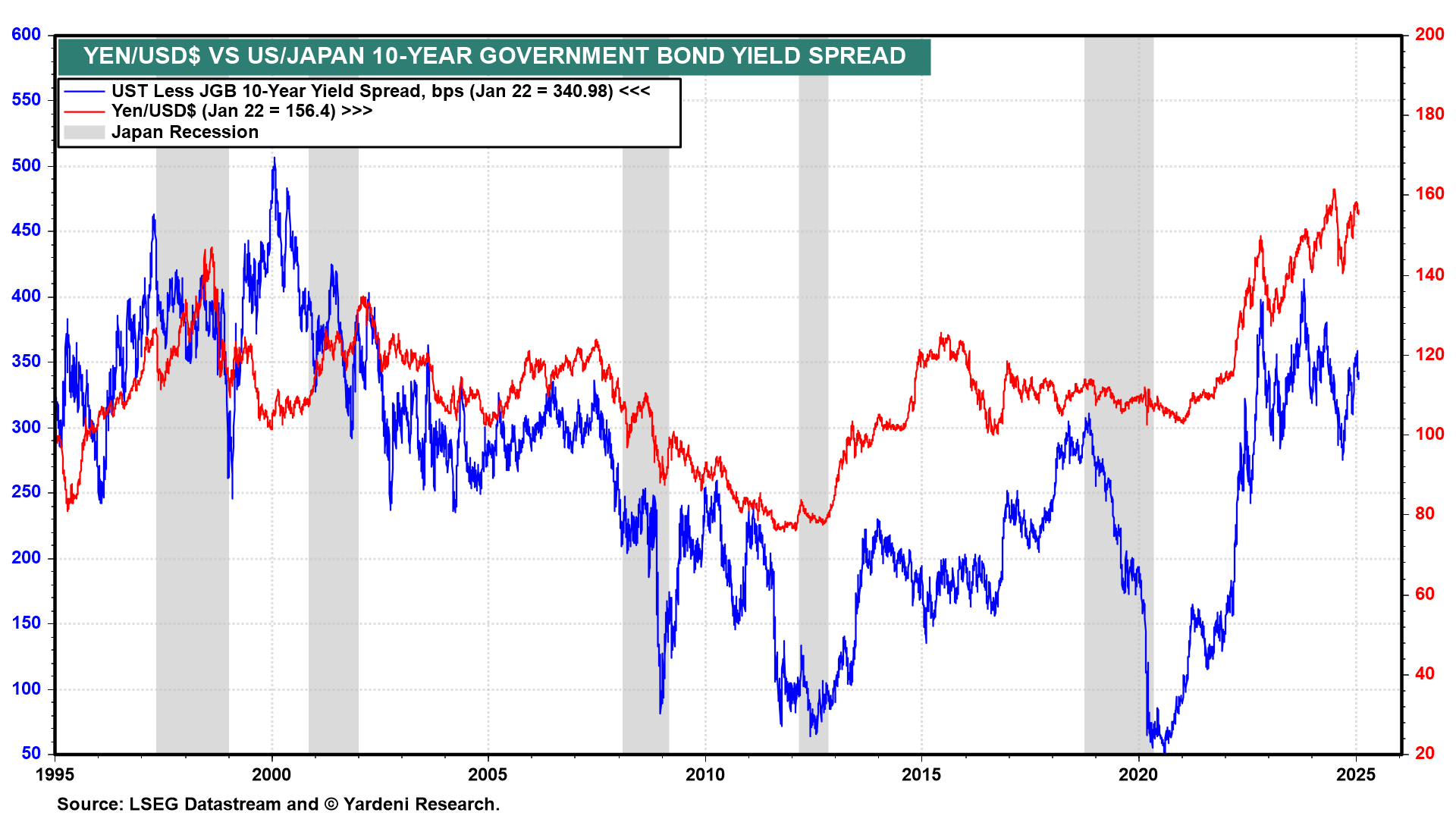

(3) Japan. The BOJ is expected to raise its policy rate by 25bps to 0.50% on Friday. This would be the first hike since July 2024, when the unwind of the yen carry trade spooked markets. Most of the focus will be on Governor Kazuo Ueda's rhetoric around potential US tariffs and elevated wage inflation. The yen has already weakened 11% against the dollar since its recent strongpoint of 140.6 yen/dollar on September 15. That was just before the Fed cut the federal funds rate (FFR) by 50bps.

FFR cuts tend to shrink the differential between Japanese and US rates, leading to a stronger yen (chart). However, strong US growth and easy Fed policy have boosted long-term Treasury yields. So despite the 10-year Japanese government bond yield trading at a multi-decade high of 1.21%, the yen has weakened in recent months because US yields have increased by about 100bps since mid-September 2024.