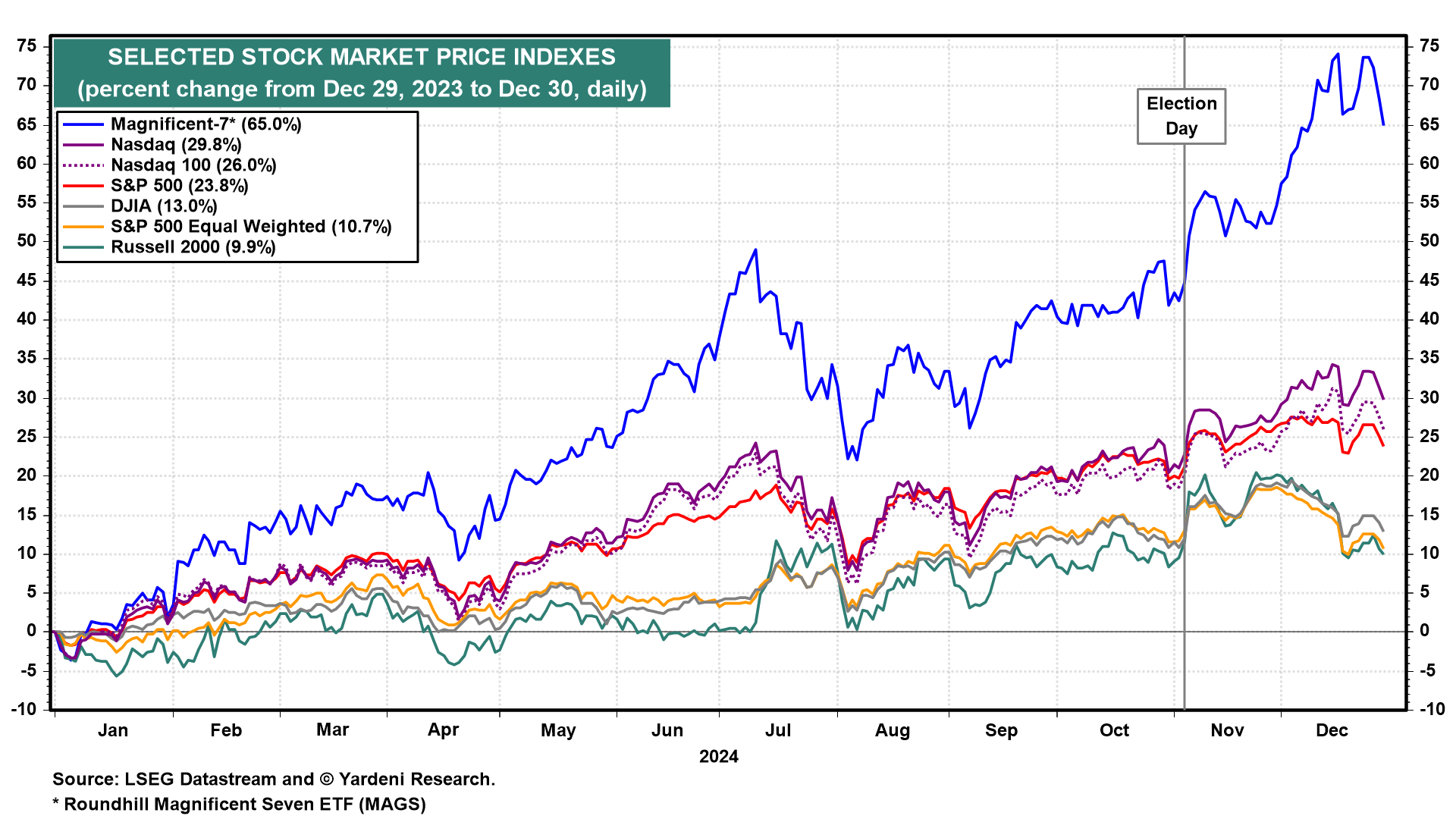

The post-election rally has been losing steam since early December (chart). The S&P 500 peaked at a record high on December 6. From a sentiment perspective, there have been too many bulls. From a technical perspective, breadth has been narrowing again as a few LargeCap momentum stocks continue to outperform. From a fundamental perspective, while earnings growth should remain bullish, the Fed may be done easing monetary policy for a while at the same time as the outlook for fiscal policy under Trump 2.0 is uncertain. From a valuation perspective, forward P/Es are stretched.

This suggests that the Magnificent-7 might continue to outperform during the first few months of the year. But we expect that broadening will resume (along with the bull market) during the spring as Trump 2.0 policies become clearer and should be bullish on balance.

A closer look at the stock market from the different perspectives suggests a cautious stance for now: