DeepSeek took a bite out of semiconductor, other tech, as well as nuclear power stocks today. Many of these AI plays dropped by double-digit percentage points, and Nvidia fell 17%. Other than the impact of the largest US stock nearly entering a bear market in one day, plus some collateral damage in other large stocks, the broader market held up just fine. The S&P 500 fell less than 1.5%, the Dow rose 0.7%, and the CBOE volatility index (VIX) finished the day at a historically low 18.0.

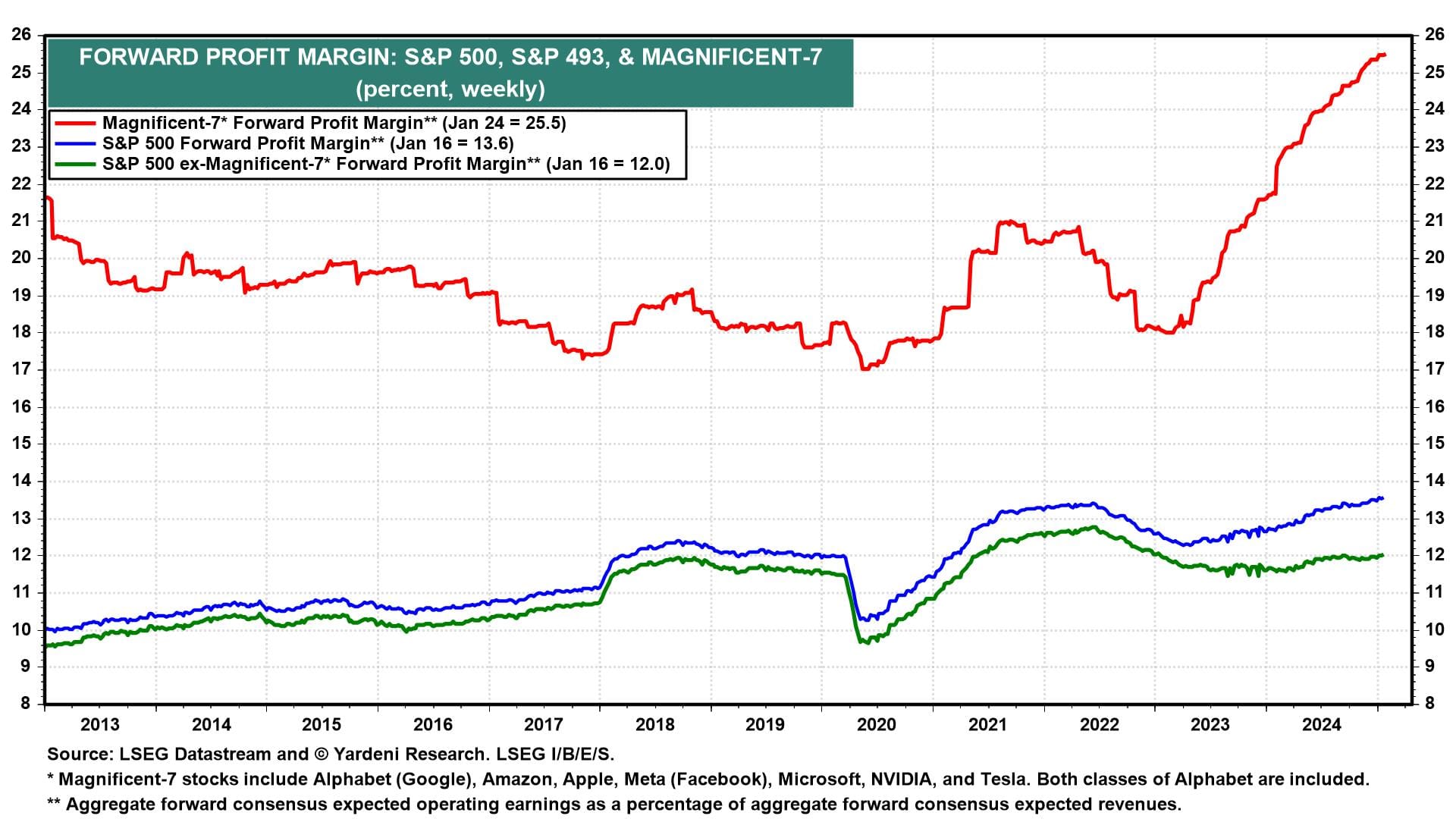

There's still plenty of uncertainty over what the true demand for state-of-the-art chips, semiconductor fabrication plants, and energy will be. Earnings conference calls this week from Microsoft, Meta, Tesla, ASML (all Wed), and AAPL (Fri) may provide more clarity on what DeepSeek means for big tech. They may signal that cheaper AI spending will help cut costs and therefore maintain their collective profit margin of 25.5% (chart). Meanwhile, other companies in the S&P 500 may be able to boost their profit margins thanks to cheaper and quicker implementation of AI.

We’ve been favoring the S&P 493 as a cheaper way to play AI and its positive impact on productivity and profits margins than the Magnificent-7. So we were pleased by today’s action. The market absorbed a significant body blow to Nvidia remarkably well. We don’t think that Nvidia is down for the count. Indeed, the company’s statement praised DeepSeek’s breakthrough and noted that it would create more work for its GPUs.

As of now, we're in the camp that says cheaper AI is a good thing for the US economy and stock market. Here's more on today's action: