On Sunday (April 20), we observed that The Economist had just featured three consecutive very bearish cover stories suggesting that the dollar might be on the verge of collapse and that so might the US stock and bond markets along with the US economy. Make that four consecutive bearish cover stories, with this week's magazine showing an eagle battered by Trump's first 100 days (image). We repeat our conclusion from a week ago: Contrarians of the world, unite! Now, we would add that our Roaring 2020s scenario might be back on track soon.

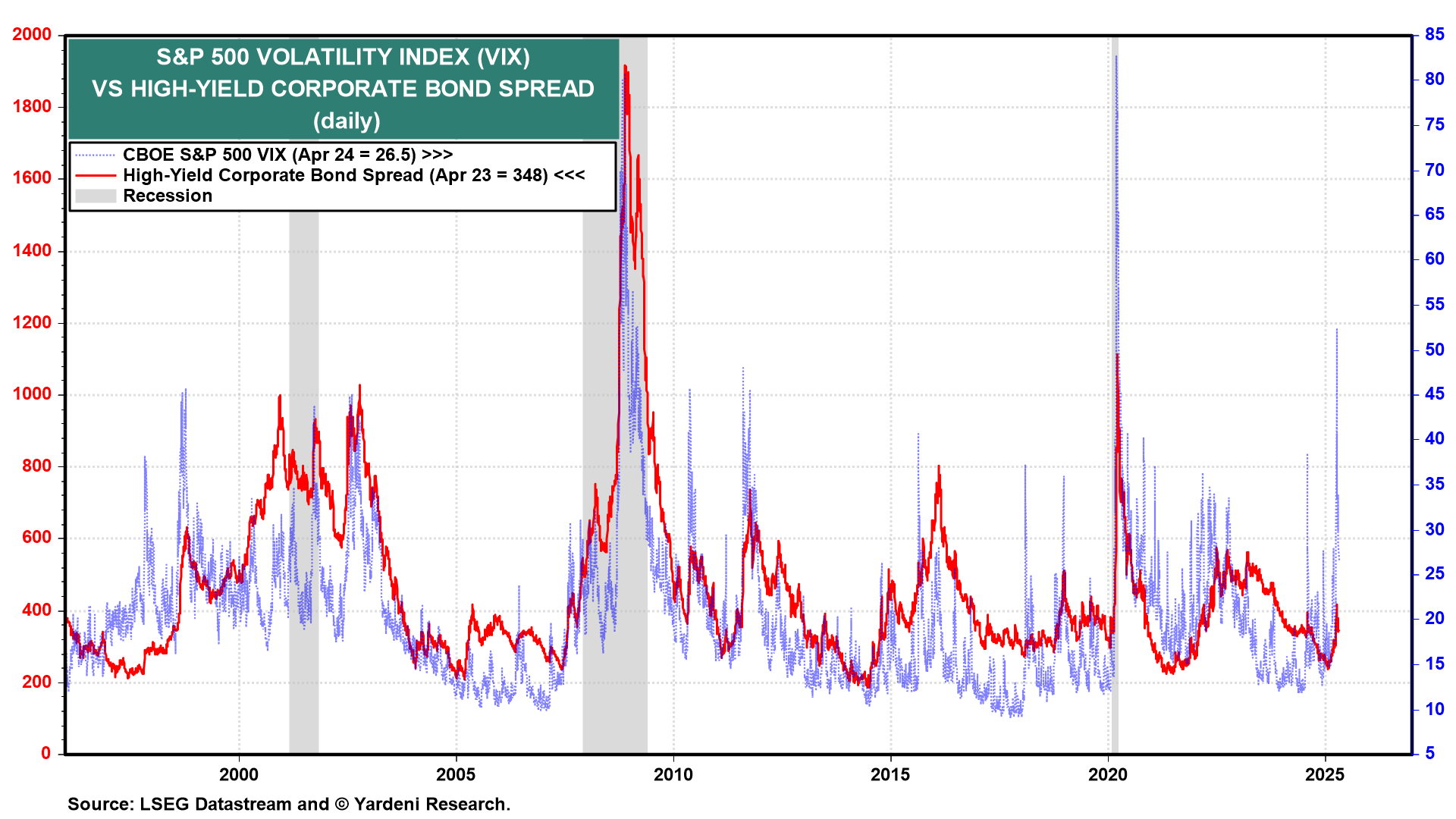

The S&P 500 is up more than 7% from its Monday lows, the VIX is back below 28, and the high-yield corporate bond spread is down from 461bps a few weeks ago to 348bps (chart). The 10-year Treasury yield also fell 7bps today after Cleveland Fed President Beth Hammack told CNBC that the Fed could cut interest rates if the data deteriorated by the FOMC's June meeting. We still doubt that will happen.

Meanwhile, Treasury Secretary Scott Bessent is increasingly taking on more economic and trade responsibilities. Investors believe he is more like one of us given his hedge fund career. We think trade deals will need to be inked soon for the stock market to sustain its current bounce. We still believe that the latest correction in the S&P 500 bottomed on April 8, a day before Trump basically postponed "Liberation Day."

In the meantime, here's a look at the latest on US consumers, who continue to consume: