In the past, the major foreign central banks often followed the Fed's lead. This time, they aren't waiting for the Fed to ease before doing so themselves. That's boosting the foreign exchange value of the dollar as well as many overseas stock markets. Consider the following:

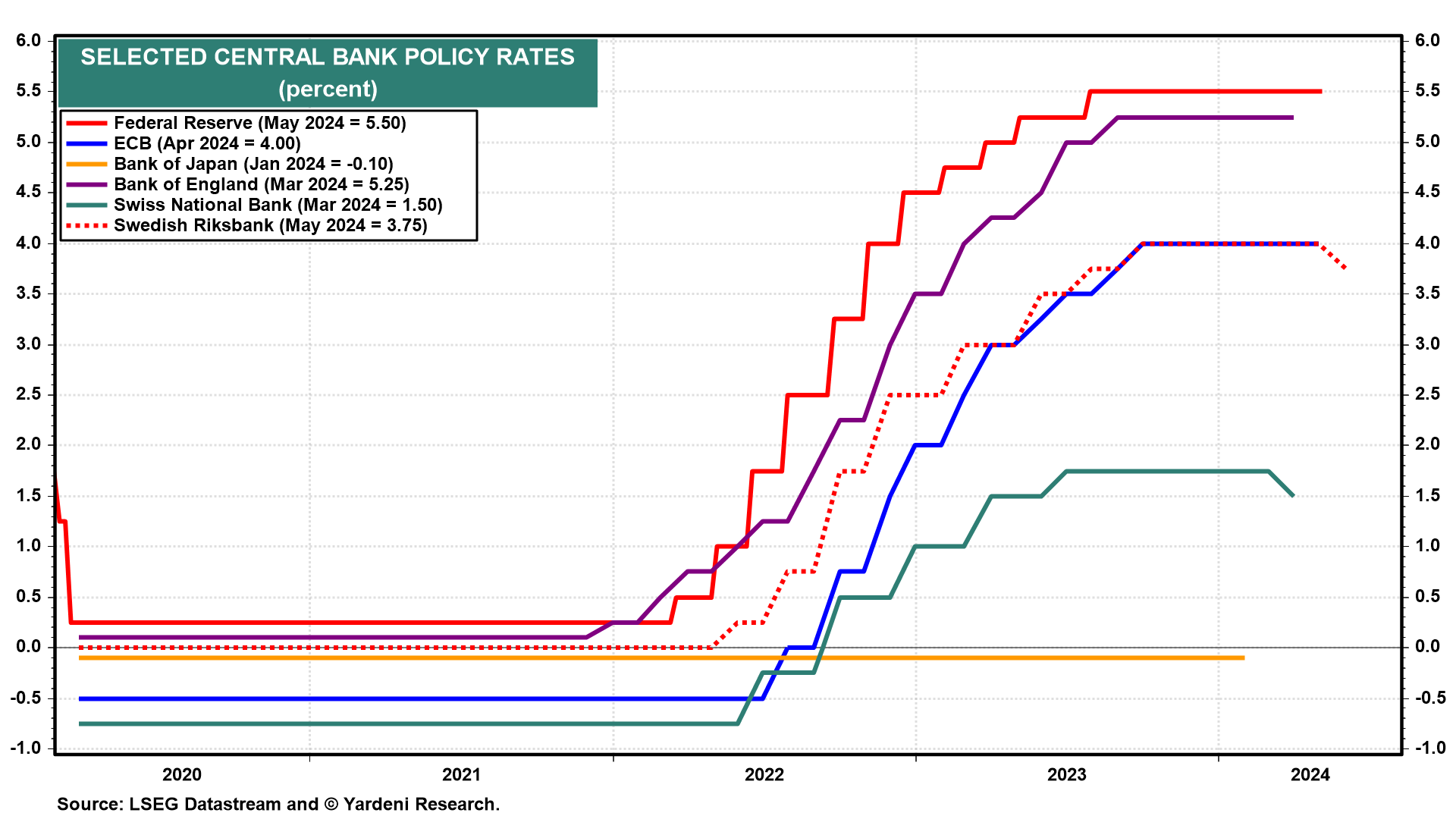

(1) The Swedish Riksbank cut its official rate by a quarter-point today, to 3.75% from 4.00%, projecting two more cuts in the back half of this year should inflation continue to moderate in Sweden (chart). We expect that the Swedish central bank and the Swiss one (that cut in March) will be joined by their counterparts soon, too. While the ECB stood pat Tuesday and the Bank of England is likely to do the same on Thursday, there’s a decent chance both will cut in June.

(2) The major global central banks’ shift into an easing stance (excluding Japan) while the Fed holds rates higher-for-longer should continue to boost the dollar (chart). DXY has been trending higher since the Great Financial Crisis with higher highs and higher lows.