The S&P 500 sizzled last week on Thursday. It fizzled on Friday. Why is it sizzling again today?

On Friday, Reuters interviewed St. Louis Fed President James Bullard. As we observed in today's Morning Briefing, Bullard said that he favors “frontloading” hikes in the FFR, with a wait-and-see stance on 2023. In other words, he suggested that the Fed should go ahead with the widely expected 75bps hike in the rate at the November 1-2 meeting of the FOMC and another 75bps hike at the December 13-14 meeting. That would bring the FFR target range up to 4.50%-4.75%. But then Bullard went on to imply that the Fed should pause for a while. Bullard is often ahead of the pack on the direction of monetary policy.

We think that’s one reason that stocks are rallying today. Another reason, of course, is that Bank of America reported better than expected Q3 earnings, implying that the economy is still growing despite the many challenges. In addition, net interest margins are boosting bank earnings.

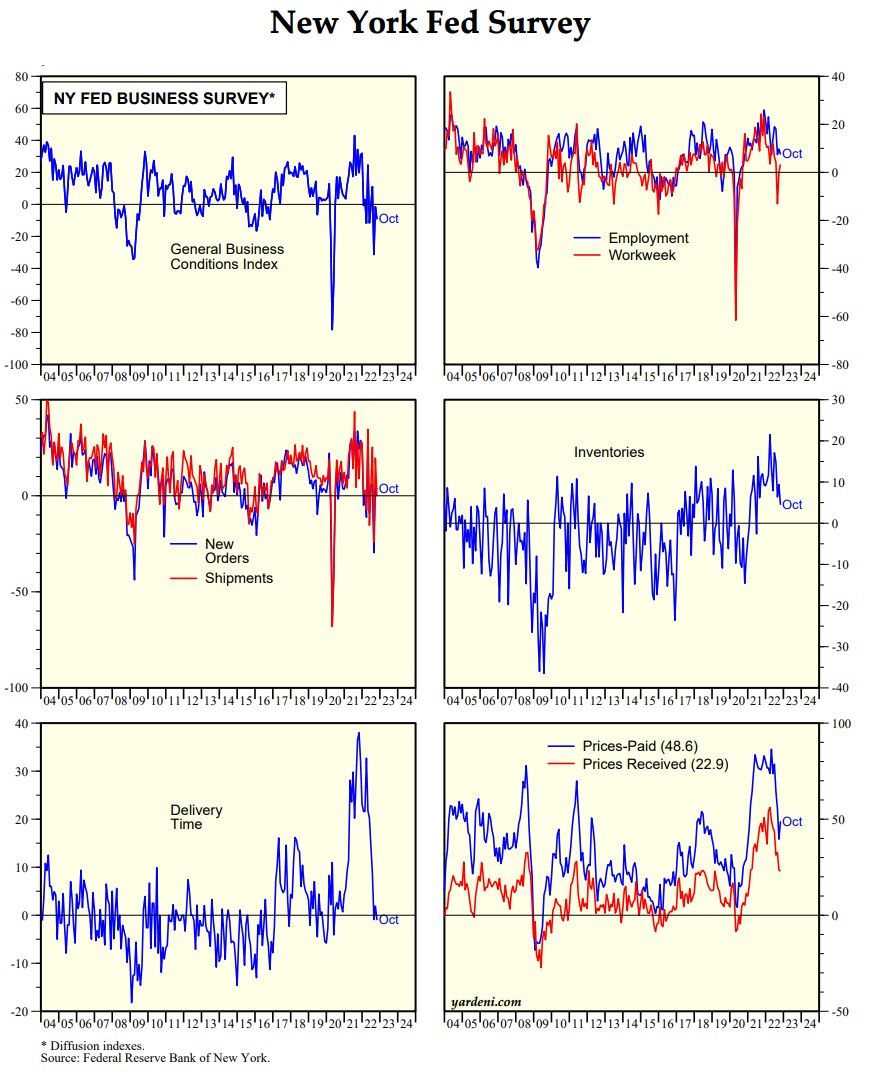

In addition, October's NY Fed regional business survey is consistent with our rolling-recession-with-rolling-inflation scenario (chart below). Economic growth is lackluster at best, while pricing pressures are easing.

We are thinking that instead of a V-shaped capitulation bottom, the S&P 500 may very well remain in a volatile trading range around the June 16 low of 3666 for a while longer before moving back toward the August 16 high of 4305 over the rest of this year.

Joe Feshbach, our trading consultant, told us this morning that he is very impressed with the strength of Financials and the weakness of the dollar. He would buy the market on any pullback. He sees a potential for 3850-3900 in this move.