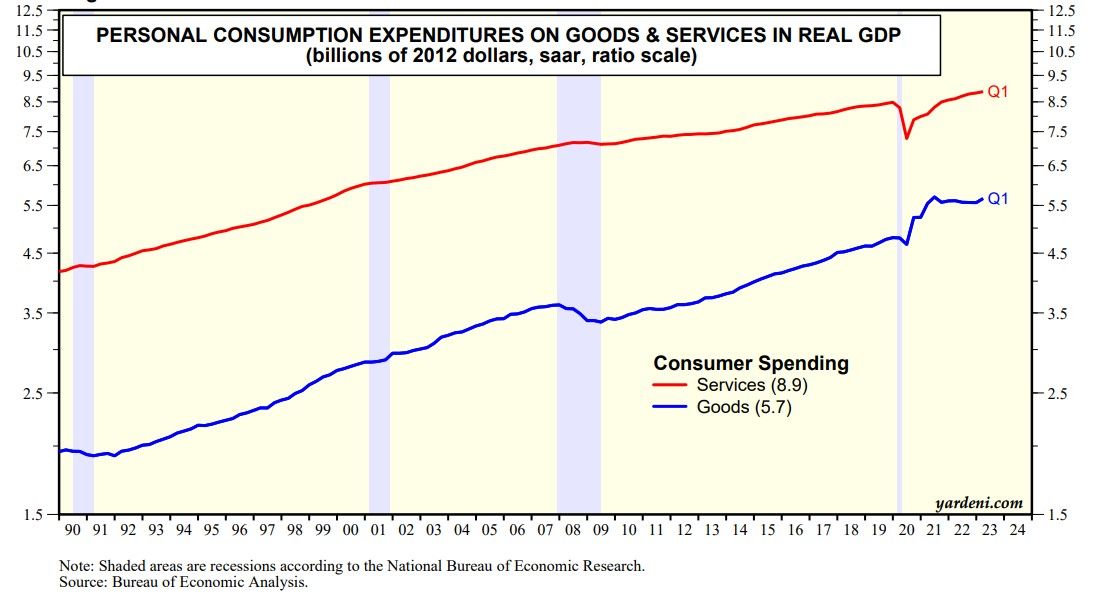

The widely anticipated recession is still MIA. That's one reason why stocks have rebounded smartly since October 12, 2022, which was the end of the latest bear market in our opinion. It's hard to have a recession when consumer incomes are rising and they are spending more on both goods and services (chart). Inflation-adjusted incomes are rising because employment gains remain solid. Just as important is that wages have been increasing faster than prices in recent months, which may be a sign that productivity may be making a comeback after getting clobbered by the pandemic.

Consider the following:

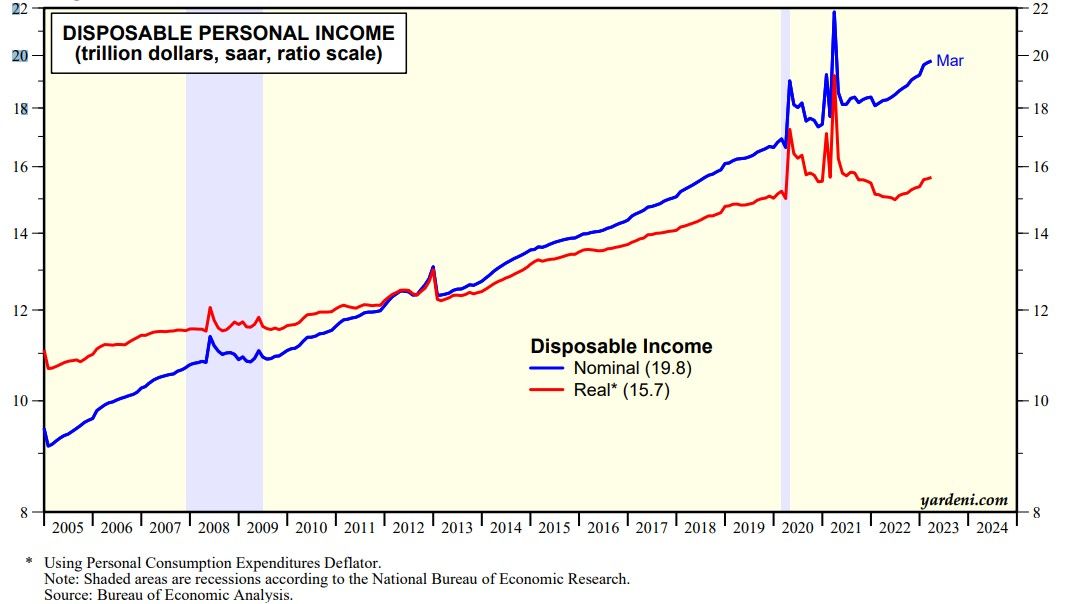

(1) Nominal disposable personal income (DPI) is at a record high excluding the 2020 and 2021 spikes attributable to the three rounds of pandemic relief checks (chart). More significantly, inflation-adjusted DPI has been rising since mid-2022 (chart). Real DPI was falling during the second half of 2021 and the first half of 2022 as inflation raged. Consumers continued spending nonetheless thanks to their excess savings accumulated during the pandemic. They are likely to run out of excess savings by the end of this year, but rising real disposable income should keep them spending.