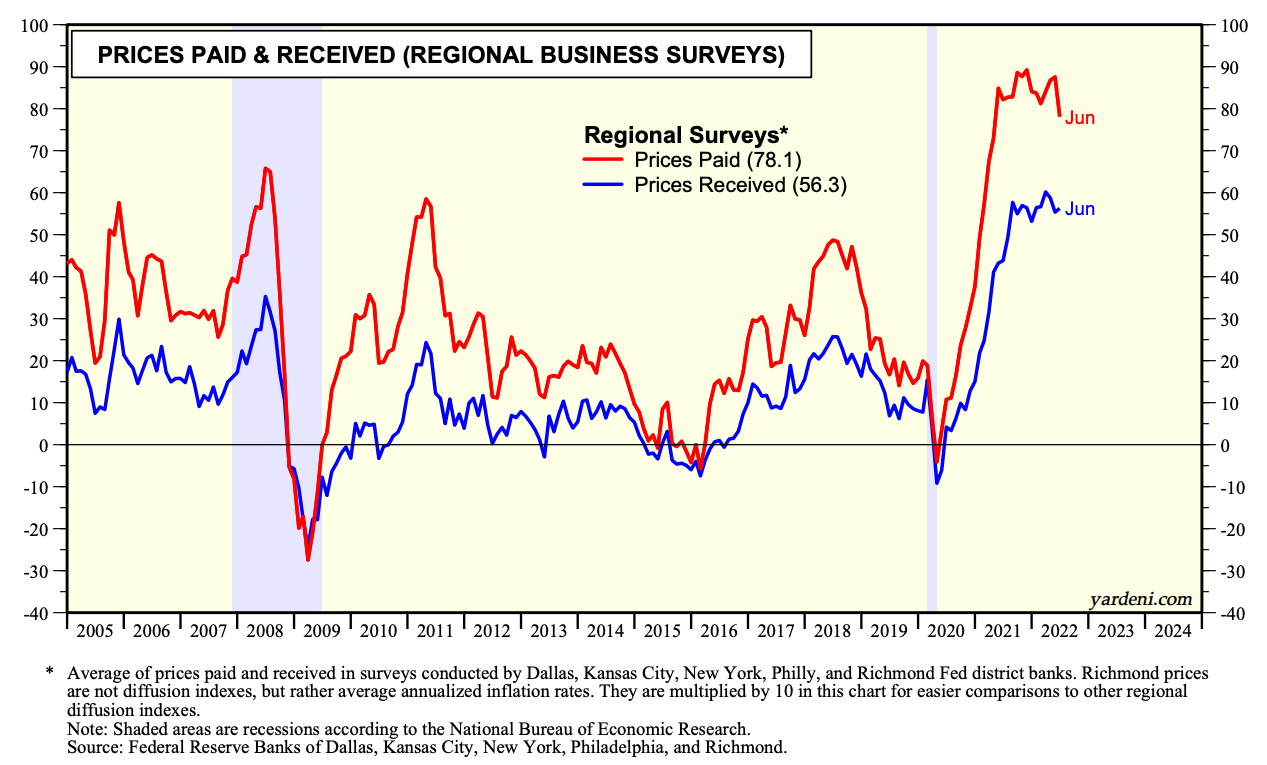

June's surveys of five of the 12 district Federal Reserve Banks strongly suggest that supply-chain disruptions have eased significantly in recent months. However, that has yet to relieve inflationary pressures according to the surveys.

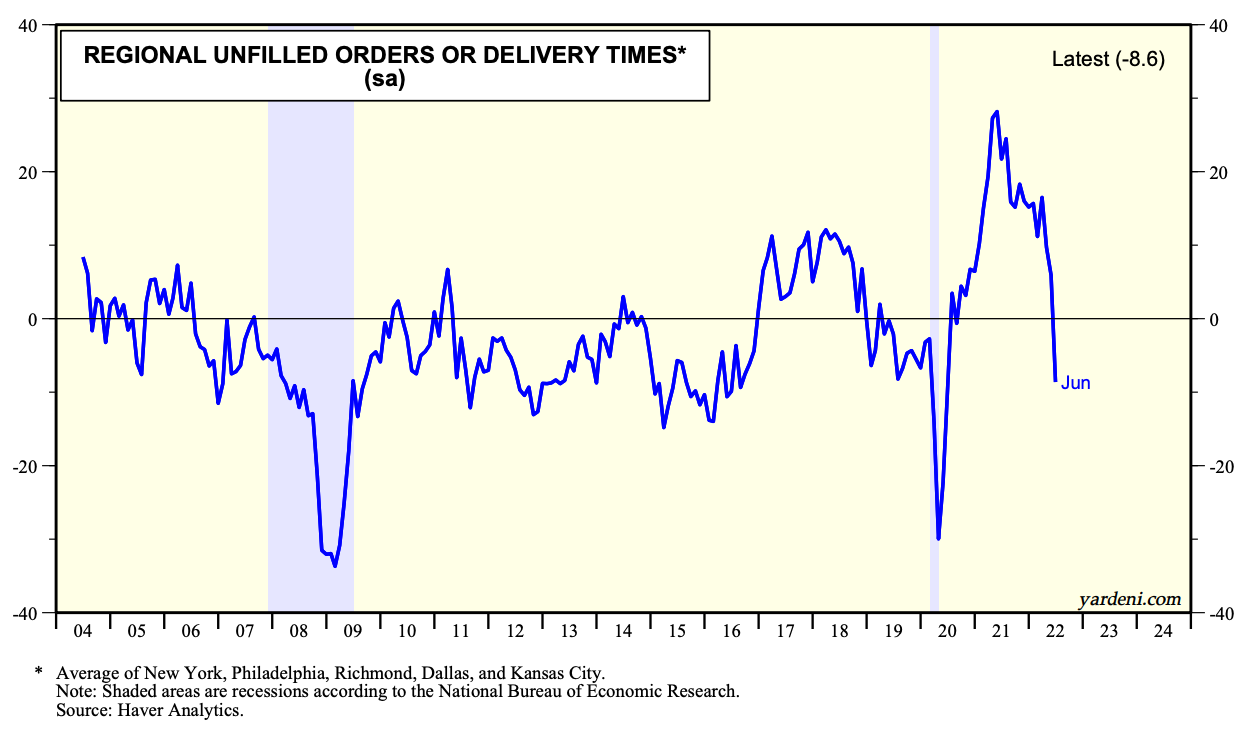

The question is whether the drops in regional indexes tracking unfilled orders and delivery times during the first half of this year reflect more ample supplies or diminishing demand. Presumably, if demand is taking a dive, so should the regional prices-paid and prices-received indexes, which have remained elevated over the past 12 months through June (charts below).

It's a puzzle that most likely will be resolved during the second half of this year. We are expecting that fewer supply-chain issues combined with some slowing in the demand for goods will push inflation lower over the remainder of the year. Leading the way down should be inflation of durable goods. Offsetting some of the improvement is likely to be rent inflation, which should continue to heat up.