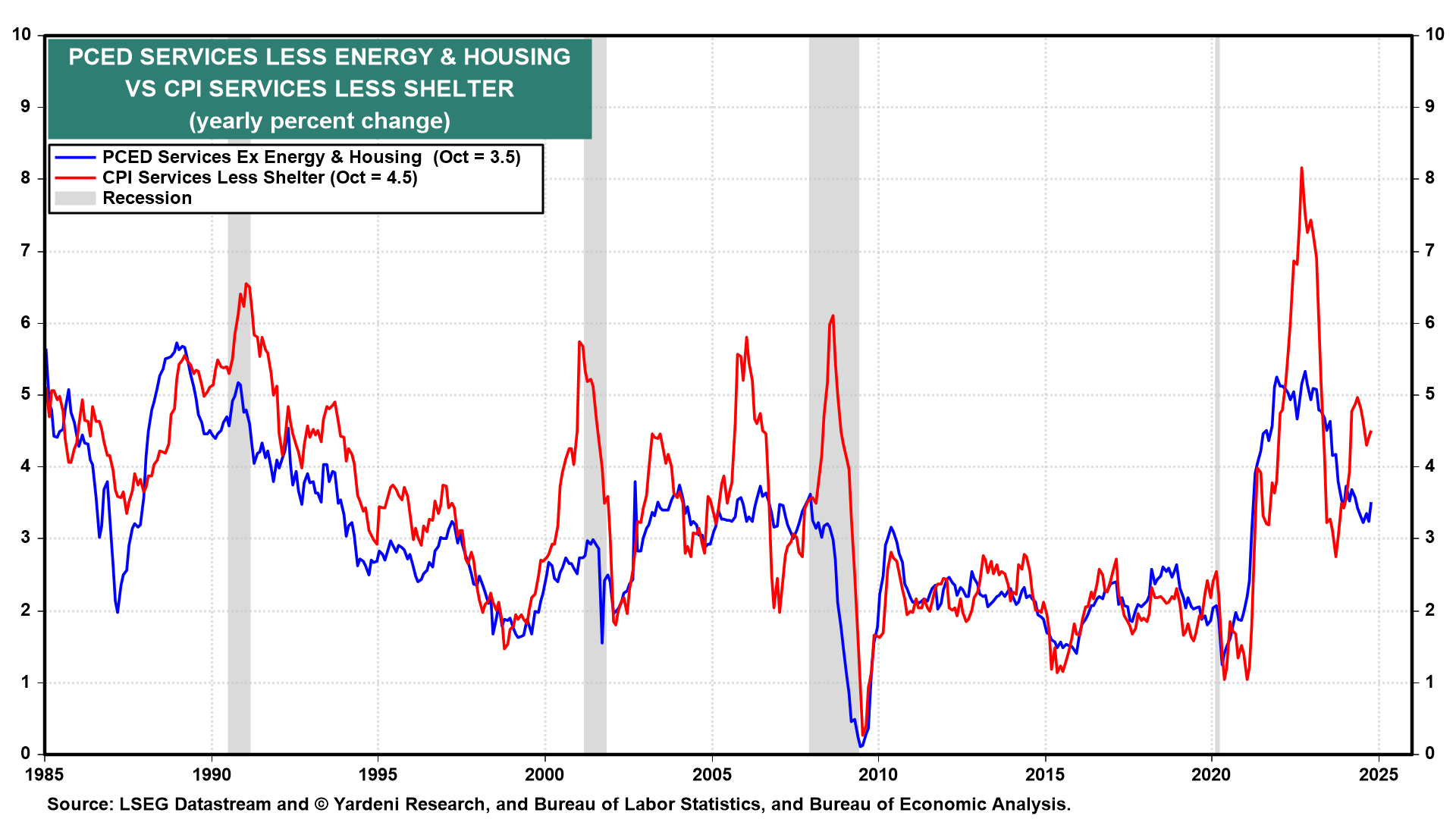

The stock market appeared calm ahead of tomorrow's November CPI report, which is likely to show that supercore inflation (i.e., CPI services less shelter) remains stuck around 4.5% (chart).

However, there was plenty of action just below the surface of the stock market's calm. Oracle dropped 6.7% on disappointing earnings results. Google rallied 5.3% on a new state-of-the-art chip "Willow," which promises to be a quantum leap in quantum computing. It reportedly outpaces today's supercomputers by several orders of magnitude. To us, this is the latest evolution of the Digital Revolution, which is all about data processing, i.e., processing more and more data, faster and faster. AI is likewise an evolutionary technology in the Digital Revolution.

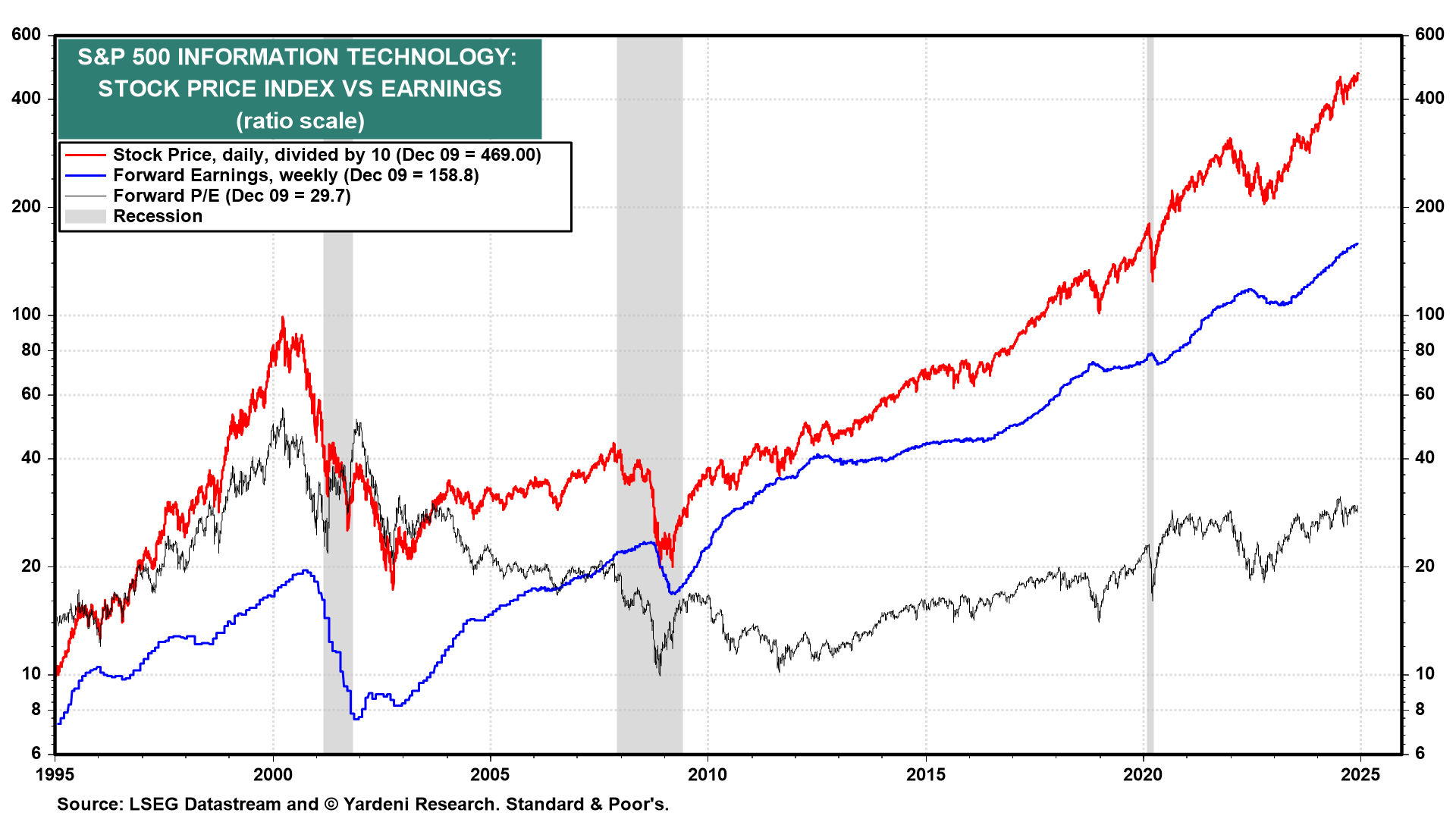

Tech companies continue to find ways to accelerate the pace and volume of processing data. As a result, the forward earnings per share of the S&P 500 Information Technology sector and its stock price index continue rising in record high territory (chart).

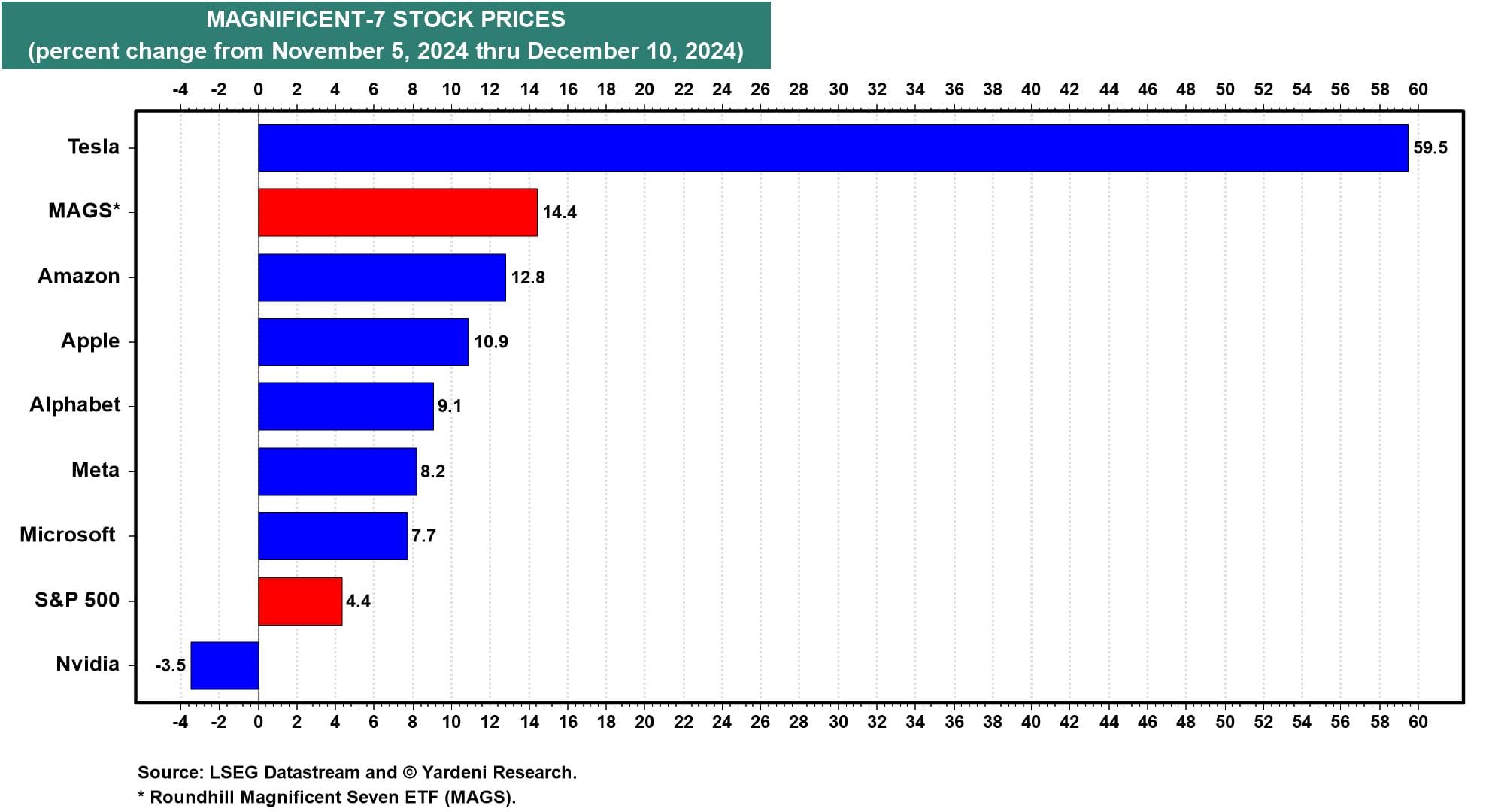

Tesla is a tech company that makes cars. It was up another 2.9% today to extend its post-election rally to 59.5% (chart). Much of the recent exuberance stems from Elon Musk's bromance with President Trump. That said, US and EU tariffs on China's EV exports are just one tangible outcome that should support its growth expectations (chart). Because Tesla can remotely update its fleet's software, its ability to scale and grow are more similar to the other tech companies in the Magnificent-7 than an auto manufacturer.