Investors had a quick look at today's economic indicators and concluded that the economy is still growing albeit slowly while inflation is continuing to moderate. The FOMC's next meeting is at the end of July. By then, the committee might conclude that the federal funds rate, currently still at 5.00%-5.25%, might be restrictive enough to get the inflation rate close to 2.0% by 2025 as they projected in their latest Summary of Economic Projections (SEP) released after yesterday's FOMC meeting. Today's stats are consistent with their (and our) soft-landing-with-disinflation scenario (SLWD):

(1) Employment. The job market may finally be cooling off. This morning's seasonally adjusted 262,000 jobless claims was unchanged from the previous week's revised figure. The latest reading came in above the forecast of 250,000. Initial claims remain at their highest level since October 2021, but still consistent with slower employment growth.

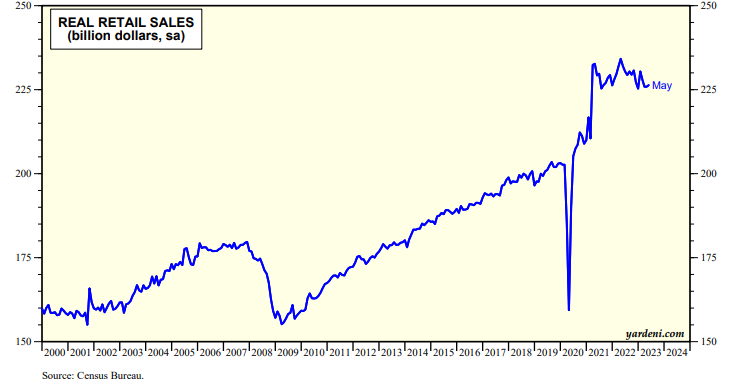

(2) Retail Sales. Retail sales at stores, online, and in restaurants grew 0.3% m/m in May. That’s above economists’ expectations of a 0.1% decline, according to Refinitiv. Inflation-adjusted retail sales has stalled in record high territory since late 2021 as consumers pivoted to buying more services (chart).

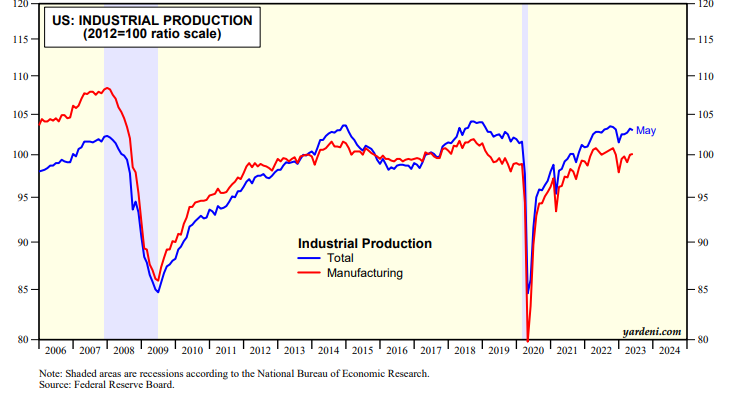

(3) Industrial production. Industrial production declined 0.2% m/m in May after rising the two prior months, pulled down by falling mining and utilities output. Manufacturing, the bulk of industrial output, gained 0.1%, after rising 0.9% in April (chart). Motor vehicles and parts output edged up 0.2% in May, following a nearly 10% rise in April.