Go figure: Stocks & bonds sold off on Tuesday following a hotter-than-expected Q1 Employment Cost Index (ECI). It was up 5.4% q/q (saar) and 4.1% y/y. Today, they both rallied despite a hot Q1 unit labor costs inflation report. We agree with the markets' response to today's news because it is consistent with our view that inflation is still moderating when measured on a y/y basis.

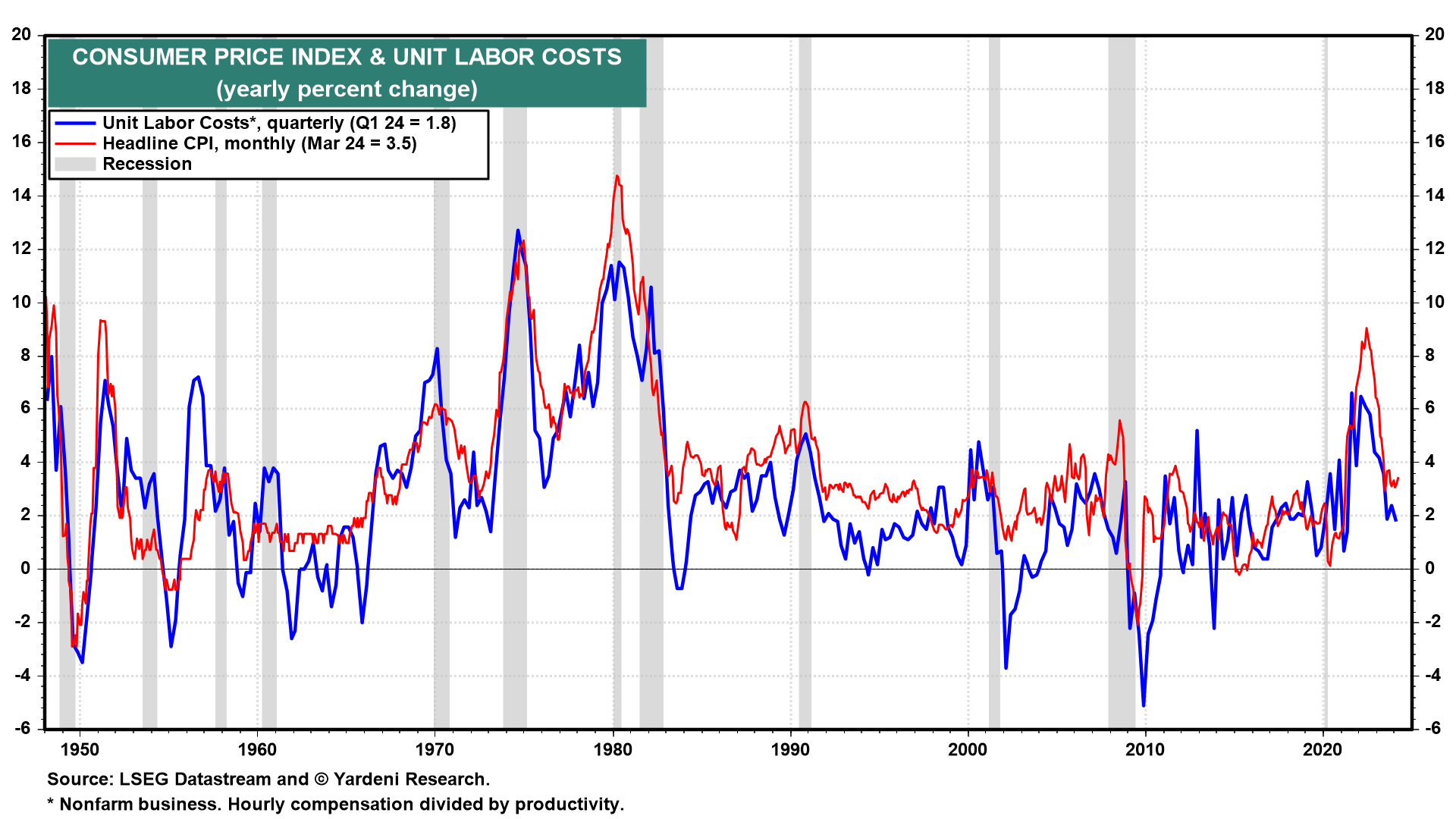

Unit labor costs (ULC) is simply hourly compensation divided by productivity. It is the most important measure of the underlying inflation rate in the labor market and is highly correlated with the CPI inflation rate when both are measured on a y/y basis (chart). ULC inflation was actually down to 1.8% y/y during Q1, suggesting that consumer price inflation could fall to 2.0% in coming months.

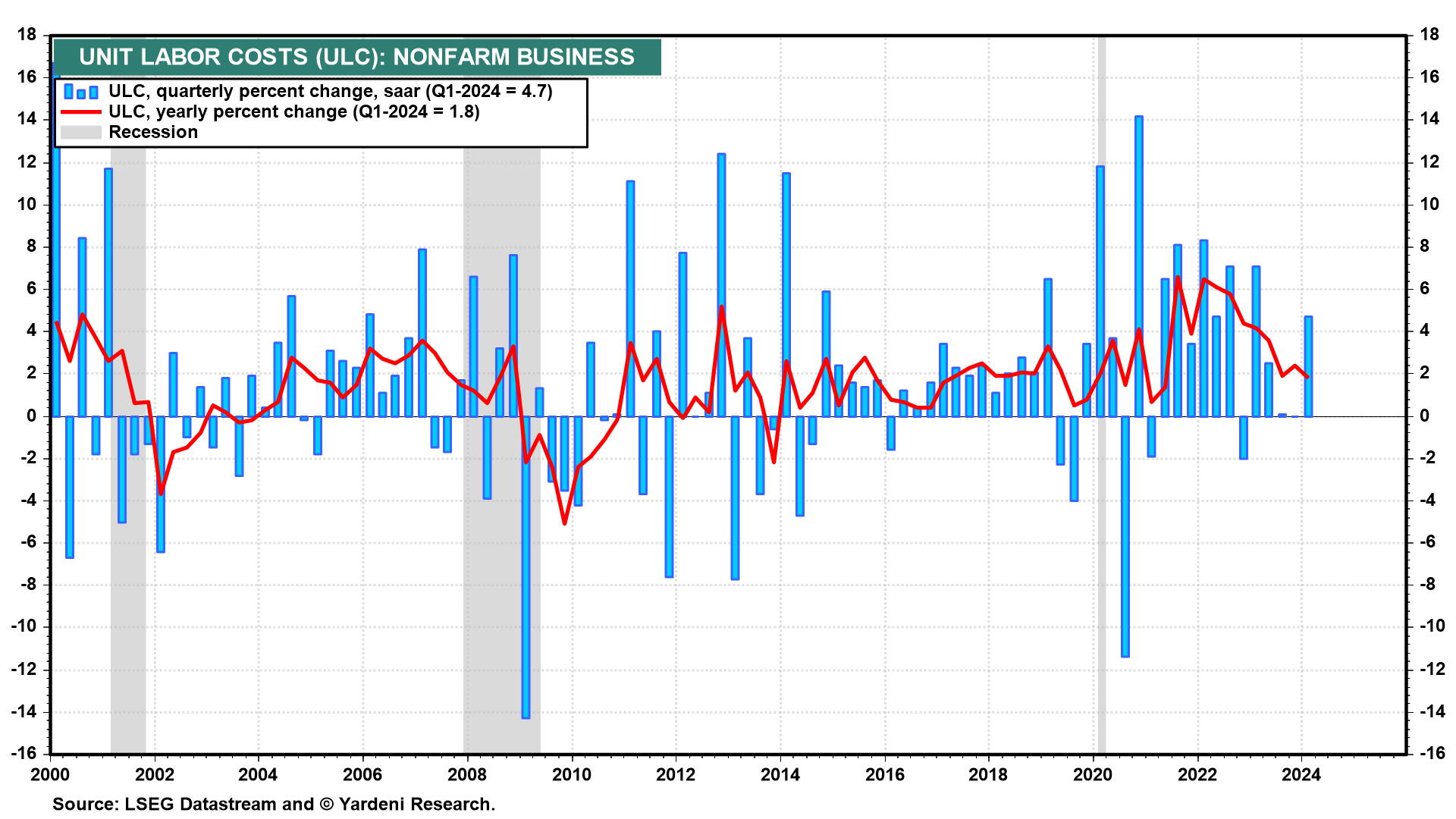

This happened even though the ULC inflation rate jumped 4.7% q/q (saar) during Q1 (chart). The q/q series is very volatile, so the y/y series makes more sense to us.

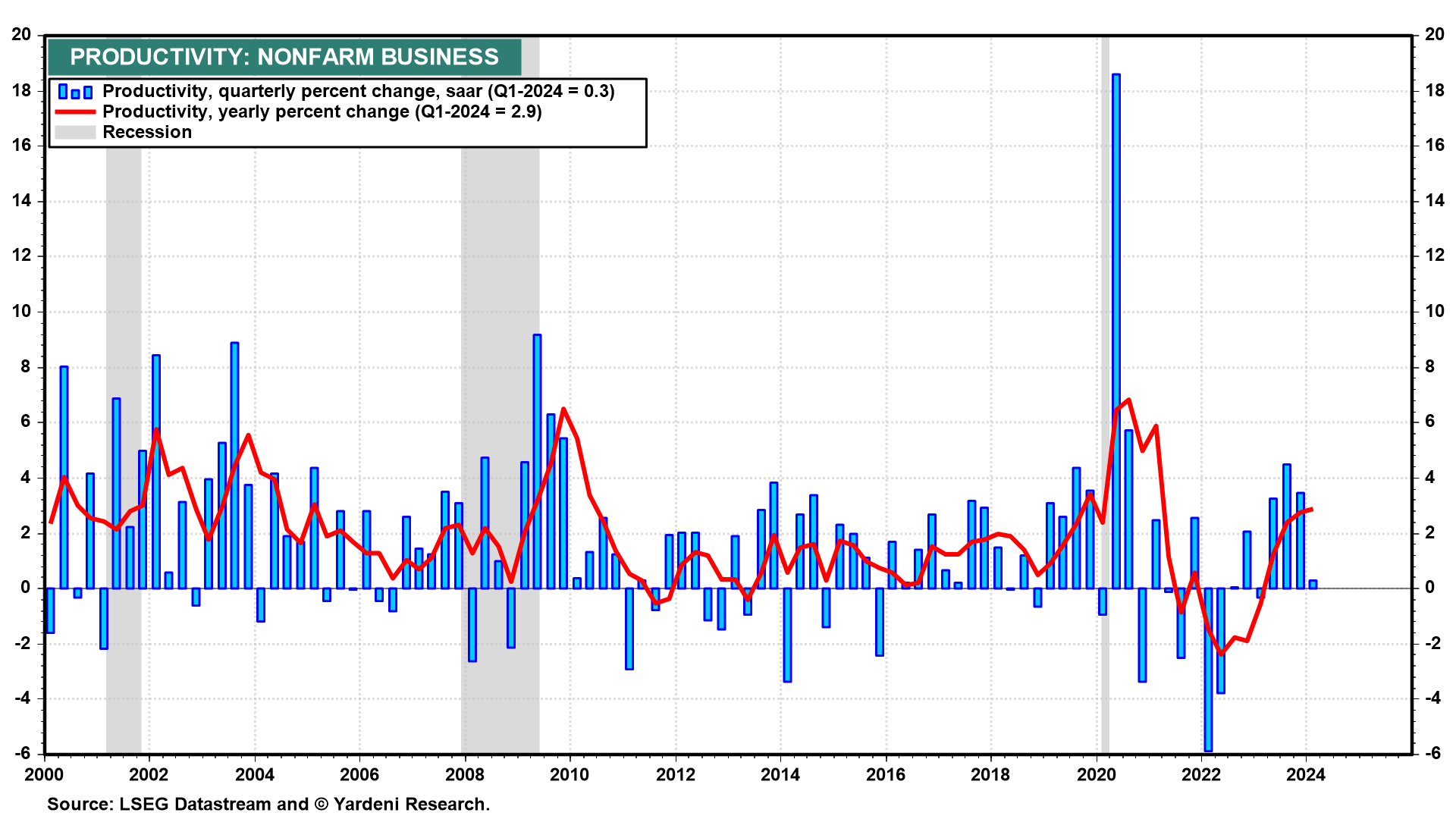

The same can be said about productivity. It was very weak on a q/q basis at an annual rate of only 0.3% (chart). But the y/y comparison shows a solid 2.9% increase.

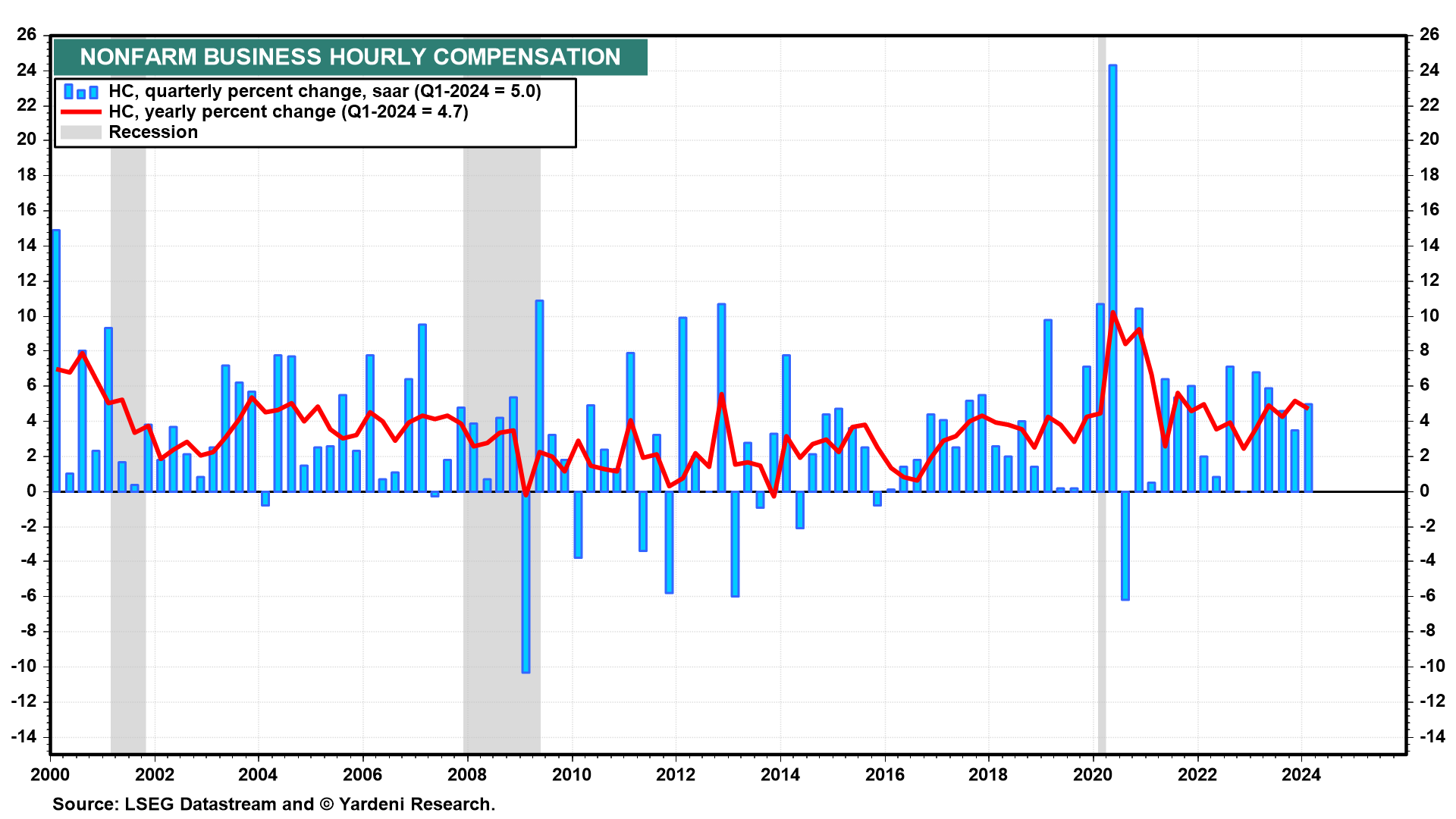

Along with productivity, the Bureau of Labor Statistics reports hourly compensation, which is a broader measure of hourly labor income than the ECI (chart). The former was down a bit compared to the ECI on a q/q basis (5.0%) and up a bit more on a y/y basis (4.7%).

Our bottom line: The markets' responses to today's inflation news makes more sense to us than they did on Tuesday. That's because we think that inflation remains on a moderating course toward the Fed's 2.0% target by the end of the year.