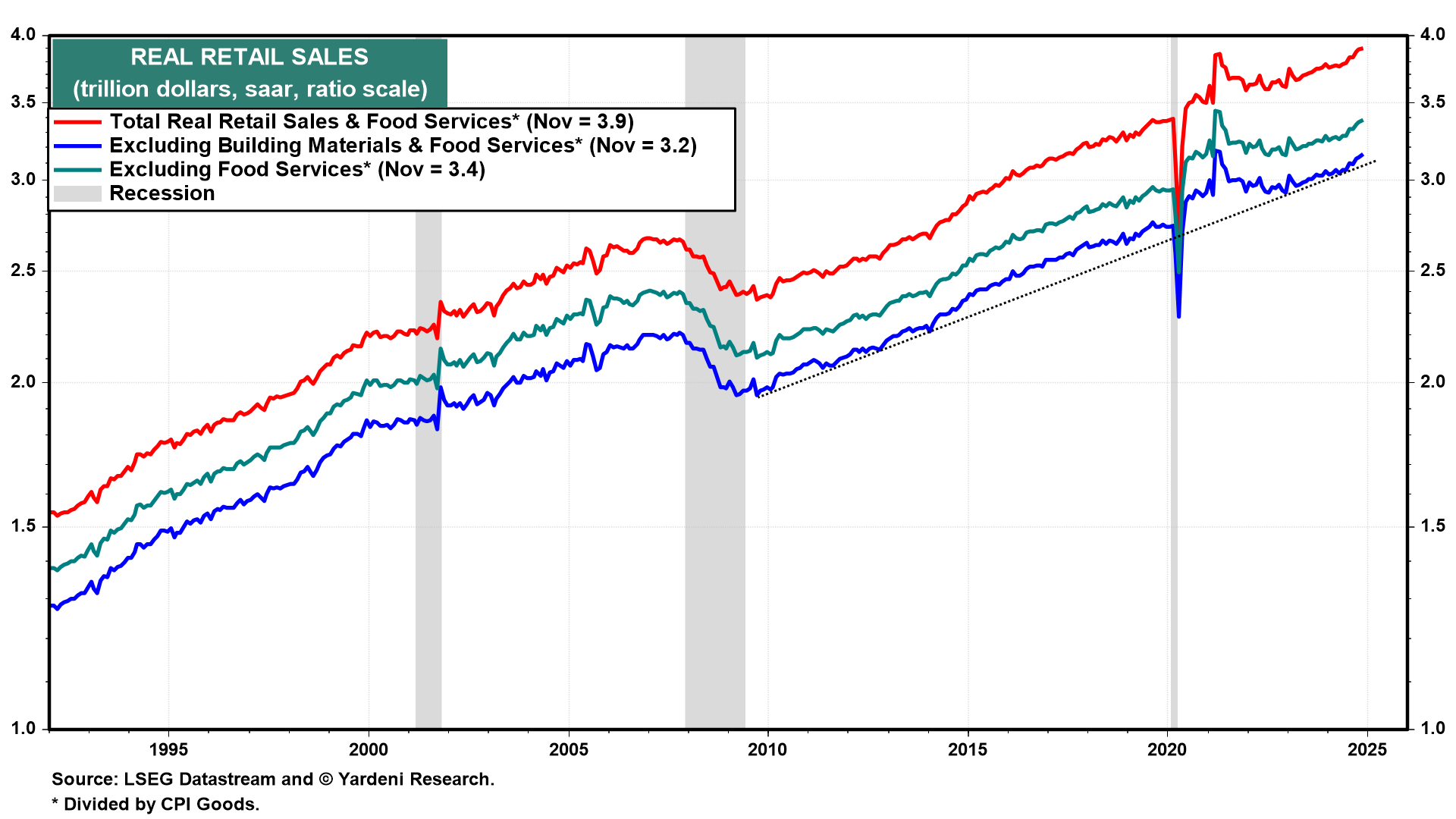

Consumer spending rose again in November, with real retail sales rising more than 3.0% y/y (chart). Rising real labor and nonlabor incomes, plus a strong wealth effect from record highs in stock and home prices, have boosted spending for the past two years. The GOP election sweep also means the 2017 Tax Cuts and Jobs Act will likely be extended in full, and there's talk in DC of expanding the child tax credit from a maximum of $2,000 to $5,000 per kid. With another 25bps cut to the federal funds rate likely tomorrow, the outlook for the US consumer looks good.

Over the past three years, we advised betting on the consumers to keep the economy growing. We are sticking with that recommendation for 2025.

Stocks were a bit lower today, mostly because investors are waiting for the FOMC's interest rate decision and updated quarterly economic forecasts tomorrow. Regardless of what the Fed does, as long as companies continue to grow their earnings, they're likely to keep hiring new employees and to increase real wages (chart). Lower interest rates, higher worker productivity, another corporate tax cut, and deregulation all suggest that this year's solid growth will continue into 2025. Indeed, the Atlanta Fed's GDPNow model is tracking 3.1% real GDP growth this quarter, with real consumer spending up 3.2%. We're expecting annual real growth between 2.5% and 3.5% next year.