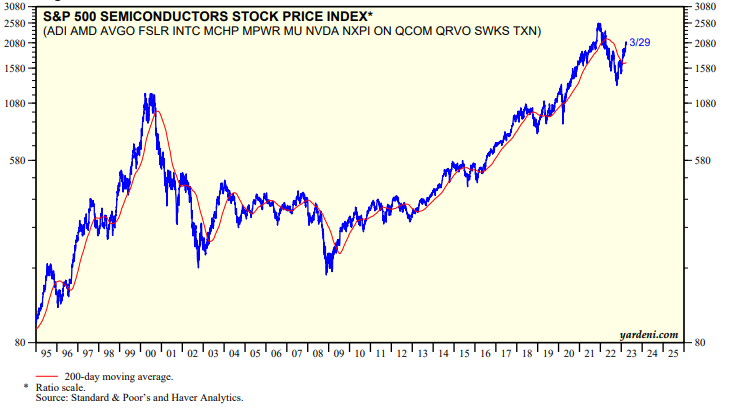

Semiconductor investors didn't get the recession memo. They have anticipated the industry’s improvement for many months. The S&P 500 Semiconductors industry stock price index has jumped 55.8% from its late 2022 low, as of Tuesday’s close (chart). The index remains 20.9% off of its November 29, 2021 peak.

As is often the case in this industry, investors jumped into semiconductor shares before seeing the industry’s results actually turn around. Revenue for the S&P 500 Semiconductors industry this year is expected to decline 10.1%, before increasing 14.3% in 2024. Likewise, the industry’s earnings are forecast to drop 21.2% this year before rebounding by 31.4% next year. The industry's forward earnings is highly correlated with worldwide semiconductor sales (chart). Both have been falling since early last year.