Stock price indexes are back at record highs. Yet the stock market's sentiment indicators have turned stubbornly bearish over the past couple of weeks. We noted this development a week ago and concluded that it might be a bullish signal from a contrarian perspective. We aren't sure why there are more bears and fewer bulls recently. Last week, the 10-year Treasury bond yield fell from 4.79% on January 14 to 4.60% today. That move was triggered by cooler-than-expected inflation news and dovish comments by a Fed governor.

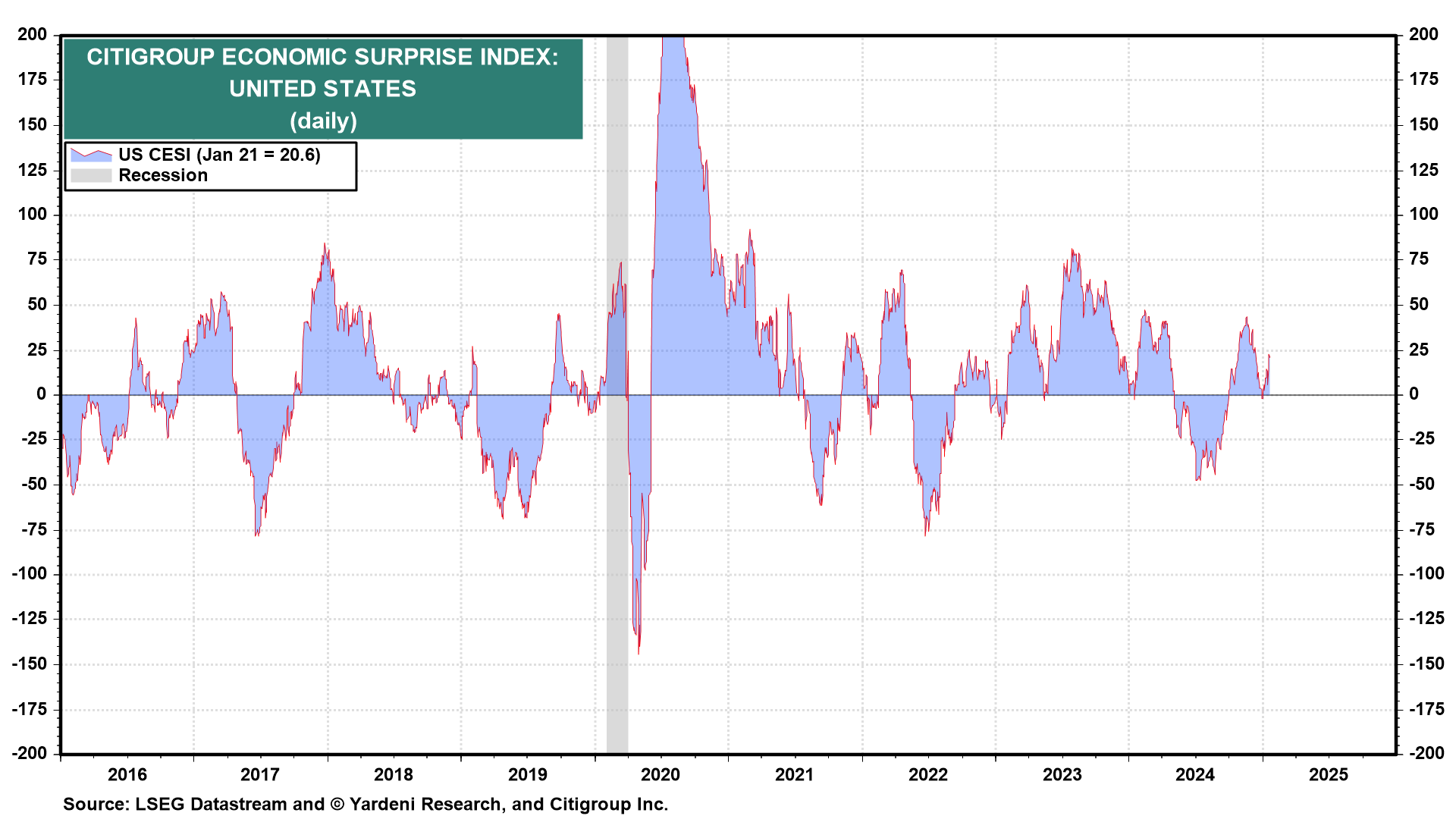

The current Q4-2024 earnings reporting season is starting with lots of better-than-expected results, led by the big banks. The news on AI capital spending remains bullish for semiconductor stocks. The Citibank Economic Surprise Index is back in positive territory (chart).

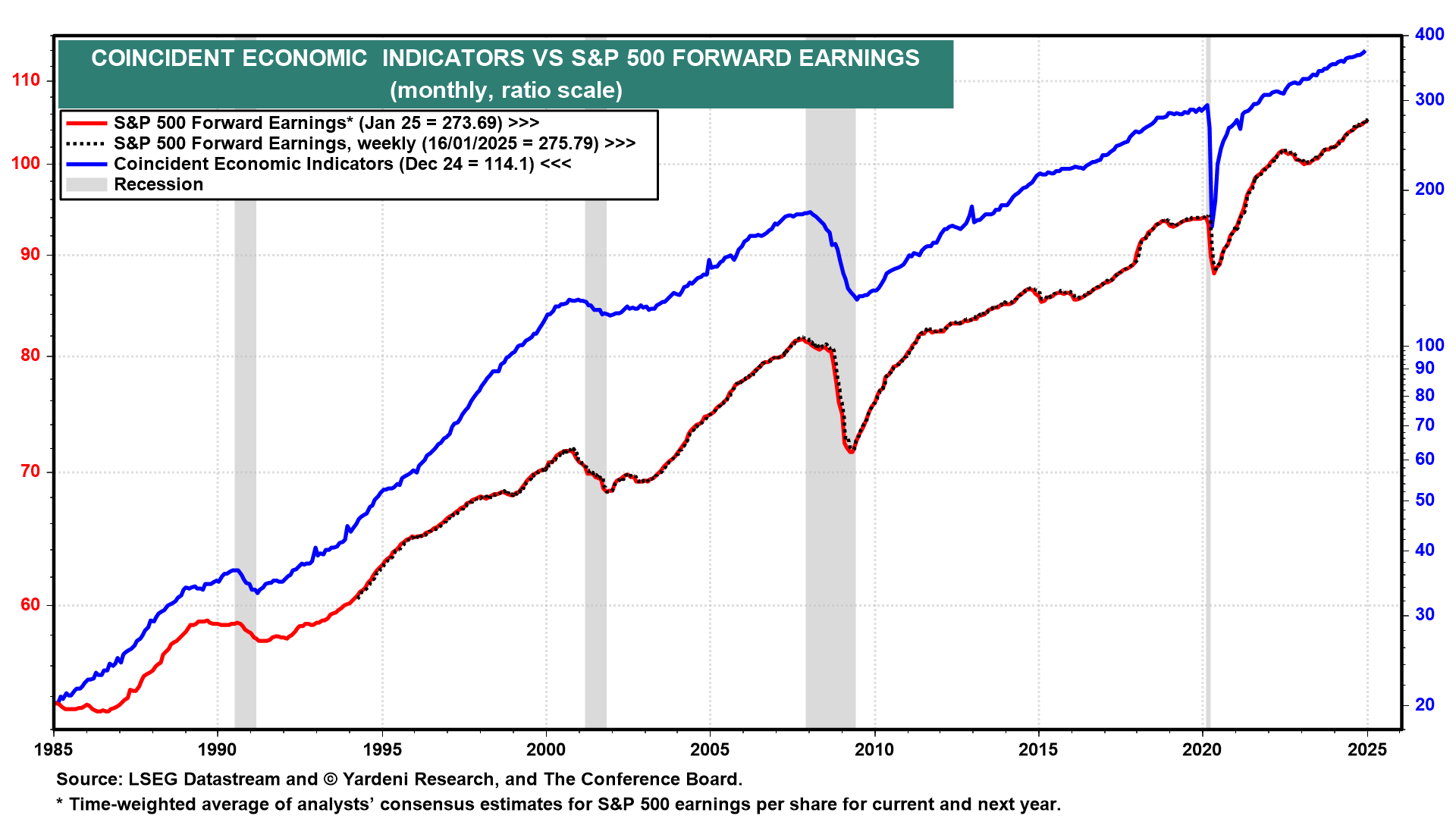

The Index of Coincident Economic Indicators rose to yet another new record high in December (chart). Even the Index of Leading Economic Indicators, which has been a woefully misleading indicator, was up last month. Our favorite economic indicator is S&P 500 forward earnings per share. It rose to a record high during the January 16 week.

Perhaps investors are spooked about Trump 2.0. Yet the stock market rallied during the first two days after Inauguration Day. Let's review the latest sentiment readings:

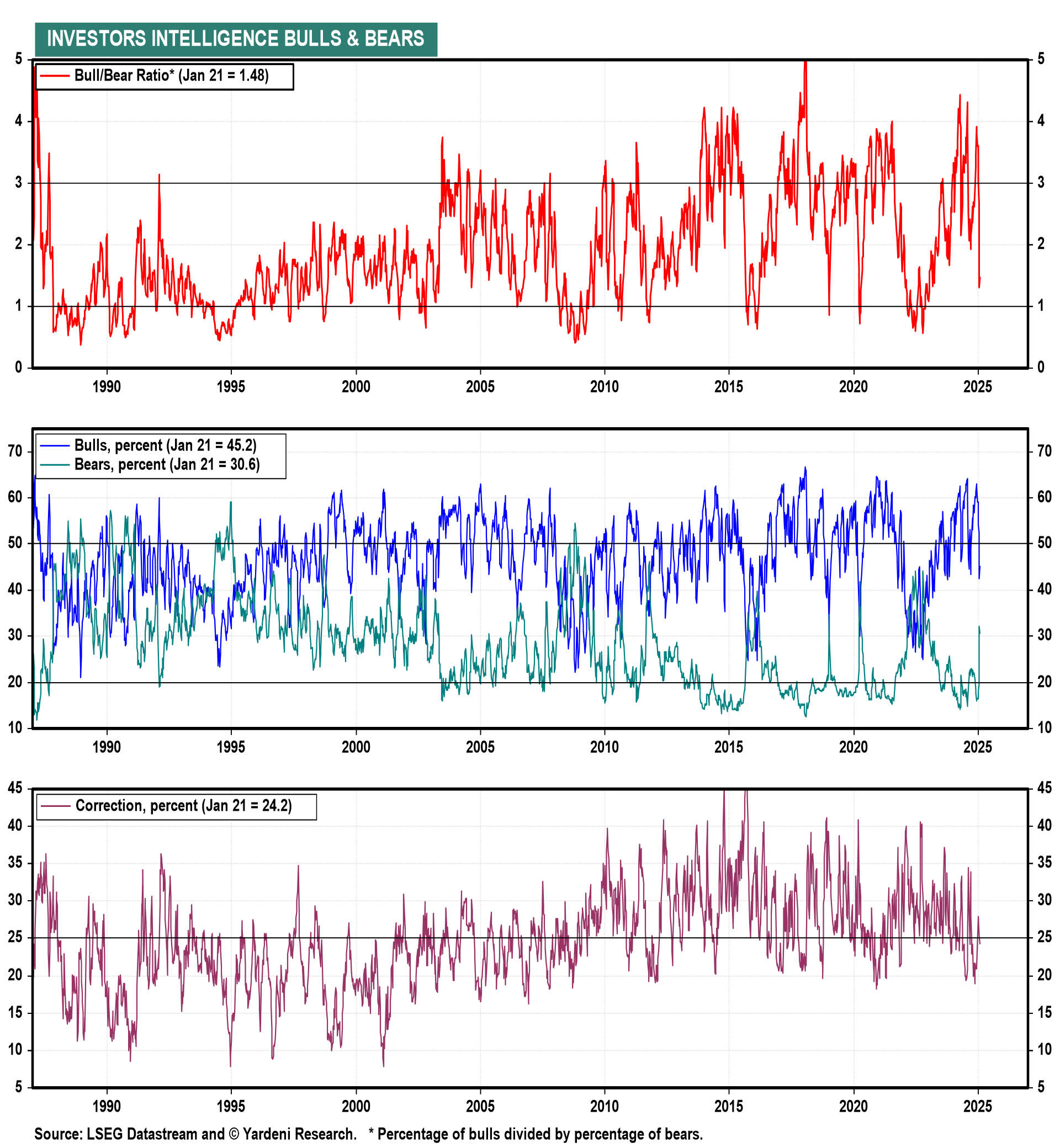

(1) Investors Intelligence sentiment survey. The Bull/Bear Ratio rose to 1.48 this week after dropping to 1.32 last week, which was the lowest in a year (chart).

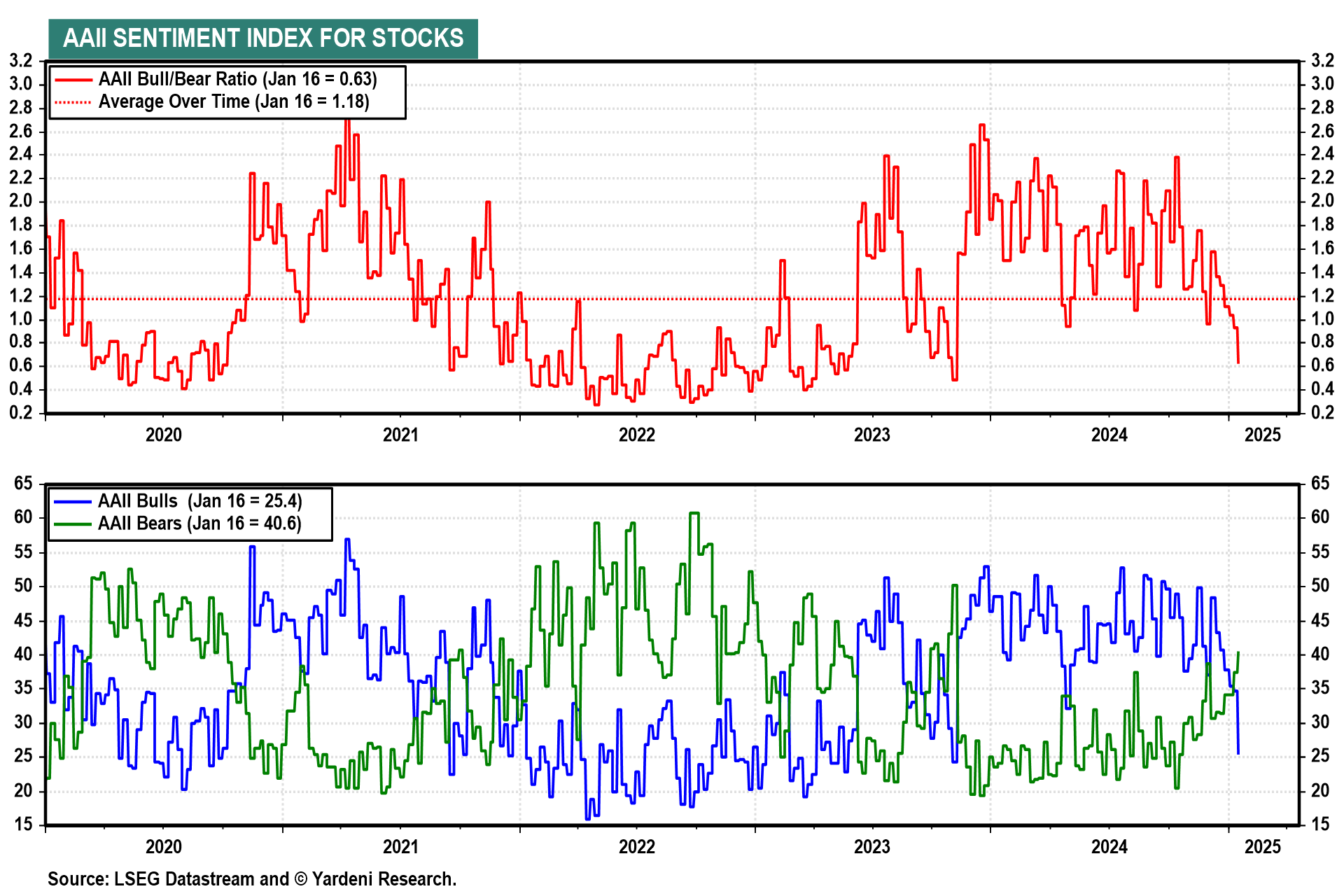

(2) AAII sentiment survey. In the AAI survey (as of January 16), bullish sentiment about the short-term outlook for stocks fell, while bearish and neutral sentiment rose (chart). Bullish sentiment sank 9.2ppts to 25.4%, the lowest percentage since November 2023 (24.3%) and below the measure’s historical average of 37.5% for the third time in seven weeks. Meanwhile, bearish sentiment climbed 3.2ppts to 40.6%, an unusually high reading and above its historical average of 31.0% for the eighth time in nine weeks, while neutral sentiment climbed 6.0ppts to 34.0%—above its historical average of 31.5% for the first time in 12 weeks.