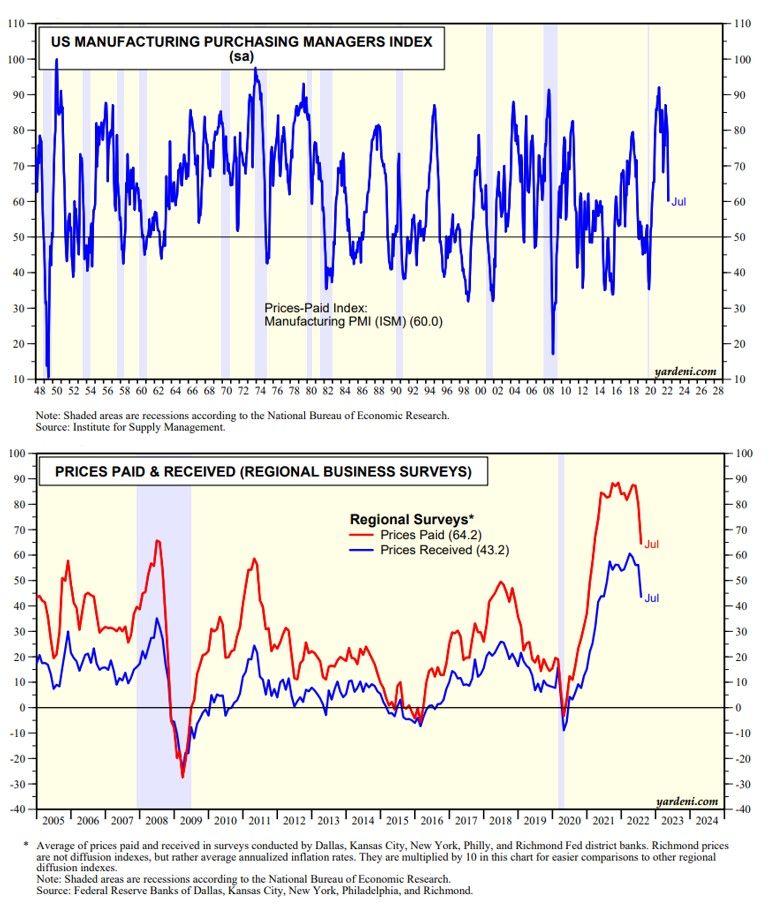

Today was a good day for those of us expecting to see peak inflation soon. July's US manufacturing purchasing managers (M-PMI) survey found that the M-PMI prices-paid index dropped to 60.0 from 87.1 in January. That's not surprising since the prices-paid and prices-received indexes that we compile from the five regional business surveys confirmed that inflationary pressures may be abating (charts below).

That's partly because supply-chain disruptions are easing as evidenced by order backlog and delivery time indexes in all these surveys. Furthermore, demand is slowing, but not cratering, according to these surveys.

In addition, the price of a barrel of oil fell sharply today. Weekend data showed a surprise contraction in China's M-PMI, along with weaker M-PMIs in South Korea and the Eurozone.